In this article, I will discuss why stock prices fall after beating earnings (aka good earning announcements), which is a common question many new investors ask around earnings season. The short answer to this comes down to the future expectations of analysts and investors, along with supply and demand. These two factors therefore drive much of a company's stock price movement after earnings are released.

Many times, a beat in earnings will drive a stock price up after the market opens, but this should never be taken for granted. In fact, it's not uncommon to see a stock's price fall after beating both revenue and earnings per share (EPS) analyst estimates.

So, this article will attempt to make sense of earnings reports and what investors should be looking for when they are released. Moreover, I will explain the various factors that can lead to a stock price reacting positively or negatively following an earnings report release. In turn, this should provide you with a better idea of a stock's short-term price movements, which will allow you to make smarter investment decisions.

Introduction to Earnings Reports

In the U.S., publicly traded companies must publish earnings reports on a quarterly basis (every 3 months) on an annual basis. Investors like to see figures from an earnings report to evaluate how well a company is performing given the current market environment.

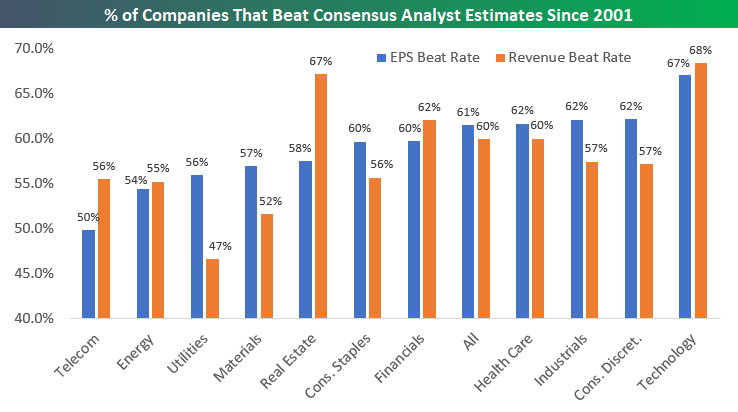

Before these earnings are available to the public, "wall street analysts" come up with estimates on how they expect companies to perform. If a company beats these analyst expectations ("earnings beat"), this usually sends the stock up. On the other hand, if a company fails to meet analyst estimates, a drop in the stock price usually follows.

The chart below (made in late 2018), gives us a good idea on how often these estimates are beat, depending on the industry.

More often than not, the days surrounding a company's earnings report release will naturally tend to be more volatile. So, you should keep track of when your company's earnings reports are released to avoid making any poor investment decisions, such as investing all of your money into the company the day before earnings are released.

Some investment brokerages provide an earnings calendar and analyst estimates within their own platforms. There are also many websites where you can see the earnings calendar and analyst estimates for free. Below are three great options:

These quarterly earnings reports are also generally backed up by the 10-Q document, which are far more comprehensive, and can be found on the sec.gov page after searching for a company. You can also find any of this information for any publicly traded company by searching: “name of a company + investor relations” into your preferred search engine.

Now, if an earnings call, which typically precedes a company's earnings report, states "after the bell," then this means the company will release their earnings report after the market closes (at 4:00 pm EST). This is the more common option, as investors are able to read and digest the data they receive before the market opens the next trading day. However, this also means you have to wait until the next open trading day to see how the market reacts.

On the other hand, if an earning call states "before the bell," then the company will release its earnings report the morning before the stock market opens. This means you only have to wait a few hours to purchase the stock, although this leads to more stock volatility than those made in post-closing hours. In short, this is something to keep in mind when assessing a stock's price after an earnings report is released.

With this in mind, the next step is to diagnose an earnings report, and to really understand what these earnings reports consist of. Doing so will provide us with a comprehensive view on why stock prices fall after beating earnings.

Earnings Reports and Stock Prices

To understand how an earnings report affects a company's stock price, it's important that we look at five important performance metrics (among others) that consist of an earnings report. These metrics essentially define how a company performed since its last quarter.

You can view earnings reports for any publicly traded company the second they are released to the public through PR Newswire or Business Wire, which is then available on financial news websites such as Yahoo! Finance, USA Today, Zacks, and many others.

Metric #1: Revenue

The first metric you should look at is revenue (sales). This is the total amount of money a company generated over the past quarter for selling its products and/or services, not accounting for any costs to make this money.

In other words, revenue is pure money before any other number like costs of producing a product/service plays a part. In general, you should aim to invest in companies that regularly beat these revenue analyst estimates.

Metric #2: Earnings per Share (EPS)

Earnings per share (EPS) translates to the actual profits the company keeps. A higher EPS number means a company is more profitable, has the potential to grow faster, and can likely pay out more to its shareholders through earnings increase and/or dividends.

