In this article, I will discuss the importance of return on invested capital, how you can calculate it, what information the figure provides to investors, and how you can analyze this figure to make better investment decisions. I'll also provide several examples along the way to guide your understanding.

The short answer on why return on invested capital (ROIC) is important, is because it measures how effective companies are at reinvesting profits back into their business. In other words, ROIC shows investors the relationship between the profits a business is generating and the amount of capital they've had to reinvest to generate additional profit. Therefore, it's crucial that investors know how to calculate and analyze return on invested capital, especially long-term value investors who will use ROIC to evaluate companies.

How to Calculate Return on Invested Capital

Return on invested capital (ROIC) measures how effective a company is at allocating capital under its control to profitable investments. Although calculating ROIC is more involved than other profitability ratios, it's well worth the effort.

Below is the traditional approach investors use to calculate ROIC:

ROIC = Net operating profit after tax (NOPAT) / Invested capital

where:

- NOPAT = Operating income * (1 - Tax rate)

- Invested capital = (Total debt + Total stockholders' equity) - Non-operating assets

However, utilizing the formula below to calculate ROIC may provide you with a better understanding of how much cash a business generates for its shareholders:

ROIC = Owners earnings / (Long-term debt + Stockholders' equity)

where:

- Owners earnings = Cash flow from operations - Maintenance capital expenditures (CapEx)

You can see my article on how to calculate owners earnings, as it's a lengthier process. However, both long-term debt and stockholders' equity can be easily found on a company's balance sheet.

Now, I will cover the more traditional approach of finding NOPAT and invested capital to calculate ROIC.

NOPAT

NOPAT stands for "net operating profit after tax" which shows what a company would've earned if it had no debt (meaning no interest expense), but it still needed to pay taxes.

This can be found on the income statement with the formula below:

NOPAT = Operating income * (1 - Tax rate)

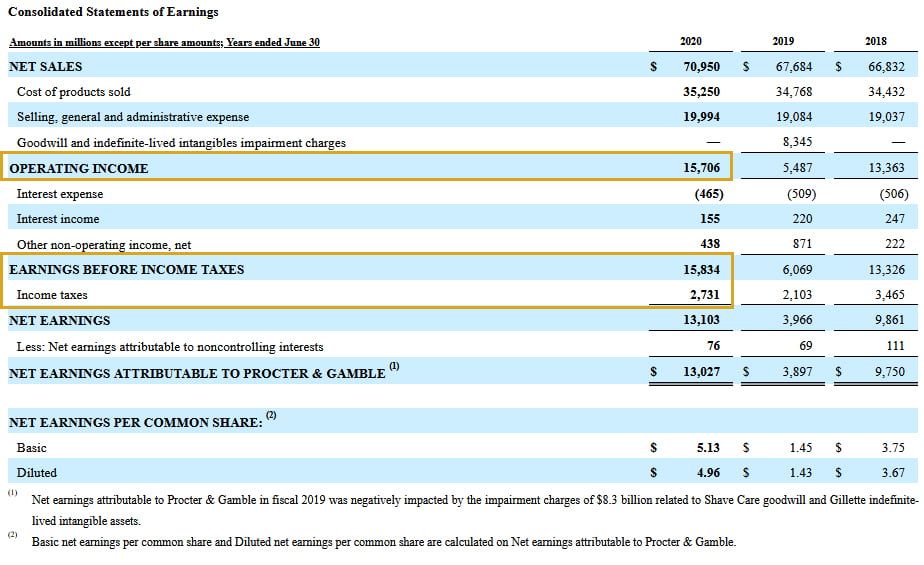

As an example, below is Procter & Gamble's (PG) FY 2021 income statement, with the information we need to find NOPAT outlined:

The tax rate here would be the income taxes divided by the earnings before income taxes (EBIT), which is ~0.1725 or 17.25% (2,731 / 15,834). Then, take the operating income of $15,706 and multiply it by 0.8275 or 82.75% (1 - 0.1725). This would give Procter & Gamble a NOPAT of $13,000 for FY 2021.

Invested Capital

There are multiple ways to calculate invested capital, but the way I prefer is to take the total equity of a company, which is the money supplied by shareholders, the total debt of the company, meaning current and long-term debt, and then subtracting any non-operating assets:

Invested Capital = (Total Debt + Total Shareholders' Equity) - Non-operating Assets

Non-operating assets here refers to cash and marketable securities, because by literal definition, cash hasn't been invested and marketable securities are not related to the operations of a business. This is often referred to as "cash and cash equivalents" and appears on the same line on the balance sheet as an asset.

Below is Procter & Gamble's (PG) FY 2021 balance sheet, with the information we need to find invested capital outlined.

Adding the total debt and total shareholder's equity here would give us $81,598 (11,183 + 23,537 + 46,878).

Then, subtracting this number by the cash and cash equivalents would give us an invested capital of $65,417 for PG (81,598 - 16,181).

ROIC Conclusion

The ROIC would therefore be 19.87% for PG in 2020 (13,000 / 65,417).

Now, if I were to use the second ROIC formula (using owners earnings, long-term debt, and stockholders' equity), I would get an ROIC of 20.35% for PG in 2020 [(17,403 - 3073) / (23,537 + 46,808)].

