In this article, I will show you how to analyze and protect your portfolio against inflation, regardless of the current market environment. Inflation is one of the most important investing topics, and as value investors, we can position ourselves in a way that we can profit from inflation, or at the very least, not let inflation adversely affect our portfolio. This article will therefore discuss the importance of inflation, its relationship with interest rates, and will provide a perspective based on the current market scenario to better understand where inflation is currently and how one would go about hedging their portfolio against inflation.

Importance of Inflation

Inflation is the average change of the price of goods and services, which is measured by the consumer price index (CPI). Inflation can also be thought of the change in the money supply for a particular nation. As the money supply increases, each individual dollar will have less purchasing power (meaning a weaker dollar), which tends to cause rising prices. Inflation therefore slowly but surely chips off the value of your currency, which this U.S. inflation calculator helps to illustrate. The CPI and money supply are also very much tied together, and what you'll often see is an increase in the CPI shortly after an increase in the money supply.

For reference, the live CPI chart is shown below:

The Federal Reserve (aka the Fed) and most economists agree that the average target inflation rate should be between 1-3% (as highlighted in the chart above). A 0% rate is unrealistic because most businesses, private and public, are allowed to increase or decrease their prices to be more competitive or to make a higher profit margin. Inflation is therefore the byproduct of a growing economy, but the loss in purchasing power for consumers still makes inflation a "bad thing." Regardless, if inflation lies within this 1-3% range, businesses and consumers alike will be able to make sound financial and investment decisions, which contributes to a well-functioning economy.

When the inflation rate is below 0%, this is known as "deflation." In other words, deflation is when the inflation rate goes negative. Historically, periods of deflation are characterized by economic stagnation and higher unemployment. In short, this is due to the reduced spending power from businesses and consumers (e.g., from falling prices and lower wages), which often contributes to lower economic growth. The consensus from economists is therefore that a low stable inflation rate is a lot more logical than letting deflation occur, let alone hyperinflation.

Hyperinflation is essentially a super-high inflation rate. The International Financial Reporting Standards (IFRS) defines hyperinflation as cumulative inflation of more than 100% over a 3-year period. With compounding, this results in a 26% rate of inflation each year, for three years. Obviously, hyperinflation is terrible for the economy as it can lead to cash becoming worthless, people hoarding perishable goods, and many investment allocations not seeing any real return.

Inflation and Interest Rates

To better invest in an inflationary environment, understanding the key relationship between the inflation rate and interest rate is crucial. To accomplish this, we must understand the role the Fed has with influencing both rates.

Put simply, the Fed really only has two main jobs:

- Maintain healthy economic expansion: Accomplished by ensuring the unemployment rate is close to zero.

- Maintain the prices of goods and services: Accomplished by ensuring the inflation rate is between 1-3%.

To elaborate, the Fed accomplishes these two main jobs by printing money (controlling the money supply) and by influencing/manipulating the interest rate.

The "overnight lending rate" or "federal funds rate" is the interest rate the Fed manipulates. Commercial banks within the U.S. use this rate to charge each other for borrowing money over the short-term. This interest rate is therefore the baseline interest rate of our entire financial system, and the higher this rate, the more banks will have to increase their own interest rates for the debts consumers take out from the bank (e.g., mortgages, credit cards, car loans, etc) to cover their own increasing interest expenses.

If the inflation rate is too high, the Fed will increase the interest rate which makes borrowing more expensive for consumers and businesses, thereby discouraging spending. On the other hand, when the inflation rate is too low, perhaps even deflationary, the Fed will cut interest rates and make borrowing more affordable, thereby encouraging spending and economic growth. Although changing interest rates can influence inflation rates, the money supply is another factor to consider. As later discussed, this is because a larger money supply tends to lower interest rates, whereas a smaller money supply tends to raise interest rates.

In relation to the stock market, when the Fed announces that it will be increasing the interest rate, the stock market almost always falls afterwards. This is because higher interest rates makes credit more expensive, which can limit the growth of most businesses that rely on borrowing as a form of financing their operations. Naturally, higher inflation can cause stock prices to go down as well over the short-term, due to the relationship between inflation and interest rates discussed before. Fortunately, this may offer good buying opportunities as well. Ultimately, changes in the relationship between the inflation rate and interest rate will have a significant impact on different industries in the stock market and different asset classes, as later discussed.

