In this article, I will explain how the three financial statements are linked. This will be accomplished by providing an overview of the three financial statements and then navigating through an integrated financial statement model using a simple business model. The three financial statements are the cash flow statement, the income statement, and the balance sheet. Accounting is the language of business, and understanding how each of these three financial statements are interconnected is crucial for investors seeking to further evaluate the viability of a stock investment opportunity.

The Three Financial Statements

The three (primary) financial statements are the income statement, the cash flow statement, and the balance sheet. The other statement not discussed in this article is the "statement of shareholders' equity," but this statement will not be discussed further in this article as it simply shows the change in the interests of a company's shareholders over time.

All publicly traded companies are required to report their financial statements on a quarterly basis (Form 10-Q), within 45 days of each quarter-end. They are also required to report their financial statements within 90 days after each year-end (Form 10-K). Both of these reports are filed with the U.S. Securities and Exchange Commission (SEC).

If you are not familiar with one or more of the three primary financial statements, you can read the articles below to gain an in-depth understanding on how to effectively read and analyze the statements from a value investors perspective:

- How to Effectively Read and Analyze an Income Statement

- How to Effectively Read and Analyze a Cash Flow Statement

- How to Effectively Read and Analyze a Balance Sheet

In any case, an overview of the three financial statements is broken down in the three sections below.

Income Statement

The main purpose of an income statement is to show whether or not a company has a profit or loss, as typically shown over three months or a full year. Most income statements use accrual accounting, which means that revenue and expenses are realized as they're earned and billed (unlike cash basis accounting).

The income statement formula is broken down below:

Revenue - Cost of goods sold = Gross profit - Operating expenses = Operating income - Interest expense = Pre-tax income - Income tax = Net income (or loss)

where:

- Revenue: Money generated from a company's normal business operations.

- Cost of goods sold (COGS): Direct costs associated with creating the product(s) the company offers.

- Gross profit: Equal to a company's total revenues minus COGS. In other words, the remaining profit for a company after deducing the costs associated with creating its products.

- Operating expenses: Expenses a company incurs through its normal business operations.

- Operating income (aka "earnings before interest and taxes" (EBIT)): Profit realized from a company's business operations after deducing operating expenses.

- Interest expense: Cost incurred by a company for the use of borrowed money.

- Pre-tax income (aka "earnings before taxes" (EBT)): Profit realized from a company's business operations after deducting interest expense.

- Income tax: Tax paid by the company on any earned income. Equal to the tax rate multiplied by the taxable income amount for the company.

- Net income (or loss): The remaining profits (the "bottom line") after deducting all business expenses from the revenues generated over a particular period.

The income statement formula can also be simplified, as shown below:

Total revenues - Total expenses = Net income (or loss)

Clearly, if revenues are greater than expenses, the company will generate a profit. Otherwise, the company will realize a loss over the given period.

Cash Flow Statement

The main purpose of a cash flow statement is to show how much cash moves in and out of a business within a period time.

Cash is divided into three sections on the cash flow statement:

- Cash From Operating Activities: How much cash a company generates during the period for its normal business operations.

- Cash From Investing Activities: How much and where a company reinvests cash during the period to sustain and grow its business.

- Cash From Financing Activities: How much cash a company raised from or returned to its debt and equity investors.

The formula for cash from operating activities is shown below:

Cash from operating activities = Net income + Non-cash charges +/- Changes in net working capital

where:

- Net income (or loss): The remaining profits from the income statement.

- Non-cash charges: Any accounting expense that does not involve any actual cash outflow from the company (e.g., depreciation, amortization, stock-based compensation, asset impairments, etc.)

- Changes in net working capital: Net working capital itself is calculated by subtracting current liabilities from current assets. The change is simply the difference in net working capital from one accounting period to the next.

The formula for cash from investing activities is shown below:

Cash from investing activities = Capital expenditures - Acquisitions + Proceeds from sale of investments

where:

- Capital expenditures (CapEx) (aka property, plant and equipment (PP&E)): Money a company spends to acquire, upgrade, and maintain physical assets.

- Acquisitions: Money spent for the purpose of acquiring new businesses.

- Proceeds from sale of investments: Cash received from the sale of assets over a particular period.

The formula for cash from financing activities is shown below:

Cash from financing activities = Cash from debt and equity issuance - Share buybacks and dividends - Debt repayment

- Cash from debt and equity issuance: Cash generated by a company for issuing debt and equity.

