In this article, I will show you how to calculate the intrinsic value of a company like Warren Buffett, using his approach to discounted cash flow (DCF) valuation. This will be accomplished by looking through the Berkshire Hathaway shareholder letters, the Berkshire Hathaway website, and from reading the transcripts of any speeches and interviews Buffett has done. Value investing, as Warren Buffett practices, always begins with the idea that investors should pay less for an asset than its intrinsic worth. Therefore, value investors can use Warren Buffett's DCF valuation approach, which is theoretically one of the most accurate ways to estimate a firm's intrinsic value, to approximately estimate whether a stock is attractively valued or not at its current price. Investors can then use their understanding of a business, its industry, and valuation price range to make more informed investment decisions.

Warren Buffett describes intrinsic value in the quote below:

“Intrinsic value is an all-important concept that offers the only logical approach to evaluating the relative attractiveness of investments and businesses. Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.”

— Warren Buffett | Owner's Manual (page 4)

Therefore, to find a company's intrinsic value, one of the best ways is to use a DCF calculation. As a result, you will need to know how much cash the business will generate for you in the future and also what these future cash flows are worth to you now, as discussed in the following sections. However, any DCF valuation is only as accurate as the forecast it relies on, and it's merely an approximation of intrinsic value, as Buffett mentions:

"The calculation of intrinsic value, though, is not so simple. As our definition suggests, intrinsic value is an estimate rather than a precise figure, and it is additionally an estimate that must be changed if interest rates move or forecasts of future cash flows are revised. Two people looking at the same set of facts, moreover – and this would apply even to Charlie and me – will almost inevitably come up with at least slightly different intrinsic value figures. That is one reason we never give you our estimates of intrinsic value. What our annual reports do supply, though, are the facts that we ourselves use to calculate this value."

— Warren Buffett | Owner's Manual (page 5)

Buffett is therefore implying that valuation is not an exact science, but rather an art form. Because of this, you will need to be reasonable in your cash flow and growth rate estimations, in particular, in a very assumption-heavy valuation model. Regardless, the more conservative and knowledgeable you are on a particular company and its respective industry, the more accurate your final intrinsic/fair value calculation will likely end up being.

Step #1: Owners Earnings

The amount of cash a business generates for its owners is what Warren Buffett refers to as "owners earnings." With the right management team, cash deployed in a business will add value and give investors the chance to sell it for more in the future and/or generate income from dividend payments.

Warren Buffett first mention of the phrase "owner earnings" was in his 1986 Berkshire letter, as quoted below:

"If we think through these questions, we can gain some insights about what may be called "owner earnings." These represent (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges such as Company N's items (1) and (4) less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume. (If the business requires additional working capital to maintain its competitive position and unit volume, the increment also should be included in (c). However, businesses following the LIFO inventory method usually do not require additional working capital if unit volume does not change.)"

— Warren Buffett | 1986 Letter to the Shareholders

The formula below describes what Buffett is saying here about calculating owners earnings:

Owners earnings = Net income + Non-cash charges - Maintenance capital expenditures (CapEx)

where:

- Non-cash charges: Includes depreciation, depletion, amortization, impairment charges, and any other non-cash charges.

- Maintenance CapEx: Money a company spends to maintain the normal operations of the business.

Buffett's formula for owners earnings can also be simplified into the formula below:

Owners earnings = Operating cash flow - Maintenance capital expenditure

The difference here is that "net income + non-cash charges" in the formula above is replaced with "operating cash flow," from the cash flow statement. This alternative owners earnings formula is typically more accurate as net income can be manipulated and non-cash charges often differ between companies.

Operating cash flow is a measure of the total amount of cash generated by a company's normal business operations. A company's capital expenditures (CapEx) can also be found on the cash flow statement under the "Investing Activities" section. Capital expenditures can also be listed as "Property, Plant, and Equipment" (PP&E), which are both the same thing, just named differently.

