In this article, I will show you to how to value a company using the discounted cash flow model (DCF), and will guide you through a complete DCF valuation for a real company on the stock market. By doing so, we'll be able to estimate the company's intrinsic value, which will tell us whether the current stock price is undervalued or overvalued.

The intrinsic value, also known as the fair value, can be defined as the value today of all expected free cash flows from the future. Knowing a company's intrinsic value is useful for value investors who want to purchase companies at attractive (undervalued) prices in hopes of future investment gains.

The formula to find intrinsic value is below:

Intrinsic value = [FCF1 / (1+r)1] + [FCF2 / (1+r)2] + .... + [FCFn / (1+r)n] + [FCFn * (1+g) / (r - g)]

where:

- FCF = free cash flow

- r = discount rate (required rate of return)

- g = growth rate

- n = time period

To find the intrinsic value of a business, one of the best ways is to use a DCF valuation, which is an absolute valuation method. With a DCF, you can value any asset based upon its intrinsic characteristics, the asset's expected cash flows over its lifetime, and the uncertainty on receiving these cash flows. Therefore, by completing a DCF valuation, you will follow the principal that the value of a company can be derived from the present value (PV) of its projected free cash flow (FCF).

The 8 steps to completing a DCF valuation are listed below (and on the table of contents), and will be covered after the next section.

- Step 1: Free Cash Flow

- Step 2: Discount Rate

- Step 3: Perpetual Growth Rate

- Step 4: Terminal Value

- Step 5: Shares Outstanding

- Step 6: Discount Back and Find Intrinsic Value

- Step 7: Sensitivity Analysis

- Step 8: Margin of Safety

Discounted Cash Flow Valuation Viability

The DCF stock valuation method is a widely accepted and respected method in the world of finance. Although investors have to make a number of assumptions when completing a DCF analysis, if investors value companies with a long-enough operational history, are conservative with their numbers, understand how to apply sensitivity analysis and a margin of safety, and avoid bias (which is all easier said than done), they may be able to accurately value these companies and profit significantly over the long-term.

Therefore, as investors, the DCF model should be utilized for long-term investment opportunities. However, the intrinsic value number you find should never be looked at independently as it never tells the complete story of a company and what its stock price may be worth. In other words, investors should also look at the company's competitive advantage (economic moat), its management team, how the company manages debt, and many other financial and non-financial variables to really determine the price range they would be willing to purchase the company for.

With this in mind, when is a DCF valuation the most viable?

Put simply, the DCF model works when companies have free cash flow (FCF) and when FCF can be reasonably estimated. FCF measures how much cash is available to companies after repaying creditors or paying dividends and interest to investors.

Therefore, early-stage companies are likely not a good candidate for a DCF as they may have high growth but limited amounts of FCF in their current state. It's also difficult to accurately value companies that are cyclical due to the nature of their business. On the other hand, large blue-chip companies that are more established are typically perfect for a DCF analysis.

Now, as a general rule, if any one of the four criteria below are met, the company is a viable candidate from a valuation perspective because it has free cash flow (FCF):

- The company does not pay any dividends.

- The company pays a dividend, but the dividend it pays is minuscule in comparison to the company's ability to pay this dividend, and therefore is not significantly tied to the earnings/profitability of the firm.

- FCF aligns with the company's profitability within an analyst's forecast horizon.

- Investor has a controlling interest in the company, which means the majority owner has the discretion over how to use equity cash flows (in contrast to DDM modeling)).

Follow the criteria above to the best of your ability to determine whether a DCF valuation can be applied to the company you may be looking to invest in. It's also wise to stick with more established companies as their capital expenditures (CapEx) and FCF may be more accurately estimated, although this differs between companies and industries. Regardless, it's a good idea to have a thorough understanding of a company (e.g., its business model, competitors, what its revenue sources are, etc.) before completing a DCF valuation for a company.

Intel Corporation (INTC) DCF

The company I'll be completing a DCF valuation for is Intel Corporation (INTC), a market leader in manufacturing and developing computer microprocessors and chip-sets.