Note that investors cannot regularly and accurately predict where interest rates are going to be in a few years, and even where inflation is heading. Even experts have difficulty predicting these macroeconomic factors. Interest rate forecasters themselves, whose specialty is to forecast interest rates, have struggled to accurately predict forward interest rates as well.

Factors that Affect Inflation

Besides the Fed changing interest rates, there are two main factors that can cause higher inflation, or even an inflation crisis (hyperinflation):

- Money supply

- Supply and demand

Investors can therefore analyze these two main factors to determine the current market condition, which will help when making investment allocation decisions.

Note that hyperinflation will be driven by an excessive money supply and extreme supply and demand imbalance.

Money Supply

The money supply is how much cash and liquid assets are in the economy. Stimulus payments therefore add to the money supply. In theory, the more money that circulates throughout the economy, the greater the chances of higher levels of inflation. For example, the $5 trillion pandemic-era stimulus over March 2020 to March 2021 has been substantially higher than previous aid measures, which can be seen with the spike in the live chart below:

Therefore, it can be argued now that inflation levels in the future may be higher, as already evident with the current 8.5% inflation rate (as of Q2 2022), the highest it has been since September 2008. Fortunately, the Fed can fairly quickly shrink the money supply if inflation rates rise above expectations, by raising bank reserve requirements in the U.S. This would help to reduce the amount of money in circulation which, in practice, will help reduce inflation levels.

Velocity of Money

When examining the money supply, another factor to look into is the velocity of money. In short, the velocity of money shows the number of times a single dollar is used to buy goods and services over a specific period of time. For example, if everyone living in the U.S. received $1,000 but not one person used this $1,000 to buy any goods or services, perhaps deciding to invest it all or keep it in their bank accounts, then inflation levels will see little to no change whatsoever. On a side note, if this were the case, then the stock market would likely rise significantly.

The live M2 velocity of money chart is shown below:

As you can see, the velocity of money has been regularly decreasing, which means that less transactions are occurring between individuals within the U.S.

The velocity of money formula is shown below:

VM = GDP / M

where:

- VM = velocity of money

- GDP = gross domestic product (nominal)

- M = money supply

Some economists believe the velocity of money is irrelevant, due to how it's calculated and the fact that what matters more is how much credit is created and spent, and not how often money changes hands. Regardless, the velocity of money is still useful to look at if the Fed prints too much money, for example, which can cause the velocity of money to rise and higher levels of inflation to follow.

Supply and Demand

On the supply and demand side of inflation, currently the pandemic has disrupted both. On the supply side, the cost of supply chains and delivery services has increased due to the global lock downs. On the demand side, people are saving more money than ever before, largely due to the stimulus checks, which can be seen in the live chart below:

The Fed narrative of "transitory inflation" follows the argument that due to the pandemic there was a lot of "pent-up" demand, and with a recovering global supply chain system, this has caused the prices of good sand services to rise temporarily. Therefore, the notion is that higher inflation is only temporary until the economy begins to recover more, where the Fed may then act to increase interest rates and decrease inflation levels.

Until then, investors should realize that this pent-up demand will likely only continue to increase as the economy reopens, perhaps resulting in a rapid outflow from the savings accounts of consumers into the real economic environment. This has the potential to create an imbalance between the demand and supply side of the economy as it reopens, thereby causing higher levels of inflation, which investors should be proactive in hedging against.

Other factors that are signs of higher or lower inflation, largely related to the supply and demand of the economy, are described below (not a comprehensive list).

Bond Market

When higher inflation is expected, this causes bond prices to decrease and bond yields to increase. With expectations of the economy bouncing, this has encouraged investors to buy riskier assets such as stocks over bonds. This weaker demand for debt therefore leads to higher bond yields, to make the asset more attractive to investors, but this is also a sign of the bond market pricing in higher future inflation expectations.

You can look at the U.S 10-Year Treasury yield chart to examine whether this is currently the case. As of writing, bond yields have increased over the last year.

Breakeven Inflation Rate

Another, perhaps more useful chart to look at is the breakeven inflation rate chart, as it's a measure of how much inflation the market is anticipating. This chart visualizes the difference between the 10-year treasury constant maturity bonds and the 10-year treasury inflation-protected bonds. In other words, this chart compares the yield on an inflation-protected bond and an unprotected bond, which will give you the breakeven inflation rate. Essentially, this is the markets best guess of future inflation over the horizon of the bond (10 years), plus a risk premium to compensate for the uncertainty on future inflation.