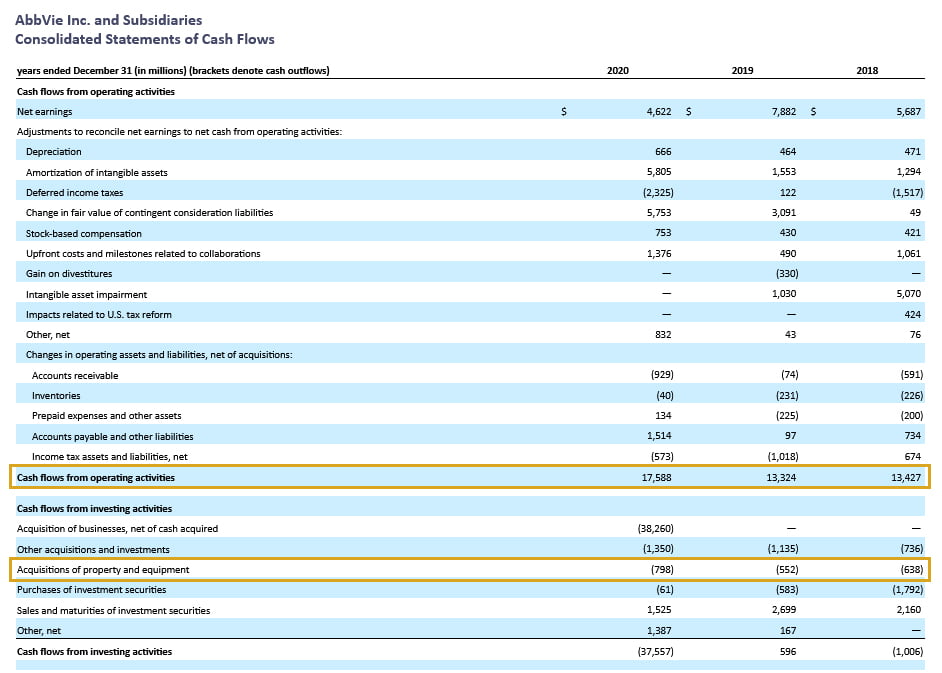

These two items are outlined below on AbbVie's (ABBV) most recent cash flow statement, which is that of a giant pharmaceutical company:

As you can see, these two items are fairly easy to locate. However, the owners earnings formula requires investors to find maintenance CapEx, not just the total CapEx amount shown on the cash flow statement (called "Acquisitions of property and equipment" for ABBV). In other words, the CapEx amount shown on the cash flow statement consists of growth and maintenance CapEx, and we only want the growth part of this total CapEx figure, so we subtract maintenance CapEx.

Growth CapEx is money a company spends to reinvest and grow the business, whereas maintenance CapEx is money a company spends to restore assets to what they were before. Therefore, the key difference is that maintenance CapEx does not contribute to growing the business, but more so to just ensure the company can continue its normal operations.

Unfortunately, maintenance CapEx can be difficult to find, as most companies do not report it on their 10-K annual reports, let alone on their website, during earnings calls, or in other publicly-available company filings. Therefore, our job is to estimate how much of this total CapEx figure is growth and how much is maintenance, which we can then use to accurately calculate owners earnings.

Owners earnings is also very similar to the simple "free cash flow" (FCF) calculation, as typically used in traditional DCF valuations. However, as seen below, it differs due to the definition of capital expenditures (CapEx), where total CapEx is used instead of maintenance CapEx:

Free cash flow (FCF) = Operating cash flow - Total capital expenditure

Because free cash flow considers both growth and maintenance CapEx to estimate the amount of cash a business can generate for its owners, it's a more conservative measure. However, because it's conservative, it's also slightly less accurate. Therefore, if you're unable to accurately estimate the maintenance CapEx number or want to speed up the valuation process, then you can calculate FCF instead using total CapEx.

How to Estimate Maintenance CapEx

See the article linked below to understand the various ways of estimating maintenance CapEx. This can be a lengthier process depending on how accurate you want the valuation to be.