You can see Intel's stock price performance over time in the chart below:

Intel has a current market cap of over 212 billion, has a rather low dividend yield, and is a blue-chip stock. Therefore, a DCF valuation will work well for this company as it meets more than one of the four criteria described above. Moreover, the company has FCF and we can reasonably estimate FCF over the next 5 years at the very least.

Now, follow the steps laid out in this article to see how I found the intrinsic value of Intel. Before I begin, make sure you know how to read and access the 10-K's for the company you're analyzing. You can also use a financial data website like QuickFS to reduce the amount of time spent looking through financial statements and 10-K's.

Step #1: Free Cash Flow

The first step in a DCF valuation is to find the free cash flow (FCF) of a company. FCF measures a company's financial performance and shows the amount of cash a company has remaining after accounting for operating expenses and capital expenditures (CapEx). In other words, FCF is the amount of cash flow available for discretionary spending by management and shareholders.

There are two types of FCF calculations:

- Free cash flow to the firm (FCFF): Cash flow that is available to the firm, including bond investors, if the company hypothetically has no debt. Also referred to as "unlevered free cash flow."

- Free cash flow to equity (FCFE): The amount of cash generated by a company that is available to stock investors. Also referred to as "levered free cash flow."

The primary difference between FCFF and FCFE are interest payments and taxes, as FCFE includes interest expense paid on debt and net debt issued or repaid. For reference, the FCFF and FCFE calculations are shown below:

FCFE = Net income + Depreciation & amortization (D&A) - Increase in net working capital (NWC) - Capital expenditures (CapEx) + Net borrowings

FCFF = Earnings before interest & taxes (EBIT) * (1 - Tax rate) + Depreciation & amortization - Changes in net working capital (NWC) - Capital expenditures (CapEx)

In most DCF valuations, you'll want to use FCFE because it provide a more accurate picture of the cash flows an equity investor can expect. FCFE is also ideal as long as the leverage for the company you're analyzing is fairly stable.

So, use FCFE unless the firm's capital structure is expected to change in the near future, for example because of the company taking on a lot more debt. On a side note, if FCFE or FCFF is expected to be negative in the foreseeable future, then you picked the wrong company for a DCF valuation.

Because I'm attempting to find the intrinsic value of Intel, a company with a fairly stable capital structure, I will use the FCFE approach to calculate and estimate Intel's FCF.

How to Calculate Free Cash Flow

Some analysts (myself included) choose to use the simple FCF calculation, instead of the complete FCFE calculation shown above, as it's very difficult to predict the net borrowing a company will have in the future.

Below is the simple and most commonly used FCF formula approach:

FCF (simple) = Cash flow from operations - Capital expenditures (CapEx)

The first thing you need when analyzing FCF is cash flow from operations (aka cash from operations (CFO)), found in the cash flow statement. Then, you would subtract total capital expenditures (CapEx), also called the plant, property and equipment (PP&E) under the investing section on the cash flow statement. This would give you the simple FCF number.

Doing this for Intel gives me the following FCF numbers:

INTC: FCF (Simple)

This is the approach many wall street analysts take, primarily because it's difficult to predict when a company has "net borrowings" in the future.

However, it's in good practice to add back any "net borrowings," or money borrowed for financing activities in a business (found under the financing activities in the cash flow statement). This is simply the difference between the total debt issued and the total debt paid over a period. In Intel's case, this line item is called "Net Issuance of Debt."

Below is the FCF formula approach with net borrowings included:

FCF = (Cash flow from operations - Capital expenditures (CapEx)) + Net borrowings

You would add net borrowings to account for any debt the company took out. Sometimes, this can change the FCF figure significantly.

For example, adding net borrowings to the Intel FCF table (from above) will provide you with a different picture on FCF:

INTC: FCF (With Net Borrowings)

Now, if we compare the difference in FCF after adding net borrowings, we can see just how much this fluctuates year-over-year:

INTC: FCF Differences

Calculating FCF with net borrowings is the more accurate method of the two, as it considers any money borrowed by the company which may affect the cash available to shareholders. However, because net borrowings is difficult to predict accurately, I would recommend that most investors stick with the simple FCF approach and ignore net borrowings altogether.