The chart below visualizes the difference between the two ROIC calculation methods, using Procter & Gamble's 10-year performance data (from 2011-2020):

The percentage ROIC number you get shows how much profit is generated relative to how much capital has been invested in the business. So, with the 19.87% ROIC computed above, for every $1 of invested capital, Procter & Gamble is generating 19.87 cents of profit.

You can also use financial data websites to find the ROIC. However, the ROIC figure you find may differ as some websites use a profit figure from the income statement instead of a cash figure, which value investors may prefer.

Sometimes, ROIC can be found in the 10-K annual reports themselves and are defined differently depending on the company, as it's a non-GAAP metric, so this can be looked at as well.

Implications of High Return on Invested Capital

Companies with a high ROIC have several significant advantages, with the most important being their ability to rapidly increase the amount of cash flow they can generate for owners. If a company consistently generated a ROIC of 10%, no matter how much they invested, then this would compound the rate at which their cash flows could grow. You should think of this compounding as compound interest or holding a security on the stock market.

For example, if a company invested $100 with a 10% ROIC, they would generate $10 in profit. Once this $10 is reinvested and a 10% ROIC is generated again, the company would earn even more in profit ($11). Assuming this same 10% ROIC, the company's cash flow would be up to $26 by the 10th year.

The takeaway here is that even over a 10-year period, having a consistent 10% annual ROIC will allow companies to double their profits overtime. Moreover, any excess cash will either stay in the company and likely increase the value of the shares you own, or will be paid out to shareholders in the form of dividends. Either way, investors will benefit from a growing ROIC.

In short, when companies are able to compound their cash flows through a consistently high ROIC, your investment will likely grow in a similar manner.

Company Management

Some of the greatest investors in the world, including Warren Buffett and Charlie Munger, use ROIC to assess a company's management and competitive advantage (aka economic moat).

We can use ROIC to determine whether a company's management team is making effective decision or not with company profits. If you have a company with consistently high and growing ROIC, then this is a strong indication that management is regularly using the money available to them to generate high amounts of profit.

Competitive Advantage

The competitive advantage, or economic moat, is a characteristic (or set of characteristics) any business has that is giving it an advantage over other companies, specifically those in the same industry.

A high ROIC can therefore be considered as an indicator of a company that is investing less money to generate more in profit. This could potentially indicate that the products and/or services a company provide are in high-demand, meaning consumers may prefer their products/services over competitors. This could be something as simple as a company's branding, or because a company develops innovative products with no real competition.

How to Analyze the Return on Invested Capital

After finding the ROIC with data from the most recent 10-K annual statement, you should see whether this number is over 10%. If the company you're analyzing has an ROIC below 10%, then I'd advise you to not invest in it over the long-term.

This is largely because of the cost of capital (WACC), which includes the cost of debt (to satisfy debt-holders), and the cost of equity (to satisfy stockholders). In other words, investors should ensure the return on investment is higher than the cost of investment.

This is one of the reasons why I recommend an ROIC above 10%, as most companies that are generating a profit do not have a WACC above 10%.

Growing ROIC

Now, if the company you're analyzing has an ROIC near or over 10%, then compute or find the ROIC for the past 10 years as well, and see if there has been a consistent ROIC trend of 10% or more. Ideally, you'd want to see that this trend has been gradually increasing over time.

If this is the case, then it's likely safe to say the company is highly effective at investing in profitable investments. Moreover, with every additional dollar invested, the company will (likely) generate even more in profit than the last dollar. This is because the money that is being compounded is increasing from an already high ROIC rate.

Flat ROIC

Of course, you'll also see companies with a relatively flat ROIC above 10%, which is not necessarily a bad sign. This is because these companies may also be generating consistently more profit and investing more capital.

For example, if a company in 2010 invested $50 and generated $5 in profit, and in 2020 invested $100 and generated $10 in profit, both of these are considered a 10% ROIC. So, even though the company has doubled their investments, they've still doubled their profits, and are still generating a high return.

In other words, this means the company likely has the potential to continue compounding these profits into the future, even if the company is not increasing the rate at which these profits are compounded, which is still the more ideal scenario.

Below is an example of Microsoft (MSFT), with its high but relatively flat ROIC:

Falling ROIC

Now, if you have a company with a down-trending ROIC number, this can indicate that the company is running out of investment opportunities. So, for each additional dollar they invest, they are generated less in profit than the previous dollar. In other words, with any new investments the company is making with recent profits, the additional money they receive from their profits (and allocate to their investments) will not be as good as their previous investments.

Granted, this will happen to every business at some stage, because not all companies can put their money to work in the same manner, and because companies don't have infinite growth potential. So, if you choose to invest in a company with a falling ROIC, you should make this decision (and take on the additional risk) with the confidence that the company will rebound in the future.

The Bottom Line

Put simply, companies with a low or falling return on invested capital (ROIC) are at risk of losing their competitive advantage and future growth potential. Furthermore, when investors see that a company's management team is unable to reinvest profits back into the business effectively, this can lead to falling stock prices and/or dividend cuts.

Therefore, understanding how to calculate and analyze ROIC is crucial for investors looking to value stocks and benefit from long-term stock price appreciation.