Regardless, here are the main ways to estimate maintenance CapEx (if it's not clearly stated in the 10-K annual report), as discussed more thoroughly in the article linked above:

- Be conservative and calculate FCF instead. Make an assumption that the total CapEx (PP&E) amount is maintenance.

- Use the definition of growth and maintenance CapEx to imply the amount of maintenance CapEx. This can be done if the company has a CapEx table or a detailed description of CapEx components in their 10-K annual report.

- Use your understanding of the business, the industry, and management's discussion in the 10-K annual reports to estimate a percentage of maintenance or growth CapEx.

- Simply use the "depreciation and amortization" number in the most recent 10-K annual report as maintenance CapEx, but realize that depreciation can be misleading at times.

- Use Bruce Greenwald's maintenance CapEx calculation, but realize that it can fall short for commodity-based businesses or companies who may have a sales growth number greater than PP&E.

For ABBV, because its maintenance CapEx number is not provided or mentioned in its most recent 10-K annual report, I used Bruce Greenwald's method to calculate a maintenance CapEx of $579.56 million in 2020. Therefore, ABBV generated about $17,008.44 million (17,588 - 579.56) in owners earnings over 2020.

Step #2: Growth Rate

The growth rate will be applied to the computed owners earnings number for a business. This will give investors an approximation on how much cash the company can produce over the forecast growth period, which is typically 5 or 10 years. Warren Buffett himself doesn't use a secret formula or model to estimate the growth rate. Instead, he gains a thorough understanding of the company and the industry it's in. This includes, but is not limited to: drivers of revenues and expenses, what the company is doing now to drive growth, the company's management team, consumer and industry trends, and the strength of the company's economic moat.

For investors who do not have this level of competence within a particular industry and/or company, the best option is to just be conservative and to focus on simple businesses that you can understand. Most likely, if you apply a conservative growth rate to your DCF calculation, your intrinsic value calculation will not be far off, especially after you apply an appropriate margin of safety (as later discussed).

Owners Earnings Growth or FCF Growth

One way to estimate the growth rate over the next 5 or 10 years, which should be held constant, is to calculate the owners earnings or FCF growth rate year-over-year, such as over the 5-year or 10-year period. Then, you'd simply take the average over this 5-year or 10-year period to get an estimated growth rate that you can then apply to the DCF calculation.

This is shown below for ABBV, using financial data from their 10-K annual reports and using total CapEx to calculate FCF instead of owners earnings, just to simplify things:

Annual Financials in Millions of U.S. Dollars from 12/31/2015 to 12/31/2020

Therefore, if we were to take the average FCF growth over this 5-year period, we'd get 20.87% as the estimated growth rate, which can then be applied to the most recent owners earnings figure over the next 5 or 10 years. The problem with this growth rate, is that it appears to be relatively high and is not a conservative figure. Therefore, you can apply your understanding of the business here to reduce this cash flow growth rate, use the owners earnings growth rate instead, or use the net income growth rate method below and choose from the most conservative option.

Net Income Growth

Another option that follows the same methodology as the FCF growth, is to instead use the average net income growth rate, such as over the 5-year or 10-year period (again). The problem with this, is that numbers on the income statement (including net income), are typically manipulated more than numbers on the cash flow statement. However, it can still be useful in determining an appropriate growth rate for owners earnings.

Again, this is shown below for ABBV, using financial data from their 10-K annual reports:

Annual Financials in Millions of U.S. Dollars from 12/31/2010 to 12/31/2020

Notice how I used the 10-year average growth rate for ABBV (instead of the 5-year), given the fluctuations in earnings the company generates. This 10-year average growth rate is 15.62%, which is a lot more reasonable than 20.87%. You can also opt into finding the percent difference change in net income from 2010-2020, a 10-year period, which happens to be 10.48% for ABBV ((4,616 - 4,178) / 4,178)). Regardless, use your understanding of the company, the industry, and the market to make a decision on the growth rate, and always keep in mind that lower growth rates offer a more conservative calculation of intrinsic value.