Forecasting Free Cash Flow

After you have your FCF figures, you must forecast how much this will grow in the next 5 or 10 years, but this forecast growth period all depends on the company you're valuing and your preference. In our case, I will go with the standard 5-year forecast period.

Using the table below, you may be able to use your company's competitive position and determine how many years to forecast FCF for your DCF valuation:

Again, this is a table you can refer to when deciding on the forecast growth period for your company's FCF. If you're unsure on how many years to forecast FCF, stick to 5 years. If you decide on projecting FCF 10 years (or even longer), just know that the further these numbers are projected out, the more these later periods are subject to estimation error. Moreover, these later FCF figures may be completely inaccurate, simply due to the uncertainty the future holds.

Now, there are various ways to forecast growing FCF, but I will show a simple and effective method that works well. I will begin by finding how much FCF aligns with profitability by using the approach below:

FCF rate = FCF / Net income

This will give us a percentage, and the closer this is to 100%, the more FCF aligns with profitability. This is also one of the four criteria for deciding on whether a DCF can be used for a company. I will then use the number I think best represents the company's FCF's, relative to net income over the past years, and estimate future cash flows afterwards.

For example, in the table below, we can see that the FCF rates for Intel in the past 5 years are, on average, close to 80%:

INTC: FCF Rate

The percentage you choose to use here depends on your research of the company and how different you think FCF will be relative to net income over your forecast period. If you're uncertain on a company's future, you can use the smallest percentage (if it's not an outlier) to be conservative. If you decide to use a higher percentage, it would obviously make your estimates more aggressive.

Based on my research and knowledge on Intel, and because I want to be conservative, I will choose to use 70% as the FCF rate.

Now, to estimate future FCF, the method I will show you involves forecasting revenues, estimating net income, and then coming up with FCF afterwards. You could also just forecast net income and then derive FCF afterwards, but the method I'll demonstrate should give you an idea on how to accomplish both approaches.

FCF: Revenue Method

For a large company like Intel, there will be many analysts covering the company and giving their estimates. One common way of finding revenue estimates is to use Yahoo Finance, search your company, and then go to the "Analysis " tab. From there, you can see what analysts estimate for revenue over the next few years, along with the number of analysts as well:

In the image above pulled from Yahoo Finance, we can see the revenue estimates for 2022 and 2023 are $76.12B and $77.86B respectively, both with a good analyst sample size. I will therefore use these numbers as Intel's revenue estimates for 2022 and 2023.

If you're valuing a company that does not have a revenue (or net income) estimate, or perhaps too few analysts for the estimate to be considered reliable, you can choose to identify a reasonable growth rate for the company instead. You must do this anyways to project a company's revenues at the end of your forecast growth period.

One method to determine this growth rate is to find the revenue growth rate between each year, which is just the percent difference between any two consecutive years:

Revenue growth rate = (New year - Old year) / Old Year

Then, you can simply average the forecast revenue growth rate (for 2022 and 2023 in our case), or use the average revenue growth rate for the past 5 years to come up with a reasonable revenue growth rate. Afterwards, you would apply this rate to the rest of your forecast growth period.

In Intel's case, this would be -0.69% if I were to average the next 2 years (2022 and 2023) or 1.97% if I were to use 5 years instead (including 2022 and 2023). The growth rate you select will be dependent on you and how you think the company will perform in the future. In my case, I will choose to use 1.97% as the revenue growth rate and apply this revenue growth to 2024, 2025, and 2026.

The revenue and revenue growth rates (actual (A) and projected (P)) for Intel are shown below:

INTC: Revenue Growth Rate and Revenue Projections

The important thing here is that you use a revenue growth rate that makes sense, which is where your understanding of the business plays a large role. Clearly, a large and established company will likely have a smaller growth rate than an early-stage tech company with more growth potential.

It's also important to reiterate that the further you project a company's revenue growth, the more uncertain revenue will become, simply because the future is impossible to predict. Therefore, if you have a forecast growth period of 10 years instead of 5 years, using a more conservative revenue growth rate is recommended.