Therefore, the latest value implies what the market is expecting to be, on average, in the next 10 years, as visualized in the live chart below:

Intuitively, it may seem that the breakeven inflation rate is one of the better predictor of inflation, but this is actually not the case as the rate has very little relationship with future realized inflation. This rate is therefore more of a measure of today's sentiment, and not one that accurately predicts future inflation.

Unemployment

When unemployment rates are lower, this can imply wage growth, more consumer spending, and therefore higher prices of goods and services. Obviously, this ties into the supply and demand relationship as well. Therefore, when there's higher levels of unemployment, you'll likely hear about inflation less.

The live unemployment rate chart is below, and as you can see, currently the unemployment rate has returned to more normal levels (albeit a little high):

Commodity Prices

Commodity prices have all generally risen in price since the beginning of the year (YTD) as well. This can clearly be seen on IndexMundi, where this change is evident. Commodity prices are a leading indicator for expected inflation, in terms of economic shocks (e.g., demand increases), and in terms of systematic shocks (e.g., caused by a disaster), both of which imply lower supply (and higher supply costs). Put differently, today's commodity prices state that the global demand for goods and services is strong relative to global supply, which can imply higher inflation in the future.

Certain commodity prices I like looking at to possibly determine the future of inflation include:

- Lumber and Steel: Besides being one of the world's most utilized materials, lumber and steel affect construction and housing prices. On average, framing (largely wood and steel) makes up an average of 18% of new home construction costs. Increasing lumber and steel prices can clearly add to the price of an average new single-family home in the U.S. Clearly, demand for lumber and steel has exploded in recent months, which has caused suppliers to struggle keeping up, thereby being a sign of higher inflation and higher costs of other raw materials as well.

- Oil: Oil prices have also climbed significantly since the start of 2021. Besides having a ripple affect across the economy, oil makes plastics and plastics are frequently used in many products. Higher costs will therefore hurt the economy, and the travel industry in particular. However, the pent-up demand from travel restrictions being lifted may lead to consumers being more willing to pay a higher premium for plane tickets, although no one knows for sure.

- Corn: Corn prices have also skyrocketed as well due to the pent-up demand, and corn is used in many products (from food and industrial products) and for livestock feed. Ultimately, this may imply that increases to the price of raw goods will lead to increased prices to consumers, thereby contributing to higher expected inflation rates.