Step #3: Discount Rate

After you apply the estimated growth rate to the most recent owners earnings figure over the 5-year or 10-year period, you must discount these cash flows back to the present value. This is because of the time value of money concept, which essentially states that a dollar today is worth more than a dollar in the future, simply due to its potential earning capacity. Afterwards, you can evaluate whether the stock price is currently overvalued, undervalued, or fairly-valued.

Weighted Average Cost of Capital (WACC)

Traditionally, what is taught in finance is to use the "weighted average cost of capital" (WACC) as the discount rate (aka hurdle rate), as it's a measure of what it costs a company to acquire funding. However, the WACC comes with many false assumptions and simplifications of reality, and the WACC formula is also rather complex and not beginner-friendly. Additionally, it's not used by Warren Buffett. Therefore, as a retail/individual investor, it's usually in your best interest to not calculate and use the WACC as your discount rate.

U.S. 10-Year Treasury Rate

Warren Buffett uses the U.S. 10-year Treasury rate as the discount rate, as described below:

"And once you've estimated future cash inflows and outflows, what interest rate do you use to discount that number back to arrive at a present value? My own feeling is that the long-term government rate is probably the most appropriate figure for most assets. And when Charlie and I felt subjectively that interest rates were on the low side – we'd probably be less inclined to be willing to sign up for that long-term government rate. We might add a point or two just generally. But the logic would drive you to use the long-term government rate. If you do that, there is no difference in economic reality between a stock and a bond. The difference is that the bond may tell you what the future cash flows are going to be in the future – whereas with a stock, you have to estimate it. That's a harder job, but it's potentially a much more rewarding job."

— Warren Buffett | 1993 Letter to the Shareholders (NOTE: Quote is taken from the June 1993 Outstanding Investor Digest issue)

The U.S. 10-year Treasury Note represents the long-term return at which investors can expect to receive from the U.S. government for practically taking on no risk (called the "risk-free rate"). However, as Buffett mentions in the quote above, if interest rates are relatively low (as they are now), he will adjust this rate upwards so that the valuation is more feasible. This is logical, given lower discount rates lead to higher valuations, which would generally make more stocks appear undervalued. As of writing, the U.S. 10-year Treasury has an interest rate of ~2.5%, which is rather low. Therefore, I'd adjust this rate upward to be around 3%, for example, especially if I were expecting interest rates to rise.

As the quote above also suggests, another factor to analyze is whether you can get a better return from just buying a risk-free 10-year treasury note than if you were to invest in an individual stock. In other words, after you discount the future cash flows for a company using the U.S. 10-year Treasury rate, if the stock price is very similar to the intrinsic value, you would not want to invest in the company because you could just invest in the U.S. 10-year Treasury and get roughly the same return for essentially no risk.

Personal Required Rate of Return

Although you can use Buffett's approach to the discount rate, this small discount rate is not representative of what you may want to earn as an investor. Moreover, as previously mentioned, smaller discount rates lead to more stocks appearing undervalued. As later discussed, Buffett applies a big "margin of safety" to account for this, but the discount rate can be simplified even further if you just use your personal required rate of return. This is because you will not have to find and/or adjust the U.S. 10-year Treasury rate (which changes on a daily basis) every time you apply a DCF calculation, let alone the WACC. As a result, it can also make comparing different valuation models a more simpler process, given that you're using the same discount rate.

Your personal required rate of return is also known as your expected rate of return for an asset, as it will discount future cash flows and give you an idea of the price that you should pay for an asset to earn your required rate of return. Naturally, if you require a larger rate of return, the company you're analyzing will be worth less today than if you required a smaller rate of return. For example, if you want a rate of return of 15%, then you obviously need to demand a lower entry price than if you wanted a rate of return of 10%. Higher discount rates can therefore lead to lower entry prices which can increase upside potential and decrease downside risk.

