In this article, I will discuss the importance of the cash flow statement for dividend investors, and how investors can analyze and make sense of this report, regardless of the company or industry. By the end of this article, you'll be able to screen for dividend-paying companies that are capable of issuing and growing dividends over the long-term.

In very simple terms, the cash flow statement is a report that records how much cash comes in and out of a business over a particular time period. If the company you're looking to invest in doesn't grow the amount of cash they have every year, then your dividend will most likely be unsustainable.

Therefore, it's crucial that investors know how to analyze any relevant information in the cash flow statement to understand the potential risks of investing in a company for its dividends.

Introduction to the Cash Flow Statement

The cash flow statement tells investors all about the cash flows (cash that is generated and spent) within a business over a particular period. Cash is king when it comes to investing, as it reflects the overall fiscal health of a business.

Below is the most recent (2020) cash flow statement from 3M Company (MMM), a multinational dividend-paying company operating in the fields of industry, worker safety, U.S. health care, and consumer goods. I will use this company as the primary example for the rest of this article as well.

As you can see, the cash flow statement is broken up into three sections to explain how cash was generated and spent over a particular period:

- Operating Activities: This section covers the cash flows generated and spent for the normal operations of the business, including short-term assets and short-term liabilities. This includes the purchase or sale of inventory, operating costs such as advertising, and changes in the accounts payable and accounts receivable.

- Investing Activities: This section covers the cash that is used or produced by long-term investments. This includes purchasing buildings, machinery, and other long-term assets to maintain and grow the business, along with repairing old machinery. In addition, acquisitions and the sale of marketable securities are included in this section as well.

- Financing Activities: This section covers the cash flows relating to paying down or taking on more debt, issuing shares or buying back shares, as well as paying dividends are all found here.

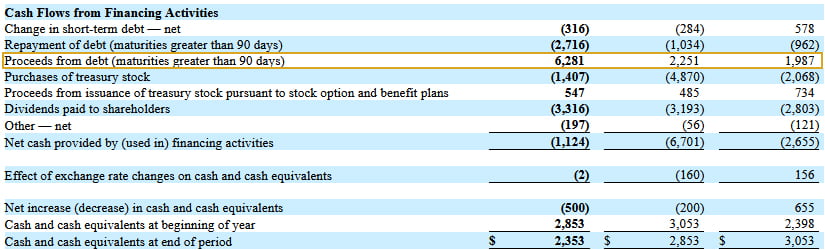

If you look under the "Cash Flows from Financing Activities" section for 3M (as outlined below), you can see that they paid $3.316 billion in dividends in 2019:

Importance of Positive Cash Flow

A company needs to make more money than it spends to sustain itself, this is a given. However, there are other advantages a company has when it has positive cash flow.

Advantage #1: Cash Measures Liquidity

The more cash a company has, the more liquid it is. The line item "cash and cash equivalents" is found in the balance sheet under the assets section, and reflects a company's abilities to meet short-term debt obligations.

It's important that this figure grows overtime consistently, as low amounts of cash and cash equivalents can lead to a reduction or cut in the dividend.

Advantage #2: Positive Cash Flow Provides Flexibility

If opportunities arise, companies with positive cash flow have the opportunity to do a number of things, such as hiring new workers, upgrading old equipment, expanding their factories, and investing in new technologies. These opportunities may be time-limited and may never come back!

If a company does not have positive cash flow, they would not be able to take advantage of these opportunities, and this makes it so much more difficult for a company to grow and sustain itself.

In addition, if something were to go wrong with the company, or if an economic crises were to happen and the company did not have a large cash flow, they would not be able to pay for the loss without going into debt.

Advantage #3: Less Manipulation

One last advantage, is that when you look at the three primary financial statements of a company, the net income figure can be manipulated through accounting tactics and such, but cash flow cannot to the extent that net income is.

It’s very hard to manipulate, change up, and lie about the cash flows. So, when you see positive cash flows, this should be more believable to you than other line items such as net income.

Why This Matters to Dividend Investors

From a dividend investors perspective, strong cash flows means that a company is more capable of paying out dividends.

Dividends are an optional payment to shareholders, and if dividend-paying companies do not have the money to take advantage of new opportunities, they may not be capable of paying or increasing their dividend in the near future.

On the other hand, if a company has strong cash flow or high profitability at the end of the year, they will likely continue to increase their dividend payments. Therefore, when you invest in a dividend-paying company, you should ensure that the company has a strong positive cash flow history.

Importance of Cash on Hand

As an investor, you should look for companies that have around 10% cash growth every single year. If you want to be safer, look for companies with 12-13% annual cash growth.

Generally, a ~10% annual cash growth rate is a good indication of a company that can reserve its cash and isn’t really spending it poorly on things that don’t make them money. This figure also varies significantly depending on the industry, company, and economic condition.

As mentioned before, this is found on the balance sheet, and not on the cash flow statement. Below is 3M's 2020 balance sheet:

Of course, there could be years where a company may not have as much cash and equivalents as it did in its previous years, as was the case for 3M. So, you should also be looking at the bigger picture and general direction of a company’s cash growth, such as the 10-year overall trend.

Importance of Cash Reserves

Cash reserves are funds in short-term and highly liquid investments that companies set aside for use in emergency situations.