- Share buybacks and dividends: Cash spent by the company to buyback public shares from the public. Stock buybacks will directly affect a company's cash balance, treasury stock, and additional-paid-in-capital balance. If the company pays dividends, then this refers to any cash the company gave out to its eligible shareholders.

- Debt repayment: Cash spent by a company to pay down debt.

Finally, the net change in cash balance (aka ending cash balance) formula is shown below:

Net change in cash balance = Cash from operating activities + Cash from investing activities + Cash from financing activities + Beginning cash balance

In summary, the cash flow statement (prepared under the indirect method) adjusts net income from the income statement (to exclude non-cash items) and describes the sources and uses of cash during a period (cash + cash in - cash out = new cash).

Balance Sheet

Unlike the income statement and cash flow statement, which describe what happened over a certain period, the balance sheet (aka statement of net worth) is a snapshot of a company's financial situation at a certain point in time. The balance sheet balances the amount of assets that a company has against its liabilities and stockholders' equity.

The balance sheet formula is shown below:

Assets = Liabilities + Shareholders' equity

where:

- Assets: Any resource with economic value that a company owns. Ideally, a company's assets will provide future benefit to the company's stakeholders.

- Liabilities: Obligations or claims to a company's assets.

- Shareholders' equity (aka book value of a business): The residual claims on a company's assets once all liabilities have been paid down.

Common asset line items (what the company owns) include cash and equivalents, accounts receivable, inventory, and other fixed assets. Common liability line items (what the company owes) include accounts payable, accrued liabilities, and debt. Common shareholders' equity line items include common stock and retained earnings.

Net Income Linkage

The short answer on how the three financial statements are linked is to focus on net income (aka the "bottom-line" number), which is calculated on the income statement (after deducting all expenses from the company's revenues). Net income flows into the cash flow statement as its top-line item. Solving for the net cash flow and adding the beginning cash balance (for the period) will get you to the new/ending cash balance. This cash balance then flows to the company's "cash and equivalents" on the balance sheet. Additionally, net income flows into shareholders' equity (on the balance sheet) via retained earnings (RE).

In this article, we'll begin by examining the financial statements of a simple lemonade stand business. Below is a link to download the integrated financial statement model for this lemonade stand business if you'd like to follow along (NOTE: the blue numbers are all hard-coded assumptions):

When you're analyzing the three financial statements, and especially when you're trying to understand how they are interconnected, the simplest approach is to always start with the income statement, then work to the cash flow statement, and finally to the balance sheet.

You can see the net income relationship between the income statement, cash flow statement, and the balance sheet for this lemonade stand business in the image below:

As you can see in the image above, after deducting all expenses from the company's top-line revenues over a particular period on the income statement, the company is left with a net income/profit (or loss).

This net income number flows directly into the company's cash flow statement, where it's adjusted for non-cash charges and changes in net working capital. Adding the cash at the beginning of the year to the "net cash flow" (cash from operations + cash from investing + cash from financing), will solve for the ending cash balance.

For this example, this ending cash balance represents the real cash balance at the end of the company's fiscal year. This number then flows into the cash line item (typically shown as "cash and equivalents"), which is a current asset on the balance sheet. Given the liquidity of cash, it will always be a top-line item on the balance sheet.

Note that on the balance sheet under shareholders' equity, net income from the income statement also flows into retained earnings. Retained earnings is simply how much in earnings a company retains after accounting for any distributions to investors (e.g., dividends). See the formula below for further explanation on how to calculate retained earnings:

Retained earnings = Beginning retained earnings + Net income (profit or loss) - Dividends paid

In our case, the lemonade stand business does not pay out dividends, so retained earnings is simply equal to the retained earnings at the beginning of the period plus the net profit/loss for the current period.

In summary, net income from the income statement flows to the top of the cash flow statement, which flows into the bottom of the balance sheet as retained earnings. Net income also impacts cash, which is reported at the bottom of the cash flow statement, which then flows into the top of the balance sheet. This is how net income links all three of the primary financial statements.

Depreciation Linkage

Another way the three financial statements are linked is through the depreciation account, which is usually on all three of the financial statements, even if it's not always explicitly shown. Depreciation is the process of reducing the cost of an asset over its useful life (aka life expectancy).

On the income statement, depreciation is considered an operating expense. On the cash flow statement, depreciation is added back under the "cash from operating activities" section because it's a non-cash expense (meaning there's no real cash outflow for the business). On the balance sheet, accumulated depreciation reduces the value of plant, property and equipment (PP&E) (aka capital expenditures or CapEx for short). CapEx is money a company spends to acquire (growth CapEx) or maintain fixed assets (maintenance CapEx). This is the short answer on how depreciation links the three primary financial statements.