As an individual investor, your goal should be to invest your capital at a rate of return that surpasses what you can easily achieve elsewhere, such as the S&P 500 Index which averages 10% annually. Therefore, although everyone's personal required rate of return will differ depending on their risk tolerance, investment horizon, and goals as an investor (among other things), I'd recommend starting with a static discount rate of 10%. Afterwards, I would adjust this rate depending on what rate of return you're seeking.

For example, a 20-something year-old may have a discount rate of 15%, while a 60-something year-old may have a discount rate of 8%. This rate also does not have to be constant for every company you're valuing, as you'd likely seek a lower rate of return from a blue-chip 'safer' stock than from a high-growth 'risky' tech stock.

Step #4: Terminal Value

Terminal value (TV) is the value of a business after the forecast growth period (e.g., 10 years) for when future cash flows can be estimated. Terminal value exists because you cannot reasonably estimate cash flows forever, and you either have to assume the cash flows remain constant and don't grow into perpetuity ("no-growth perpetuity method"), or grow at a constant rate that is smaller than your discount rate and the growth of the long-term U.S. GDP rate ("perpetuity growth method").

Below is an article covering three different methods of estimating terminal value for discounted cash flow (DCF) valuation methods:

The preferred/default method for calculating the terminal value of a stock is to use the perpetuity growth method, also called the Gordon Growth method. This method assumes that the cash flows after the forecast growth period will grow at a constant rate into perpetuity (forever).

Below is the perpetuity growth (aka Gordon Growth) method formula for calculating terminal value:

FV of TV = FCFn * (1 + g) / (r - g)

where:

- FV of TV = future value of terminal value

- FCFn = Free cash flow for the last 12 months of the forecast growth period

- r = discount rate (required rate of return)

- g = estimated annual terminal growth rate

You must discount the future value of this terminal value solution to account for the time value of money (TVM):

PV of TV = (FV of TV) / (1 + r)n

where:

- PV of TV = present value of (future) terminal value

As you can see, we have a terminal growth rate (g), which is the estimated growth rate the company will grow at into perpetuity.

The important thing here is that the growth rate that you're using to project cash flows into infinity forever (g) must be smaller than your discount rate (r). Moreover, if you're using a discount rate for intrinsic value, such as the current risk-free rate as Warren Buffett does (which can sometimes be below 1%), then you cannot use a growth rate that is above this. If you do, you would get a negative terminal value.

Furthermore, investors should use a growth rate that is somewhere below the rate of the long-term GDP growth rate of the country they're investing in. In most cases, somewhere between 1-3% is a reasonable growth rate to calculate terminal value. Anything beyond this will lead to a misleading valuation, which is why a 0% growth rate is a viable option as well.

Calculating Terminal Value for ABBV

For ABBV, we can be conservative and assume a perpetual growth rate of 1%, as this is well below the long-term GDP growth rate in the U.S., and the discount rate of 3% referenced in this article. We'll also use the forecast owners earnings number at the 10th year, which is grown by 10.48% annually (as estimated in step #2).

These inputs are all shown in the formula below to calculate the future terminal value number for ABBV:

FV of TV (ABBV) = $46,079 * (1 + 1%) / (3% - 1%) --> $2,326,979

As you can see, the future terminal value for ABBV after 10 years is $2,326,979. This future value of terminal value solution must now be discounted back to arrive at the present value of terminal value:

PV of TV (ABBV) = ($2,326,979) / (1 + 3%)10 --> $1,731,491

As shown in step #5 below, this number will be used in the DCF valuation method to estimate the intrinsic value of ABBV.

Step #5: Calculate Intrinsic Value

The two methods below discuss two ways of calculating the intrinsic value of a company like Warren Buffett. Method #1 is the standard approach while Method #2 is a less-common (and more conservative) approach that value investors can also apply if desired.