Inflation Mentions

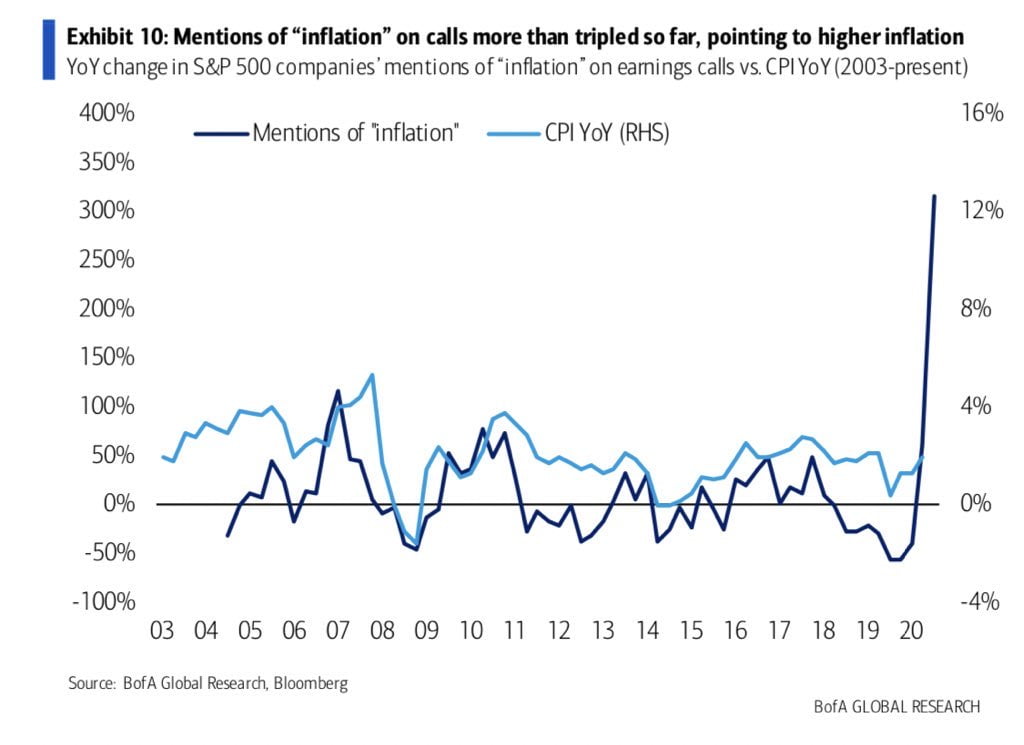

Recently, the Bank of America reported that the number of "inflation" mentions in earnings calls from S&P 500 companies has more than tripled year-over-year per company, which has not been seen since 2004. BofA Global Research also claimed that the number of inflation mentions has historically led the CPI by a quarter, with a 52% correlation.

This can be seen in the chart below, which is interesting to examine at the very least:

Investments for Inflation Protection

Now that you have a better understanding of inflation, the relationship inflation and interest rates have, and what factors could lead to higher or lower inflation in the future, the next concept investors should understand is how to best invest when inflation is not at normal levels (outside of the 1-3% range in the U.S.).

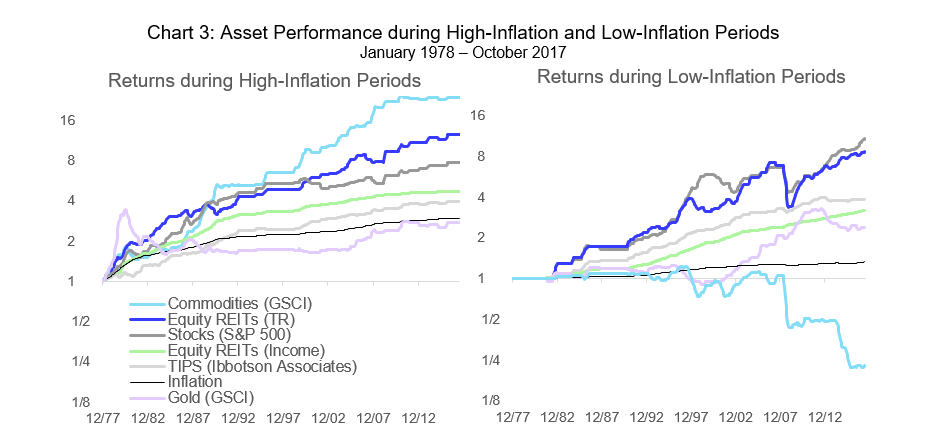

The "ultimate inflation hedge" would be an asset that correlates positively with inflation, responds to unexpected inflation, is not overly volatile, and has a positive real expected rate of return. Obviously, this type of hedge doesn't exist, so investors can look towards the asset classes discussed shortly that meet some of these criteria to best hedge against inflation.

The chart below helps to capture the inflation-hedging asset classes discussed below:

Inflation Hedge #1: Treasury Inflation Protected Securities (TIPS)

Treasury Inflation Protected Securities (TIPS) are fixed-income securities that investors can purchase to profit directly from rising inflation rates, as measured by the CPI. In other words, TIPS are U.S. government bonds where the interest rate is linked to inflation, and the principal payment of a TIPS will increase with inflation and decrease with deflation. Therefore, if you purchase a TIPS and inflation increases 3%, the TIPS principal will also increase 3%. When the TIPS matures, the investor (bondholder) will be paid the inflation-adjusted principal or the original principal value, whichever is higher (e.g., $1,000 minimum (usually), or the inflation-adjusted principal).

In short, TIPS provide direct one-for-one protection against rising inflation (not deflation!). Investors will also never be paid less than their original principal value when TIPS mature, and the principal and interest payments the TIPS offers will only increase as inflation rises. TIPS are therefore great asset allocation options in times of high expected inflation, but are not optimal for investors if inflation does not materialize over the length of the TIPS bond, especially considering that interest rates on TIPS are typically lower than other fixed-income bond classifications. Fortunately, unlike stocks, TIPS will always provide protection and the ability to profit against inflation.