For reference, the formula below shows how EPS is calculated:

Earnings per share (EPS) = (Net income - Preferred dividends) / Weighted average of common shares outstanding

So, when a company releases a positive EPS (above 0), this means they came out with profits since the last quarter. However, when the company comes out with a negative EPS, this means they made a loss in profits since the last quarter.

Metric #3: Guidance

When an earnings report is released by a company, many investors mistakenly focus only on whether it beat revenue and EPS estimates. However, this is a huge mistake, as something called "guidance," although not obligatory for companies, can also significantly influence a stock's price performance.

As of Q2 of FY 2020 and FY 2021, of the 285 S&P 500 companies that have historically provided EPS guidance, only ~48% or 138 of these companies stated they would provide EPS guidance for either FY 2020 or FY 2021. Clearly, guidance will not always be there for the company you're trying to analyze.

This EPS guidance is broken down by sector in the chart below:

Even if guidance is not explicitly published/stated, most public companies hold a conference call after earnings are released, where management will provide a sort of "guidance" about the future prospects for the company, including how the company is expected to perform in the upcoming quarter. This could refer to things like revenue, profits, and/or other products/services they sell that can significantly affect a company's bottom line.

Moreover, these conference calls are something analysts set their expectations for before an earnings report is released. In particular, when earnings reports are released and a company announces guidance for the next quarter, investors look for one of three guidance measures:

- Weak (Smaller) Guidance: Company guidance is lower than what analysts expect, which typically makes the stock price fall.

- Same Guidance (Rare): Company guidance is equal to what analysts expect. This may or may not strongly affect the stock price.

- Strong (Higher) Guidance: Company guidance is better than what analysts expected, which typically drives up the stock price.

In short, earnings guidance can affect many investors' decision on whether to buy, hold, or sell a stock, which is why they're so important. One thing to note here, if not obvious, is that these guidance figures are based on the future, so they may not be accurate at all.

So, although it's very likely that an unexpected and stellar earnings report (that beats all analyst estimates) will move a stock price positively, guidance may play a bigger role in how a company's stock price moves after an earnings report, especially with more normal earnings reports.

Unfortunately, you'll see that guidance is typically not as well published as EPS and revenue is, especially on news article sites which release earnings reports or earnings summaries for companies. Therefore, you may have to dig a little to find guidance reports, but most of the times this can also be found in the investor relations section on a company's website. If you cannot find guidance, then it simply does not exist for your company.

Metric #4: Unit Sales

The fourth metric is unit sales, which is simply the number of units a company sold in comparison to its previous quarter.

Typically, a stock's price movement will move due to a sales increase/decrease of one of its more popular products (if the company has multiple), and not one which has never dominated the industry market share.

One example of this is Apple (AAPL), a multinational technology company, and its popular iPhone smartphone product. This product line alone accounts for around 50% of the company's annual revenue.

So, even if Apple crushed earnings and EPS estimates for one quarter, a significant decrease in the number of iPhone's sold since the previous quarter could lead to Apple's stock price falling after the market opens. However, if investors had realized that Apple's average iPhone selling price had increased since the previous quarter, then the stock price would likely increase on market open instead.

Metric #5: Users and/or Subscribers

The fifth metric that is overlooked frequently, although not applicable to many companies, is the number of users and/or subscribers a company has, and how much this has grown since the last quarter. In general, this is more applicable in the technology industry.

For example, with companies like Netflix (NFLX), a subscription-driven media services provider, investors are more concerned about subscriber numbers and subscriber growth than they are EPS or revenue for the quarter. Essentially, this is because over the long-run, this is what will drive the company towards larger profits.

Another example is Snapchat (SNAP), a multimedia camera-based messaging app, with their focus being on user retention and app usage. In particular, Snapchat focuses on the daily active users and monthly active users, which if beat when earnings are released, typically drive the stock price up. So, as long as these numbers keep growing month-over-month, more people will come to the platform and use it, which likely translates to more profit for the company and its shareholders.

Other companies include Facebook, Twitter, and Spotify, where the number of users should be growing quarter-over-quarter.

Another thing to note here is that many subscription or traffic-related companies on the stock market do not generate much in profit, or take on a lot of debt (relative to similarly-sized companies in different industries). Investors who invest in these businesses understand this, and this is why subscription and/or user growth is so much more important to these investors than beating earnings.

7 Reasons for Stock Prices to Fall After Earnings Beatings

Now, even if companies surpass analyst expectations for all five of the metrics covered in the previous section, there is no guarantee that the stock price will not drop after earnings are released! So, in this section, I will provide seven different reasons for why this may be the case.

Reason #1: High Expectations and Sell-Offs

When investors, for whatever reason, expect a company's earnings to beat all analyst estimates by a significant margin, this can cause a massive amount of buying up until the earnings report is released. This is called "buy the rumor, sell the news" and can be pretty easy to identify.

In short, this mass buying and increase in trading volume causes a stock's price to appreciate in value significantly, and by this point the potential beat in earnings is already priced-in to the stock.