Method #1: Discounted Cash Flow Valuation

Discounted cash flow (DCF) valuation follows the principal that the value of a company (i.e., its intrinsic value) can be derived from the present value (PV) of its projected free cash flow (FCF). To calculate the DCF like Warren Buffett, FCF should be replaced by owners earnings, which will grow by 10.48% annually until the end of the forecast growth period (e.g., after 10 years).

The formula to find intrinsic value is below:

Intrinsic value = [FCF1 / (1+r)1] + [FCF2 / (1+r)2] + .... + [FCFn / (1+r)n] + [FCFn * (1+g) / (r - g)]

where:

- FCF = free cash flow (or owners earnings)

- r = discount rate (required rate of return)

- g = estimated annual terminal growth rate

- n = time period

Therefore, we're growing owners earnings by 10.48% annually for 10 years, then adding the terminal value calculation we found in step #4 (at a 1% perpetuity growth rate). Afterwards, we're simply discounting these cash flows by the discount rate to estimate the present value of projected free cash flows.

For ABBV, we'll use the following conservative inputs, as found earlier in this article:

- Growth rate (g1) = 10.48%

- Terminal growth rate (g2) = 1%

- Number of periods (n) = 10

- Discount rate (r) = 3%

- Owners Earnings = $17,008

See the attached Excel sheet model (and image) below to see how this DCF model can be put together:

As the model illustrates, the current intrinsic value of ABBV today (as of initial writing) for the entire company is $1,986,696. To evaluate this number on a per-share basis, you can use the formula below:

Intrinsic value of equity per share = Current value / Shares outstanding

This results in a per-share intrinsic value of $1,125 ($1,986,696 / 1,765B shares outstanding). Obviously, this can be easier to read and is also more helpful for comparison purposes. Without taking into consideration any margin of safety or performing any sensitivity analysis, ABBV's current stock price (around $110) appears to be very undervalued because it's less than our fair value of equity (intrinsic value) of $1,125.

Method #2: Present Value Growing Annuity

Another method of calculating the intrinsic value of a company Warren Buffett's style, we can use a present value growth annuity (PVGA) formula. This formula assumes the future value of the company after the 10-year period is equal to zero. It therefore does not factor in any terminal value calculation, which is why it can be seen as a less-applicable valuation method. Regardless, the valuation method is still useful to learn, especially for more conservative investors.

The present value growth annuity formula is shown below:

PV = [P / (r - g)] * [1 - ((1+g)/(1+r))n]

where:

- PV = present value

- P = first payment (owners earnings)

- r = discount rate

- n = number of periods

- g = growth rate

For ABBV, we'll use the same following conservative inputs:

- Growth rate (g1) = 10.48%

- Number of periods (n) = 10

- Discount rate (r) = 3%

- Owners Earnings = $17,008

If you solve for the present value (PV), such as with a spreadsheet or with an online calculator, you'll get $230,966 ($231 billion). This is the intrinsic value of ABBV today (as of writing) for the entire company. You can compare this number to ABBV's market capitalization (currently $194.71 billion), to determine whether ABBV is currently overvalued, fairly-valued, or undervalued.

Because the market cap is less than the intrinsic value calculation, the implication is that the company's current stock price is undervalued because it's priced below its intrinsic value. Because we're using Warren Buffett's discount rate method, which is a slightly-adjusted U.S. 10-year Treasury rate, this calculation implies that investors would make a higher rate of return from investing in ABBV now than if they were to invest in the U.S. 10-year Treasury, a risk-free asset.

On a per-share basis (after dividing by total shares outstanding), ABBV has an intrinsic value per-share of $130.50 and a per-share market value (current stock price) of $110.

Step #6: Scenario Analysis

To adjust for possible mistakes when it comes to predicting the future, a sensitivity or scenario analysis is always a recommended practice. In short, this is simply when you have different inputs for variables that can affect your DCF valuation. In relation to Buffett's approach to the DCF valuation, this primarily refers to the growth rate, the discount rate, and the owners earnings calculation.