We can use our lemonade stand business example again to explain depreciation linkage. However, this time I will show the "fixed asset schedule," a supplementary report that displays the schedule of fixed assets on the balance sheet. Ultimately, this helps illustrate how depreciation expense, accumulated depreciation, and fixed assets such as PP&E are calculated and interconnected.

This depreciation linkage between the three financial statements and the fixed asset schedule is shown in the image below:

As you can see in the image above, total CapEx is equal to the sum of the fixed asset dollar amounts (for the lemon crusher, ice machine, and refrigerator). In this example, the lemon crusher has an asset life of 2 years (meaning the lemon crusher is not usable after 2 years) and the lemonade stand business must spend $3,000 every 2 years to buy a new lemon crusher. This is also known as property, plant and equipment (aka PP&E) and shows up under investing activities on the cash flow statement.

The next item to discuss is depreciation and amortization (D&A). While depreciation reduces the cost of a fixed asset (a tangible asset) over its useful life, amortization is the practice of spreading an intangible asset's cost over the asset's useful life. The key difference here is that depreciation refers to tangible assets (e.g., cash, inventory, equipment, land) while amortization refers to intangible assets (e.g., software, licenses, trademarks, patents, etc.). Regardless, both are treated as reductions from fixed assets in the balance sheet and are non-cash expenses, so they are often grouped into one line item.

After spreading the cost evenly over the three equipment's asset useful life's (this is called "straight-line deprecation"), total D&A for each of the five years can be summed. This then flows into the D&A expense on the income statement, and is added back on the cash flow statement (again, because it's a non-cash expense). Accumulated depreciation on the balance sheet (under non-current assets) is then calculated by adding the prior period's accumulated depreciation to the D&A expense for the period from the income statement.

It's important to note that although accumulated depreciation is classified as an asset on the balance sheet, it's not actually an asset. Rather, accumulated depreciation is classified as a "contra asset account" because it has a negative balance (with a credit balance). Therefore, the entire purpose of accumulated depreciation on the asset-side of the balance sheet equation is to reduce the gross amount of fixed assets being reported on the balance sheet (such as PP&E).

Depreciation in Financial Statements

When it comes to depreciation for publicly traded companies in the stock market, it can sometimes be a more involved process to identify. This is because it's not always explicitly included in the financial statements (particularly the income statement and/or balance sheet).

For example, Procter & Gamble (PG) does not have a "depreciation expense" line item under its operating expenses on its income statement, even though the company does have depreciating assets (e.g., $2.735B in 2021 is added back under the operating activities section on the cash flow statement).

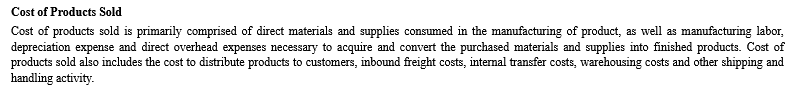

This is also where one can look further into the cash flow statement or read the "Notes to the Financial Statements" section in 10-K annual reports. In PG's case, depreciation expense is included within the "Cost of Products Sold" (aka COGS) line item, as explained under Note 1 of the "Notes to Consolidated Financial Statements:"

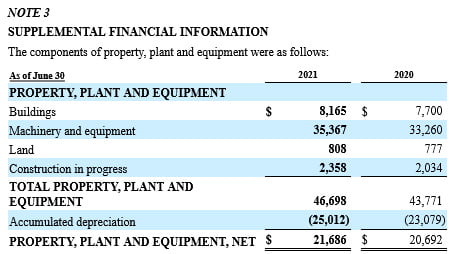

On the balance sheet for PG, accumulated depreciation can be found under PP&E. This line item is typically called "Less: accumulated depreciation." PG does not include this on its balance sheet, but upon further reading the "Notes to the Financial Statements" section on the 10-K annual statement, we can find a breakdown of property, plant and equipment that also happens to show the total for accumulated depreciation:

Clearly, the linkage of depreciation between the three primary financial statements is real, but this can be more difficult to identify than net income linkage.

Complete Linkage of the Three Financial Statements

In this section, I will use the lemonade stand business and its integrated financial statement model to provide a full picture on how the three financial statements are linked together. I will also include the assumptions used to create this model, and show the interconnections between the three financial statements and the fixed asset schedule. This entire example is shown below:

Evidently, the three financial statements are all interconnected. This complete linkage also includes a few items that were not discussed thoroughly in the net income and depreciation linkage examples above. These items are net working capital, financing, and acquisitions, as covered in the sections below.