Now, even if the earnings beat estimates by a significant margin, thereby meeting investors expectation, the stock price may still fall afterwards. This is simply because the stock price may be at an all-time or 52-week high, or simply because investors don't expect it to go any higher in the short-term. In short, this can cause mass amounts of selling, driving the stock price down because investors want to secure their unrealized gains.

Short-term traders sometimes use this strategy to sell their shares in a stock with high expectations, just before the earnings report date. They do this when they believe other investors will begin selling their shares after the market opens, due to the projected high expectations for an earnings beat.

Afterwards, if the earnings beat did come true and investors began locking-in their profits in mass (causing the stock price to fall), these traders would simply buy back the stock at undervalued prices, and hope to profit again from the stock's appreciation when it returns to "normal" levels.

Reason #2: Changes in Management

During an earnings call, the company may announce that someone in upper-level management, such as the CEO, would be leaving the company shortly. This may cause the price of the stock to fall despite a beat in earnings.

This is especially the case if this CEO did well and drove profitability for the company, if the CEO was one of the founders of the company, or if investors are not confident in the new CEO's ability to fulfill this role adequately and continue to grow the business further.

Reason #3: Stock Buybacks

Another reason for a stock price falling after an earnings beat may be due to the company buying back outstanding shares in the company. When companies buyback their own shares, it typically increases the company's stock price, while improving their financial statements.

As a result, EPS is artificially driven higher, which can lead to a somewhat misleading earnings report. This, in turn, can cause the stock price to fall after an earnings beat, especially in cases where investors believe the current stock price is overvalued, among other scenarios.

Reason #4: Debt Levels

If a company beats earnings, but analysts and investors realize that the company has taken on a lot of debt since its last quarter, to the point where it may be considered risky for the company, this can definitely cause the stock price to fall significantly on market open.

The amount of debt that is considered "risky" for any particular company depends on a number of factors, such as debt levels, interest payments, and the cash a company currently has on its balance sheet. Analysts and investors can analyze fluctuations in a company's financials on a quarterly basis, and if additional debt does not appear to be manageable for a company, this can lead to a massive sell-off.

Reason #5: Hedge Funds, Money Managers, and Liquidity

Big hedge funds and money managers look to enter and exit stocks when there is higher amounts of liquidity, or in other words, when there's high amounts of volume trading occurring in a particular stock. They do this because they own a significant amount of stock in the company, and do not want to influence the movement of a stock when there's not as much volume.

As you may know, the days surrounding an earnings report are generally when more investors are trading in and out of a stock, which leads to higher amounts of trading volume. So, if a money manager wants to exit a big position, for example, to re-balance their allocations back to their desired target, they would attempt to do so when buyers could potentially support the large sell-off.

Therefore, it makes a lot of sense for these big-money players to sell their shares after an earnings beat. However, this can also lead to panic selling, as big money managers selling off shares is not a good sign. Moreover, a small initial decrease in stock price can be further amplified once investors learn more about the earnings report.

Reason #6: Whisper Number

The "whisper number" is an unreported and unpublished revenue or EPS forecast analysts have in the back of their minds, and is largely unknown to the general public. This whisper number may also have a greater impact on stock movement than the typical analyst estimates, and may be more accurate as well.

So, an analyst may believe a company will earn $2.00 per share in the next quarter, but is really hoping it will earn $2.10 per share. When the earnings report is released, the company actually earns $2.05, and beats earnings, but did not beat the whisper number of $2.10. This in turn can lead to a sell-off, causing the stock price to fall on market open.

In short, whisper numbers are worth looking into, and EarningsWhispers is one website that provides these whispers to investors.

Reason #7: Other Factors and News

Other factors and news that many investors are not paying attention to can also cause a stock's price to fall after an earnings beat.

For example, if a company beat earnings but reported that their growth in emerging markets wasn't as strong as they expected for the quarter, this could drive down the price of the stock significantly.

Another example could be if a company beat on earnings, but decided to reduce or cut its dividend, for whatever reason. This would most likely cause a decrease in the stock price, as dividend investors would almost certainly sell-off the stock.

A final news-related example could be if a company beat on earnings, but had to push back its product/service release date. In many cases, this would upset investors and cause the stock price to fall when the market opened.

The Bottom Line

With everything considered, the best way to think about a company's future quarterly earnings report and stock price is to view the analyst estimates (focus on revenue, EPS, and guidance), and to then do your best to gauge the overall market sentiment. Doing so will provide you with a better understanding of what the expectations are for the future.

In short, there are many factors that can cause a stock price to fall after an earnings beat, which is why trading a stock around its earnings is not always the best idea. In fact, this could actually be the quickest way to drive your stock profits down significantly, with the stock potentially never returning back to your initial buy price.

If nothing else, attempting to understand why a stock fluctuates the way it does after an earnings report will provide you with the insight you may need to make a more confident investment decision.