Scenarios force you think in a different way, which is why they're valuable. For example, you can have a worst-case scenario, best-case scenario, and normal-case scenario for a company, where you only alter the owners earnings growth rate. Then, you could assign probabilities to each scenario based on your understanding of the company. For instance, you may apply a 50% probability to the normal-case scenario and 25% probabilities to the worst-case and best-case scenarios.

Afterwards, you can analyze the changes in your intrinsic value calculation. This way, you can get a better understanding on what your required rate of return would be if the company performed poorly over the next 5 or 10 years, if it performed roughly up to expectations, or if the company grew far past your expectations.

Sensitivity Analysis Application for DCF and PVGA Valuation Methods

With the DCF method, if I were to apply a personal required rate of return of 10% instead of the upwardly-adjusted U.S. 10-year Treasury rate (3%), then I would receive an intrinsic value of $211.66. This is a difference of more than $800 from the original intrinsic/fair value calculation we found in step #5 before (at $1,125).

With the PVGA method, if I were to also apply a personal required rate of return of 10% (instead of the 3%), then I would receive an intrinsic value of $89.09. This would imply that ABBV is overvalued, unlike before (from step #5). However, if I were to use one of the more aggressive growth rates for FCF found before (e.g., 20.87%), then a 10% rate of return would once again make ABBV appear undervalued, at an intrinsic value of $138.42.

Clearly, you can see how the DCF model is rather sensitive to these inputs, which is why it's crucial that value investors always estimate a range of probable intrinsic/fair value price ranges at which the company can be considered "undervalued" and worth buying.

Step #7: Margin of Safety

Margin of safety is one of the most important investment valuation concepts. The term was coined by Benjamin Graham in the 1949 edition of The Intelligent Investor, where he devoted an entire chapter to this concept. He wrote the following:

"In the old legend the wise man finally boiled down the history of mortal affairs into the single phrase, 'This too will pass.' Confronted with a like challenge to distill the secret of sound investment into three words, we venture the motto MARGIN OF SAFETY. This is the thread that runs through all the preceding discussion of investment policy - often explicitly, sometimes in a less direct fashion."

— Benjamin Graham | The Intelligent Investor

Warren Buffett learned his trade from Benjamin Graham, and is his most famous and successful student. Buffett described the importance of margin of safety in the quote below:

"You also have to have the knowledge to enable you to make a very general estimate about the value of the underlying businesses. But you do not cut it close. That is what Ben Graham meant by having a margin of safety. You don’t try and buy businesses worth $83 million for $80 million. You leave yourself an enormous margin. When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it. And that same principle works in investing."

— Warren Buffett | 1984 Superinvestors of Graham-and-Doddsville speech

As Buffett explains, the margin of safety should be applied to every intrinsic value calculation, so that you can account for errors and estimates in the DCF calculation. Moreover, a margin of safety will protect investors from uncertainties the future holds and from companies that under-perform, thereby reducing an investor's downside risk. This is simply because a margin of safety will encourage you to buy a business that's worth $100 for $70, for example.

The fundamental principle here, is that the lower the price you pay for a business, the lower the chance of you being wrong about a company's undervaluation. If the company you're analyzing somehow manages to meet your growth expectations to the exact amount, you will earn whatever you had for your discount rate. However, as previously mentioned, valuation is not a precise science, and future cash flows aren't perfectly predictable. So, if you've misjudged growth rates, and thus the intrinsic value of a company, applying a margin of safety will give you some cushion. As a result, you'll likely receive even higher returns than your discount rate.

Margin of Safety Rate

The margin of safety percentage/rate you apply primarily depends on (1) how confident you are in your valuation and (2) the discount rate you're using. There's no exact rule on what margin of safety to apply. Naturally, if you're more confident in the intrinsic value calculation you completed, perhaps due to your understanding of the business, then you can apply a margin of safety as low as about 15%. On the other hand, if you're attempting to find the intrinsic value of a cyclical high-growth company, then a margin of safety range between 50%-75% would likely be more appropriate.