Now that you have revenue projections, the next step would be to find net income. One method is to find "net income (profit) margin" (aka net margin), which determines the proportional profitability of a business, expressed as a percentage of revenues:

Net income margin = Net income / Revenue

Net income and revenue are found on the income statement. Finding net margin over the last 5 years for Intel gives me the following table:

INTC: Net Income Margin

Taking an average of these last 5 years will result in a net income/profit margin of 25.25% for Intel, which can then be used over the forecast growth period to come up with future net income (by multiplying it to the projected revenue numbers), as shown below (actual (A) and projected (P)):

INTC: Projected Net Income

Again, you can also use a lower percentage net income margin (such as 20%) if you want to be more conservative. Regardless, this will get you the projected net income numbers, in this case for 2022-2026.

Next, take your FCF rate found before (we chose 70%) and multiply this by net income to get projected/forecast FCF (over the next 5 years in our case):

INTC: Completed FCF (2017-2026)

As discussed under step #6, these FCF numbers will be used in our DCF model to calculate the intrinsic value of Intel.

Note that you can also calculate a number called "owners earnings" for the most recent year, favored by Warren Buffett, and grow this by an appropriate growth rate. Although this calculation is nearly the same as the simple FCF calculation, it can be an even more involved process. Regardless, finding owners earnings instead of FCF can provide you with a potentially more accurate valuation.

Step #2: Discount Rate

The next step is to calculate the discount rate (aka the required rate of return). The required rate of return is the minimum return an investor will accept for owning stock in a company, accounting for the risk of holding the stock. Because we're using FCF, our discount rate should be based on our individual perspectives as an investor.

Therefore, the required rate of return I prefer using will (most likely) be different than yours, simply because the return I require on the companies I purchase may be higher or lower than yours. In other words, my required rate of return will differ from yours because of the differences in our risk tolerance, investment goals, time horizon, and available capital, among other things.

If you've completed an absolute valuation before and have a required rate of return that works for you, then use this. However, if you don't have a personal required rate of return, then we can go through a more involved process and come up with a discount rate using the "weighted average cost of capital" (WACC), which is essentially a default required rate of return.

Personally, I try to avoid using the WACC because it relies on an asset-pricing model called the "capital asset pricing model" (CAPM), which comes with a number of assumptions. The main issue with this model for valuation, is that it assumes investors act rationally on the latest available public data and that markets are efficient, which is obviously not true in the stock market. Therefore, to use the asset-pricing model in this regard may lead to misleading figures in your valuation.

Regardless, the WACC is still the next-best alternative if you do not have a personal required rate of return. I will also use the WACC found below for Intel in this article because I cannot apply my required rate of return to every investor.

How to Calculate the Weighted Average Cost of Capital (WACC)

The formula below shows you how to calculate WACC for any company:

WACC = wd * rd (1 - t) + we * re

where:

- w = weights

- d = debt

- e = equity

- r = cost (aka required return)

- t = tax rate

Now, let's begin by finding the first part of the formula, the debt portion.

Cost of Debt

The cost of debt (rd) is the market/actual interest rate the company is currently paying on its debt obligations. I will show you two methods of estimating the cost of debt, but the second method can only be used if your company did not issue a lot of debt (net borrowings) in its current year.

Method #1: Debt Rating Approach

The method I prefer using is the debt rating approach, where you are simply adding the company's default spread (depending on its credit rating) to the current risk-free rate. Then, you'd multiply by one minus the effective tax rate, as shown in the formula below:

rd = (rf + default spread) * (1 - t)

where:

- rd = cost of debt

- rf = risk-free rate

- t = tax rate

The risk-free rate is the 10-year treasury yield rate, and is the rate of return an investor would expect to receive from an absolutely risk-free investment. This rate changes daily, so use the most recent date from the USDT website.

As of writing (end of March 2022), the risk-free rate is 2.41%, so I will use this.

The default spread is the difference between the yields of two bonds with different credit ratings, and a bond's credit rating is just a letter-based credit score used to judge the quality and creditworthiness of a bond. So, an investment grade bond like "AAA" will have a lower default spread and will be considered safer than any bond rated lower, such as "BBB."