Net Working Capital

Net working capital (NWC) is the difference between a company's current assets (i.e., cash, accounts receivable, inventory) and its current liabilities (i.e., accounts payable, dividends payable, accrued expenses). Albeit simple, the NWC formula is shown below:

Net working capital (NWC) = Current assets - Current liabilities

If you follow the green arrows in the image above (from the balance sheet), you can see how changes in accounts receivable, accounts payable, and deferred revenue (all working capital items) are adjusted on the cash flow statement every year. Given the complexity of some financial statements, it may help to create a separate schedule to calculate the changes in NWC.

Some examples of line items that can affect NWC are below:

- Revenues: Can be received as cash or accounts receivable. Increases to accounts receivable will occur if a company sells something and does not receive cash for it immediately.

- Operating expenses: Operating expenses on the income statement can be paid with cash, or they can be non-cash expenses such as stock-based compensation, depreciation, or amortization. If a company receives assets that has not yet been paid for, it will also show up as accounts payable on the balance sheet.

- Interest expenses: If payments on debt liabilities are made immediately, it will reduce the company's cash and equivalents, as well as the company's debt levels. If short-term interest payments are not made, it will affect the company's accounts payable balance.

- CapEx (aka PP&E): If CapEx was paid for with cash, the cash balance will be reduced while the fixed asset balance increases. If CapEx is paid for with debt, this can increase short-term or long-term debt, based on how this CapEx was paid. Therefore, changes in cash and short-term debt will affect NWC.

- Proceeds from sales of investments: This will increase the company's cash balance and/or increase the accounts receivable balance. Additionally, it will decrease the company's fixed assets and intangible assets, but these are not considered current assets, so it will not affect NWC.

- Debt: If a company decides to borrow money, this will affect the amount of cash a company has, as well as its debt levels, both short and long-term.

Financing

Total interest expense links to the income statement. Interest expense is calculated by taking the interest rate on the debt instrument and multiplying by the principal amount of debt amount (on the balance sheet) for the given period, as shown in the formula below:

Interest expense = Principal amount of debt * Interest rate

The change in these debt repayments will be reflected in the cash flow statement under the financing activities section.

In our example (refer to the gray arrows), for the last fiscal year, the lemonade stand business had $816 of interest payments (8% * $10,200 in debt on its balance sheet), as found on the company's income statement. The company's debt repayments (of $350 per year, then $700 per year) also reduced the debt on the balance sheet and was reflected as a change in cash flow under the financing activities section.

Acquisitions

At the time an acquisition is made, it will only affect the company's (the acquirers) balance sheet. On a high-level, the most obvious change is to the acquirers fixed assets, as the company will own everything the previous company (the acquiree) owned. When acquisitions are made, the acquirers cash and debt levels will also be affected. Acquirers are also likely to pay over the asking price of the acquiree because of "goodwill," which is an intangible asset.

After the acquisition officially closes, it will affect all areas of the income statement. This is because the acquirer (the company that gains control of the acquiree) must account for all the acquiree's revenues and expenses going forward. If the acquisition has to be written down (meaning the fair market value falls below the book value), this can be accounted for as a negative operating expense, which obviously impacts the income statement.

The Bottom Line

In summary, the simplest approach to understanding the linkage between the three financial statements is to follow net income. Net income is found on the bottom of the income statement (after deducting all expenses from revenues), which is then adjusted for non-cash charges and changes in net working capital on the cash flow statement (to help solve for "cash and equivalents" found on the balance sheet). Net income is also utilized to calculate retained earnings on the balance sheet.

Other approaches to understanding how the three financial statements are interconnected may require you to complete/find a supplementary schedule/report, as discussed below:

- Depreciation: This will likely require you to create a supplementary fixed asset schedule. In short, this affects common line items such as plant, property and equipment (PP&E, aka CapEx), accumulated depreciation, and depreciation expense.

- Net Working Capital (NWC): Understanding the changes to current assets and current liabilities of a company over a period may may require a supplementary change in net working capital schedule.

- Financing: Debt financing instruments typically require a supplementary debt schedule to understand debt levels, debt repayments, interest rates, and interest expenses.

Ultimately, by understanding how the income statement, cash flow statement, and balance sheet are linked, investors will be able to make more informed investment decisions.