Although fixed-income investments are not wise during high inflationary environments, and are even worse than stock investments in terms of downside risk in a high-inflationary environment, TIPS are an exception because investors can directly profit from rising inflation rates. To elaborate, if you purchased a typical 10-year bond with a 5% coupon rate, and inflation continues to rise during this period, a lot of the value received from the bond investment will be reduced or eliminated from higher inflation. On the other hand, if you had purchased a TIPS, then you'd likely be able to profit from this rising inflation.

Inflation Hedge #2: Real Estate and REITs

Physical real estate and real estate investment trusts (REITs), which are publicly traded companies in the real estate industry, tend to perform better in higher inflationary environments.

Investors can invest in residential REITs to profit from higher rents from tenants (because of higher inflation), which in theory will cause the REIT to generate more income, not to mention the (current) rising value of properties due to the rising prices of lumber and steel. Ultimately, this results in real estate owners being able to generate a higher rental income, which translates to helping investors keep pace with rising inflation rates. The same concept would obviously apply to physical real estate owners as well.

Note that REITs also are not required to pay corporate income tax as they pay out 90% of their profits as dividends, which is why dividends from REITs are taxed as ordinary income and not qualified dividends, meaning a higher tax rate on your behalf. Regardless, you may receive higher dividends in a higher inflationary environment.

- Related: Real Estate Investing vs. REITs

Farmland

Investing in farmland in a variety of market environments has proven to be a valuable inflation hedge, with farmland returns outpacing inflation over the long-term. This is because farmland is a productive and limited resource, and farmland will generally only continue to become more valuable as farmland technologies improve and become more productive cash-generating assets.

If you invest in farmland, you can expect income from rent and/or crops/livestock from the farm, and potential long-term returns from simple land value appreciation. As this income accumulates and the land value continues to appreciate, it's easy to see how farmland outpaces inflation while also acting as a valuable long-term investment.

Inflation Hedge #3: Commodities

As previously discussed, commodity prices typically rise when inflation is increasing, thereby offering inflation protection for commodity-exposed investors. To recap, this is due to the supply and demand relationship, where increases in the demand for goods and services may cause a supply shock. Higher prices for commodities, which are used to produce the goods and services offered by many businesses, can therefore cause the prices of these goods and services to rise as well, resulting in higher inflation. Investing a portion of your portfolio in commodities is therefore wise, especially in some precious metals and energy-related products.

Gold as an Inflation Hedge

Gold can be classified as "commodity money," and it's a common asset recommended when higher inflation becomes a topic of discussion. However, gold is NOT a great hedge against inflation, even if it holds its value unlike its currency counterpart, which can be proven based on its past performance. Put simply, gold is an unreliable inflation hedge at best, as its real price fluctuates heavily and does not react in any particular way to unexpected inflation rate changes.

Moreover, there's nothing inherent in gold that is tied to changing inflation rates, not to mention the uncertainty on expected returns that a gold hedge can bring. At most, rising gold prices and money supply growth (implying higher inflation) have some type of relationship, but there's no one-to-one long-term correlation historically that can prove that gold is a good hedge against rising inflation.

In other words, gold may maintain its purchasing power over very long periods of time, but it does not respond to changes in inflation, purely based on what historical data has proven. Regardless, gold can be classified as a good hedge against hyperinflation or to hedge one's portfolio prior to an economic recession. However, investors should not look to gold as an inflation hedge (especially for smaller and stable inflation) without first considering the other asset class recommendations discussed in this article.

Oil and the Crack Spread

On the topic of commodities, the oil industry is one that is worth mentioning in times of rising inflation. This is particularly due to the relationship between rising oil prices and how oil refiners can profit from this. To elaborate, oil refiners buy and refine oil, which is then turned into gasoline or distillate fuel. It goes without saying that if gasoline and distillate fuel prices rise at a higher rate than oil prices, then in theory these oil refiners will be able to generate more money. Although the stock market is unpredictable, this can likely then lead to higher real returns for investors who have exposure to these oil refiners.

The difference between the purchase price of crude oil and refined oil (gasoline and distillate fuel) can be shown on a "3:2:1 Crack Spread" chart. The chart's spread value represents the overall pricing difference between 3 barrels of oil converted into 2 barrels of gasoline and 1 barrel of distillate fuel. In other words, the higher the spread, the more profit a refinery makes. As of writing, this spread is on the higher end, which implies that oil refineries are increasing their profits. Therefore, the oil refineries sector, as of writing, may be a sector worth looking into to potentially profit from as inflation rises.