Before you determine the default spread, you first have to find the company's credit rating through Moody's, Morningstar, or FitchRatings (among others), and determine what rating the company has.

- See my dividend investing article to learn more about credit ratings, view a credit ratings table, and know how to find credit ratings.

Currently, according to S&P Global Ratings, Intel has a credit rating of A+ or A1, depending on the agency.

Then, we can use a default spread table to determine the cost of debt, using a default spread table and the formula shown above. However, because it's difficult to find an up-to-date, free, and accurate default spread table, the next-best option is to estimate a synthetic rating instead.

You can use the table the below for high market cap firms, such as Intel. This table utilizes the interest coverage ratio to estimate the default spread. For reference, this formula is shown below:

Interest coverage ratio (ICR) = EBIT / Interest expense

Although you can reference this table, keep in mind that default spreads will fluctuate due to changes in the market (inflation, liquidity, demand, etc). Therefore, it's in good practice to use an updated table.

- Table re-created from: Damodaran Online

- Table only applies for high market cap firms

Intel's interest coverage ratio is 32.6 (19,456 / 597), so according to this table it would be classified as a AAA bond with a default spread of 0.75%. However, we know the actual current rating is A1/A+, so we can go with the middle-ground and select 0.88% as the default spread.

Then, if we add 0.88% to the risk-free rate of 2.41%, we will come up with Intel's before-tax cost of debt of 3.29%. However, in most countries, interest expense is a tax-deductible item, meaning companies will pay less in taxes due to these interest payments. Therefore, this 3.29% is not the true cost of debt, and we have to use the "(1 - t)" in the WACC formula to find the after-tax cost of debt.

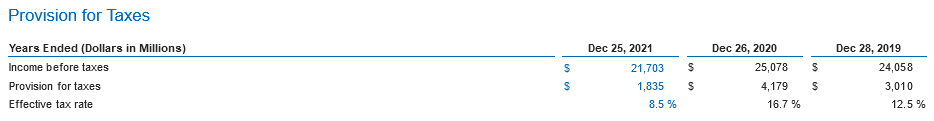

The tax rate (t) can be found on the company's most recent 10-K annual report. It can alo be calculated using the tax rate formula below:

Tax rate = Income tax expense / Income before tax (EBT)

Doing so for Intel will give us an effective tax rate of 8.46% (1,835 / 21,703). This can be compared to the tax rate on the company's 10-K annual report, which is usually found in the "Notes to Financial Statements" section:

As you can see, this effective tax rate is equal to 8.5%, which is the same as our calculation above. With this information, we can compute the after-tax cost of debt now:

rd (debt rating approach) = (2.41% + 0.88%) * (1 - 8.46%) --> 3.01%

Method #2: Interest Expense to Total Debt Approach

One quick method to find the company's cost of debt is to take the company's average annual interest expense and compare this to the company's total debt (short-term debt + long-term debt). Again, this method only works if the company did not issue a lot of debt (net borrowings) in its current year:

rd = (Interest expense / Total debt) * (1 - t)

where:

- rd = cost of debt

- t = tax rate

For Intel, it had $2,474 million in net borrowings (we found this earlier), so this method may be feasible. Just make sure to apply the effective tax rate of 8.46% we found before to compute the after-tax cost of debt:

rd (interest expense to total debt approach) = (597 / (4,591 + 33,510)) * (1 - 8.46%) --> 1.43%

Both approaches resulted in roughly the same answer for Intel's cost of debt, although this obviously is not always the case. Moreover, because method 1 has more variability to it, and because Intel does not have a lot in net borrowings, I will choose to use the result from method 2 (1.43%) to compute the WACC later on.

Cost of Equity (CAPM)

The next step is to calculate the cost of equity (re). To do this, use the capital asset pricing model (CAPM), which describes the relationship between systematic risk (β) and expected return (re) for stocks:

re = rf + β*(rm - rf)

where:

- re = cost of equity

- rf = risk-free rate

- β = beta

- rm = expected market return

We already found the risk-free rate (rf) before, using the USDT website. Again, this is the current 10-year U.S. treasury bond rate, which as of writing is 2.41%.