Unfortunately, access to information on the cash reserves a company has is often times limited. Regardless, companies with higher cash reserves tend to have higher-paying dividend stocks. The more cash reserves a company has, the more it’s able to pay out in dividends each and every single year. If a company’s dividend payment continues to grow every year, it’s highly likely the company’s cash reserves are growing as well. The opposite also tends to hold true.

If a company is losing money every single year, chances are they are low on cash reserves and will be cutting out dividend payments in the near future, to ensure the company’s long-term success and longevity.

Companies that have higher cash reserves also tend to buyback a lot of their company’s shares and accumulate it for themselves. Through buying back company shares, fewer shares are available for purchase to the public. This becomes a supply-and-demand situation, in which a shortage in supply leads to an increase in demand. If there are fewer stocks in the stock market available for purchase, this may lead to an increase in demand. Over the short-term, this may improve a company’s stock price, as the company’s earnings per share (EPS) will rise, which is attractive to investors. Over the long term, however, a stock buyback may or may not be beneficial to shareholders.

In our case, as dividend investors, stock buybacks will likely lead to increased dividend payments, as the company will have more cash reserves for themselves.

How to Analyze the Cash Flow Statement

In the sections below, I will discuss what you should be looking for in the operating, investing, and financing activities sections in the cash flow statement, strictly from a dividend investors perspective.

Operating Activities

The first thing you should look for in a dividend-paying company's cash flow statement(s) is the operating activities section. In specific, you should look to see whether the company is operating cash flow positive, as outlined below with 3M:

If this number is positive, as is the case for 3M ($7.07 billion), the company is bringing in more money than it's spending to simply operate its business. If a company is not cash flow positive, then it may begin taking on debt (under the financing activities of the cash flow statement) in order to maintain their cash positions. Clearly, dividend investors should avoid investing in companies that are not cash flow positive from their operating activities.

Investing Activities and Free Cash Flow (FCF)

If you see a negative number on the investing activities section of the cash flow statement, this is not necessarily a bad or good thing. It really just shows that they're investing their money.

On the investing activities section, you should calculate free cash flow (FCF) using the formula below, as it tells investors how much cash a business produces after investing in maintaining and growing the business:

Free cash flow (FCF) = Net cash from operating activities - Capital expenditures (CapEx)

Often times, this capital expenditure (CapEx) figure is referred to as "Payments for acquisitions of property, plant and equipment," "Purchase of property, plant and equipment (PP&E)," or something similar. This figure ($1.699 billion over 2019) for 3M is outlined below:

Applying this formula would therefore give us a FCF of $5.371 billion ($7.070 Bil. - $1.699 Bil.). This is great because it's very much in the positive, and you'd want this figure to remain consistently positive overtime as well. This excess FCF could therefore be used to pay shareholders a dividend, which is why it's important to calculate. Moreover, it could be used to pay down debt, buyback shares, or simply be kept for future investments.

In short, FCF is a strong indicator of how a company's stock price will grow overtime. If this additional FCF number ($5.371 billion for 3M) was never spent on any financing activities, such as paying back debt or issuing dividends to shareholders, the company would simply have more cash available on hand to invest towards growing the company. Even if this cash wasn't spent, you'd still be investing in a company that now has an additional $5.371 billion in cash, which is never a bad thing.

Ideally, you'd want FCF to have grown at 10% or more over the last 10 years, and in general, improving every year consistently. This is especially the case if you're a dividend growth investor who also cares more about a company's stock price appreciation.

Financing Activities

The financing activities section of the cash flow statement is one of the more important sections to look into. As previously mentioned, companies that are not FCF positive will take on large amounts of debt in order to stay alive. If you notice that a company is FCF negative and is also paying down a lot of debt, it can indicate that a company is in a dangerous position, with its dividend being in a very vulnerable position.

Sometimes, companies with bad management will payoff a lot of long-term debt with even more debt. This is feasible when interest rates are low, unchanging, and when credit is readily available. However, if an economic downturn occurs, these companies will be unprepared with typically higher interest rates and less available credit. Therefore, if a company cannot find more debt to cover their initial investment, they may go bankrupt, and the dividend will likely be eliminated far before this.

You can see how much debt 3M has taken by examining the line item called: "Proceeds from issuance of debt," "Proceeds from debt," or something similar. This is found under the financing activities section of the cash flow statement:

The Bottom Line

Below are the main takeaways from this article, and what you should be looking for when analyzing the cash flow statement and the "cash and cash equivalents" line item in the balance sheet as a dividend investor:

- Cash and cash equivalents: Growth of 10% annually, or overall positive trend in the last 10 years.

- Stock buybacks: Done more frequently by companies with higher cash reserves and may lead to increased dividends.

- Operating activities (cash flow statement): Must be a strong net positive!

- Free cash flow (FCF): Aim to invest in dividend-paying companies with a FCF growth of 10% or more over the last 10 years.

- Financing activities (cash flow statement): Ensure positive net cash and manageable amounts of debt.

In closing, after you become familiar with analyzing the cash flow statements of different publicly traded companies, you'll be able to use other ratios such as the dividend coverage ratio and dividend payout ratio, along with your cash flow analysis, to better determine how a company's dividend will perform in the foreseeable future.