Inflation Hedge #4: Stocks

To consistently beat inflation over the long-term (e.g., 10 years or more), you need to have stock investments. Stocks, as the data shows, are the best long-term hedge against inflation. Although stocks tend to perform poorly (over the short-term) when inflation is relatively high, over the long-term perspective stock returns have managed to outpace inflation by a substantial margin. Stocks therefore have a positive real return over the long-run, and this inflation-adjusted return figure is 6.75% per year since 1900.

Note that you can calculate the inflation-adjusted return of an asset over a particular period using the formula below:

Inflation adjusted return = [(1 + Return) / (1 + Inflation rate)] - 1

As discussed, stocks are considered the best long-term hedge against inflation, but not all stocks are equally good inflation hedges. In particular, in times of higher inflation, investors should look towards investing more in companies (in certain industries/sectors) that can reasonably maintain their pricing power. Therefore, when their own costs rise, they are able to raise the prices on their goods and services without losing any customers and/or their competitive advantages. In other words, how well a company performs in an inflationary environment will largely depend on the company's ability to raise prices without losing customers.

You can refer to the image below to understand what industries within the stock market to focus on based on rising/falling interest rates and rising/falling inflation rates. Clearly, this is a simplification and may need adjusting, but it's still helpful to look at and can generally be followed for most companies within the industry:

As you can see, the U.S. equity market is split into four different quadrants. Each quadrant includes industries that have historically outperformed the rest, based on the respective changes to inflation and interest rates.

When both interest rates and inflation rates are falling, this is a great environment for growth tech stocks that typically borrow more and are heavily leveraged, as well as consumer staple stocks and utility stocks. In other words, these are generally the worst stocks to buy when an inflation crisis comes. The reason growth tech is favorable, is because the cost of borrowing is cheap when interest rates are lower, with the added bonus that falling inflation generally leads to higher short-term stock prices.

With the consumer staple goods and utilities industry, there's little differentiation between products and services, especially with competition being overly saturated. Therefore, these industries have little pricing power. In other words, these businesses generally have tight profit margins, and higher levels of inflation will significantly push down their profitability which may be reflected in their stock price and even dividends.

When interest rates are falling and the inflation rate is rising, real estate, materials, retails, and hardware tech stocks perform better. This is especially the case for real estate, as investors can benefit both from rising inflation (as discussed before) and cheaper mortgages due to the lower interest rates. On the other hand, when interest rates are rising and inflation rates are falling, this market environment will generally benefit semiconductors and healthcare companies the most (although this can vary).

When inflation is rising and the Fed is raising the interest rate, there are multiple industries that can do well. Arguably, financial services companies and commodity producers (as discussed before) will benefit the most from higher inflation and higher interest rates. The financial services industry (e.g., banks, credit card companies, insurance companies) make a majority of their money from interest, and if inflation is at a manageable rate and interest rates are increasing, this is particularly profitable for these financial services companies. Energy companies and gold miners, to a certain extent, can also perform well in this type of environment.

The Bottom Line

In summary, inflation is the rate of increase in the price of goods and services over a particular period, and is measured by the Consumer Price Index (CPI). As inflation rises, the purchasing power of your nation's currency will decrease overtime. Moreover, if inflation, as an "invisible tax," manages to outpace the interest you earn on your bank account, let alone any investment allocations you may have, you will end up with negative or reduced real returns.

Over long horizons, equity investments (including REITs) have outperformed inflation by a significant margin, and according to historical data, provide the best long-term protection against inflation. Primarily due to pricing power and the relationship between interest and inflation rates, the best stocks for rising inflation are financial, real estate, and commodity stocks. On the other hand, the worst stocks for rising inflation rates are utility stocks, consumer staple stocks, and high-growth tech stocks. However, over shorter time horizons, where the overall stock market typically falls due to higher inflation, short-term Treasury Inflation Protected Securities (TIPS) may provide the best direct protection.

Regardless of the current market environment, investors can use this knowledge on inflation and how to analyze the market to make more informed investment decisions, which will ultimately contribute to maximizing the real returns investors receive from their investment portfolio.