Next, you should find the beta (β) of the stock, which is simply a measure of the volatility or systematic risk of the company when compared to the market as a whole. So, a higher beta number means higher risk and higher return potential.

For Intel, I found its beta by going back to Intel's Yahoo! Finance page, selecting the "Statistics" tab, and using the "Beta (5Y Monthly)" 0.55 number.

Now, we need to find the expected return of the market (rm). One method is to find the average annual return going back 10, 15, 20, or more years using whatever financial data website you'd like. However, I like to use 10% as it's generally the average annual return of the S&P 500 Index since its inception in 1926. If you use this 10%, you may want to adjust this figure slightly (even if it's only by 0.5-1%) depending on the current market environment, or if you have good reason to believe this will be lower or higher in the near future.

Plugging all of these variables in will get us the cost of equity for Intel below, which we can then use in our WACC equation:

re (INTC) = 2.41% + 0.55*(10% - 2.41%) --> 6.58%

Debt and Equity Weights

The final parts of the WACC formula is to find the weights of debt and equity.

To do this, take the total market cap of your company, which represents equity, and the total debt, and add them together. Then, determine how much of debt and equity consists of this total figure by simply dividing them as shown below for Intel:

INTC: Debt and Equity Weights

As you can see, the we is 84.62% and the wd is 15.38%. Now, we can finally solve for Intel's WACC, which will then be used as our discount rate in our DCF valuation.

Solving for Intel's WACC:

WACC (INTC) = (15.38% * 1.43%) + (84.62% * 6.58%) --> 5.79%

You can then plug this 5.79% figure into your DCF model as the discount rate (required rate of return), and this completes step 2. For another example on how to calculate the WACC (with downloadable spreadsheets), see the link below:

Step #3: Perpetual Growth Rate

The perpetual, or constant growth rate, is the growth rate that free cash flow (FCF) is going to grow at into perpetuity (forever).

Personally, I use a perpetual growth rate between 0-2.5% depending on the company and the market. This conservative range is about in line with the expected growth of the U.S. economy, the inflation rate, or long-term GDP growth.

The important thing here is to not use a growth rate that is too high, like 5%. If the economy is growing at 3% and we use a 5% growth rate, we're essentially implying that one day, even if it never happens, the company will be larger than the entire economy, which is absurd. So, the growth rate that you're using to project into infinity forever (g) needs to be smaller than your discount rate (r), in our case 5.79%.

For Intel, I will be more on the aggressive side and go with use a perpetual growth rate of 2%. You will use this perpetual growth rate percentage in the next step when solving for terminal value.

Step #4: Terminal Value

Terminal value (TV) is the value of a business beyond the forecast growth period for when future cash flows can be reasonably estimated, as you cannot estimate cash flows forever. By finding the terminal value, investors can estimate what the cash flows will be after the forecast growth period, which in our case is after 5 years.

One formula to calculate terminal value is shown below:

TV= FCF * (1 + g) / (r - g)

where:

- TV = terminal value

- FCF = free cash flow

- r = discount rate (required rate of return)

- g = perpetual growth rate

So, to find terminal value, you'd take the last forecast time period, in our case time period 5, and you'd grow this (FCF5) one year by your perpetual growth rate that you found earlier. This would give you the free cash flow for time period 6. Then, you would divide this figure by your required rate of return (or the WACC) minus the perpetual growth rate.

This entire calculation is shown below for Intel:

TV= $14,591 * (1 + 2%) / (5.79% - 2%) --> $392,692

So, this $392,692 (rounded) is Intel's terminal value at the end of period 5, or the beginning of period 6.

Step #5: Shares Outstanding

The next step is to find the number of shares outstanding for the company, which is the amount of company stock held by all shareholders, including insiders and institutional investors.

Going back to Yahoo Finance, we can see that Intel has 4.07B currently in shares outstanding.

To find a more exact figure, you can look at the company's most recent 10-K annual report or 10-Q quarterly report to find the number of shares outstanding. This is typically found on the cover page as shown below for Intel's most recent 10-K:

So, Intel had 4.072B in shares outstanding. This will be used to calculate the per-share intrinsic value of the stock.