As mentioned, the discount rate is also another factor that influences your margin of safety. With Warren Buffett's discount rate approach, this rate may be much lower than the WACC or your personal required rate of return, especially when interest rates are relatively low. For the 3% discount rate we used, even if I were confident in my valuation, I would still apply a margin of at least 50%. This means that you'd only be willing to pay $50 or less for a company that has an intrinsic value of $100. On the other hand, if I were using my personal required rate of return, which I generally recommend for the retail/individual investor, this could be 15%. In this case, if I were very confident in my valuation, I would likely use a margin of safety between 15-25%.

Lastly, besides underestimating the margin of safety and making the mistake of investing in a potentially overvalued company, you need to be careful about not applying an aggressive margin of safety. Obviously, if your margin of safety is too aggressive, you will have to wait longer for the stock price to fall, which could take multiple years - if not decades. In other words, the bigger the margin of safety, the harder it will be for you to find undervalued stock buying opportunities. The point being, is that investing is long-term, and you should deploy your money into the stock market as soon as possible to get the most out of your investment.

Margin of Safety Application for DCF and PVGA Valuation Methods

With the DCF method, we found ABBV's intrinsic value to be $1,125 per share and claimed that its stock price was undervalued. However, if we now apply a 70% margin of safety (given the high growth assumption and low discount rate), this would result in an intrinsic value of $337.68 ($1,125 * (1 - 70%)). With the current stock price of $110, this would make ABBV's current stock price still appear far undervalued and attractive to value investors.

With the PVGA method, we found ABBV's intrinsic value to be $130.50 per share and claimed that its stock price was undervalued. However, if we now apply a 50% margin of safety (again, given the high growth assumption and low discount rate), this would result in an intrinsic value of $65.25 ($130.50 * (1 - 50%)). With the current stock price of $110, this would make ABBV's current stock market price appear far overvalued and not attractive to value investors.

Note that I used a smaller margin of safety with the PVGA method, because the calculation itself is already more conservative than the DCF method, as it assumes the company will not exist after 10 years. Again, you can clearly see how, regardless of the valuation method used, the discount rate and growth rate assumptions can drastically vary whether a company appears to be undervalued or overvalued.

The Bottom Line

Discounted cash flow (DCF) valuations are done to assess if a stock is attractively valued or not, based on reasonable assumptions for cash flow generation in the future. Warren Buffett's DCF valuation method, in particular, can be quite useful if applied correctly for value investors seeking to maximize their long-term returns and minimize their downside risk. Because owners earnings, the discount rate, and the growth rate are the primary figures needed to complete Buffett's DCF calculation, it's also somewhat simpler than other valuation methods.

Unfortunately, all valuation models have their downsides. The major downsides to Warren Buffett's DCF intrinsic value calculation, let alone all DCF calculations, are the assumptions that have to be made. Moreover, no one really knows what a company will generate even one year from now, let alone 5 or 10, especially in the disruptive market we live in today. Additionally, it could be said that with a DCF calculation, you could justify all sorts of intrinsic/fair value prices, because you can make the model say what you want it to say by tweaking just one variable, such as the growth rate or discount rate. Finally, the DCF model may not work well for certain companies, such as those with negative or unpredictable cash flows. Regardless, if investors are conservative with their estimates, perform a sensitivity analysis, and apply a reasonable margin of safety, then Warren Buffett's DCF valuation approach can be quite useful.

In closing, Warren Buffett's DCF approach to estimating a company's intrinsic value is relatively simple once applied. Regardless, calculating the intrinsic/fair value of a business is a process that involves a lot of educated estimations and is therefore best done in a conservative manner. Investors can minimize the error of projections even further by investing in companies with an economic moat, those with consistent financials, and those with a consistent return on invested capital (ROIC). Furthermore, applying a margin of safety will protect you from downside risk, as no investor can completely rely on their intrinsic/fair value calculation given the uncertainties the future may hold.