Step #6: Calculate Intrinsic Value

Now, one of the most important steps in a DCF model is to account for the time value of money (TVM), which states that a dollar today is worth more than a dollar in the future due to its potential earning capacity. Therefore, you must discount any cash you forecast/project into the future to estimate the present value worth, which you can then use in a DCF calculation.

This would be done by using the approach below:

PV of FCF = FCF / (1 + r)n

where:

- PV = present value

- FCF = free cash flow (forecast only)

- r = discount rate (required rate of return)

- n = time period

Begin by finding the discount factor (the denominator) for each period, including the terminal value figure we just calculated.

For example, for the forecast FCF3 (2024 in our case), you would do: (1 + 5.79%)3, which would give you the discount factor for 2024. Then, you'd take the forecast FCF3 you found in step 1, and divide by this discount factor to solve for the present value of the free cash flow figure (PV of FCF) for the forecast year of 2024.

Because we're using a 5-year forecast period for Intel, you'd do this six times, but the sixth time with terminal value you'd use the 5-year time period instead (n). After this is complete, you would sum up all of these PV of FCF figures to come up with today's current equity value.

Finally, you would take today's equity value and divide it by the total shares outstanding (found in step 5) to get the intrinsic stock value of Intel today at $87.35.

This entire process for step 6 is shown below for Intel. I've also provided a downloadable Excel file with a basic DCF model you can use and/or reference (this does not include the WACC calculation):

Based purely on this DCF and not factoring in a margin of safety or doing any sensitivity analysis (as later discussed), Intel's current stock price (around $52) is undervalued because it's less than our fair value of equity (intrinsic value) of $87.35. Therefore, ignoring everything else (the market, the company, news, etc.), you should purchase Intel stock.

Step #7: Scenario Analysis

As mentioned in the beginning of this article, there are holes in using a DCF valuation to find a company's intrinsic value. This is primarily due to the number of assumptions you have to make when coming up with a company's intrinsic value. But as you know, if we're conservative with our figures and estimates throughout the DCF process, and complete a DCF on the right company, we can generally come up with reasonable intrinsic value estimates.

Now, the whole DCF calculation is very sensitive to the inputs that go into calculating intrinsic value. So, if I changed the perpetual growth rate or opted into using my personal required rate of return, this would change things significantly. This is why you should always do a sensitivity/scenario analysis after completing a DCF calculation.

For example, if I wanted to be even more conservative with our Intel DCF, I would use a lower perpetual growth rate. And, if I wanted to be more aggressive, I could keep the perpetual growth rate the same but change the computed WACC discount rate to my personal required rate of return (i.e., 10-15%), which would drop the intrinsic value price significantly.

A basic sensitivity analysis for Intel is shown above, where I'm using discount rates from 6-15% to find the per-share intrinsic value price. I'm also using the perpetual growth rate of 2% we found before and comparing this to a more conservative 1% perpetual growth rate. This causes the intrinsic value price to fall and gives me an idea of the price I may be willing to pay for Intel if I expect slower perpetual cash flow growth.

As a final note, if you change assumptions incrementally, such as the discount rate or growth rates as I previously did, a healthy DCF model will reflect this through incremental changes to its intrinsic value. However, an incorrect DCF model will not reflect these incremental changes, and a 0.5-1% change to your discount rate, for example, may result in significant changes to your entire DCF model and buy-price. If this happens to you, you're depending way too much on your discount rate and therefore your model may be incorrect.

So, by completing a sensitivity/scenario analysis, you can also check to see whether incremental changes to assumptions in your DCF model are outputting reasonable incremental changes to your intrinsic value. If not, then revisit the previous steps and attempt to find why this is the case.

Step #8: Margin of Safety

After you have an intrinsic value of the stock and have completed a sensitivity analysis, you should have a range of stock prices you'd be willing to purchase the company for. This would depend on your required rate of return and your understanding of the business.

The final step would therefore be to place our own personal margin of safety to these numbers, or in our case, just the intrinsic value figure we found before for Intel ($87.35) with the WACC of 5.79%.

You always want to apply a margin of safety because of the following two main reasons:

- You will always make assumptions and estimates in your DCF valuation. For instance, you may have over/under-estimated growth rates, come up with an incorrect WACC, or your FCF estimates may have been too low or high (among other things).

- Even if your valuation is accurate, the market may not adjust your company's stock price to the intrinsic value price in a very long time, or even in your lifetime.

In short, by applying a margin of safety, you will account for errors in your valuation and market uncertainties, which may also prevent you from purchasing companies that are actually overvalued. This will provide you with more confidence when the stock finally falls within your buy-price range, as you'll be purchasing it far below its intrinsic value price.

Naturally, the more confident you are, the smaller the margin of safety will be. On the other hand, the less confident you are in your valuation, the larger the margin of safety. This goes hand-in-hand with risk, with riskier investments naturally having a larger margin of safety than safer investments.

Below is a margin of safety table you can refer to, based on the level of confidence you have with your DCF valuation:

Note that these margin of safety rates differ between investors, and that for lower discount rates a higher margin of safety should apply. So, even if you have high confidence in your DCF valuation but are using a low discount rate (i.e., < 8%), it may be wise to apply a margin of safety of 20% or more. Moreover, for valuation beginners who may overestimate growth rates, I would recommend going with a larger margin of safety which would drive down your intrinsic value buy price(s).

In short, it's wise to have a flexible margin of safety measure that you can vary across different investments. Doing so, while considering your confidence level, the risk level of the security, and the model's discount rate will provide you with a reasonable margin of safety that you can then apply to your intrinsic value buy-price.

Below, you can see how the intrinsic value buy price range varies when we apply discount rates from 10-30% (intrinsic value per share of $87.35, perpetual growth rate of 2%, and WACC of 5.79%):

In our case, if I were fine with the low discount rate (required return) of 5.79%, and had medium confidence in our DCF valuation, I would be willing to purchase Intel at a 25% margin of safety for under ~$65. Currently, Intel's stock is hovering around $52 per share, so in this case it would still be a buy.

The most important thing here when applying a margin of safety is to avoid being too aggressive with your margin of safety, or else you will miss good buying opportunities. On the other hand, if your margin of safety is too small, you may end up purchasing an overpriced company. Ultimately, this is where your understanding of the business and your investment thesis plays a role, which should help you to come up with a fair margin of safety figure.

Note that you can also apply this margin of safety to your personal required rate of return and ignore this step altogether. However, I would only recommend doing this if you're using a relatively high personal required rate of return, such as 20% or more, or are more experienced with valuation.

The Bottom Line

Completing a discounted cash flow (DCF) valuation model for a company will provide you with an estimate range of the company's intrinsic value. After this range is estimated, it all comes down to patience, and having the discipline to wait for the company's stock price to fall within your stock's buy-price range. When the company's stock price finally falls within your buy-price range, it can be classified as an "undervalued" stock worth buying, with the expectation that it will generate the return of your discount rate (aka required rate of return) on an annual basis.

If the stock price never falls within your buy-price range, it may be due to errors in your valuation or an aggressive margin of safety, but more often than not it's simply because the stock price is overvalued and not at an attractive price. Therefore, as a value investor, there's nothing wrong with completing a DCF valuation and waiting one or two years before finally being able to purchase the company at the right price.

It's also important to note that your conservative figures, sensitivity analysis, and margin of safety should protect you to an extent from errors in your valuation and the number of assumptions made in a DCF valuation. Therefore, even if you purchase a company at an undervalued price and the company's stock price continues to under-perform, you should already have a good understanding of the company which may reduce any emotional and/or irrational investment decisions.

In closing, if anything else, completing a DCF valuation will give you a flexible, market independent, cash-flow based, and self-sufficient approach to understanding a company and what it's worth, along with providing you with the confidence you may need as a long-term value investor. Ultimately, this may drive significant long-term investment growth and put you one step closer to achieving your financial goals.

Disclaimer: No positions in Intel (NASDAQ: INTC). INTC is only used in this article as an example based on recently reviewed 10-K annual reports. This is not a complete analysis of INTC.