In this article, I will show you how to apply the H-Model for dividend discount valuation. The H-Model, introduced by Fuller and Hsia in 1984 through their seminal paper "A Simplified Common Stock Valuation Model," builds upon the Gordon Growth Model (GGM). This two-stage model begins with an initial phase characterized by an extraordinary growth rate, which then linearly transitions into a stable growth phase, akin to the GGM. By capturing the gradual change in dividend rates over time, the H-Model provides a more realistic perspective on the future value of dividends.

This article delves into the H-Model, outlining its formula, assumptions, applications, limitations, and finally, offers a comprehensive example illustrating how to calculate and interpret the H-Model in dividend discount valuations.

H-Model Explained

The H-Model builds upon the Gordon Growth Model (GGM), which calculates the present value of a future series of dividends expected to grow at a constant rate indefinitely. It's also a variation of the Two-Stage Dividend Discount Model (DDM).

The figure below depicts the expected dividend growth over time in the H-Model:

As illustrated, the H-Model features two stages. The initial stage is marked by extraordinary growth, which gradually transitions into a stable growth phase where dividends are projected to grow indefinitely. Typically, the H-Model is designed to reflect a gradually declining rate of dividend growth in its first stage. However, it can be modified to represent an increasing growth rate if that better corresponds with the company's anticipated performance.

Regardless of the growth trajectory, the H-Model effectively computes the present value of dividends throughout these two growth phases, adeptly capturing the gradual evolution in dividend rates over time. This methodology is fundamental to the H-Model's framework.

H-Model Formula

The H-Model dividend discount formula is shown below:

where:

- P0 = stock's fair value (at year 0)

- DPS0 = annual dividends per share (at year 0)

- H = half life of anticipated transition period

- g1 = increasing/declining dividend growth rate (first stage)

- g2 = perpetual dividend growth rate (second stage)

- re = discount rate (aka required rate of return)

To gain a deeper understanding of the H-Model formula, it's beneficial to examine its two key phases:

- First Phase (Extraordinary Growth Phase): This phase is characterized by a period of extraordinary growth, which gradually changes to a sustainable rate into perpetuity. The initial dividend growth rate (g1) is determined from historical trends, analyst predictions, or expected growth based on the company's return on equity (ROE) and dividend payout ratio (DPR). The formula segment "DPS0 * H * (g1 - g2) / (re - g2)" computes the present value of dividends during this initial growth phase. "DPS0" denotes the current dividend per share, while "H" signifies the half-life of the extraordinary growth period. The expression "(g1 - g2)" reflects the difference between the early extraordinary growth rate (g1) and the later stable growth rate (g2). The consistent discount rate across both stages (re) is often derived using the Capital Asset Pricing Model (CAPM).

- Second Phase (Stable Growth Phase): Following the initial period, the model transitions into a phase of consistent, perpetual growth. This stage is encapsulated by the formula "DPS0 * (1 + g2) / (re - g2)," mirroring the Gordon Growth Model (GGM). It calculates the present value of dividends that grow indefinitely at a steady rate (g2). The perpetual growth rate (g2) can be inferred from historical data, analyst projections, or calculations of the sustainable growth rate. The discount rate (re), consistent with the first phase, maintains valuation uniformity.

To determine a stock's estimated fair/intrinsic value using the H-Model, one must discount dividends from both the extraordinary growth and steady growth phases. The cumulative present values from these stages give us P0, the estimated value of the stock. An upcoming example in this article will detail how to find and calculate these inputs for the H-Model, offering a comprehensive guide to applying this valuation method.

Assumptions of the H-Model

The H-Model relies on key assumptions that are critical for accurately valuing companies amid growth rate transitions. These assumptions ensure the model's effectiveness, particularly in assessing firms evolving from rapid to stable growth:

- Extraordinary Growth Phase: The model presupposes that currently, a company's earnings and dividends are experiencing an extraordinary growth phase.

- Linear Change in Earnings: The H-Model states that during the extraordinary growth period, earnings will not maintain their initial growth rate but will instead change at a consistent, linear rate. This period of decline is structured to last twice the length of the half-life of the transition, denoted as 2H.

- Stable Dividend Payout and Cost of Equity: The dividend payout ratio and the cost of equity are considered constant over time, unaffected by changes in growth rates. This means that despite the transition from higher to lower growth rates, the proportion of earnings paid out as dividends and the cost of equity are maintained.

- Steady State Growth Post-Transition: After the initial phase of linearly declining growth, the model assumes that the firm will enter a steady state, growing its dividends at a stable rate in perpetuity.

These foundations of the H-Model are crucial for its application to firms moving from a phase of rapid expansion to more sustainable growth rates. However, these assumptions may not hold for companies with variable growth patterns, changing dividend policies, or fluctuating costs of equity. Understanding and acknowledging these assumptions is essential for the accurate valuation of stocks using the H-Model.

Relevant Applications of the H-Model

After understanding the assumptions underlying the H-Model, it's important to consider its practical applicability. This model is particularly beneficial for companies in a unique phase of their growth trajectory, as described below:

- Effective for Diverse Growth Phases: Suitable for companies exhibiting varied growth patterns, this approach is relevant for both high-growth firms transitioning to normal growth rates and businesses initially facing low or negative growth trends.

- Companies in Transition: The H-Model is apt for firms transitioning from an extraordinary growth phase to a stable growth rate. It effectively captures the gradual change in growth rates, making it ideal for larger firms experiencing a diminishing differential advantage over competitors.

- Firms with Temporary Growth Spurts: Companies with temporary growth spurts, often driven by new products, services, or first-mover advantages, find the H-Model especially useful. These firms typically have growth rates that are not sustainable in the long run, a scenario well-modeled by the H-Model.

- High Growth and High Payout Firms: The model requires a combination of high growth and high payout. Consequently, it may not be suitable for firms with low or no dividends.

In conclusion, the H-Model is particularly effective for companies undergoing a crucial transition from a phase of high growth to a more sustainable rate. It excels in scenarios where firms experience rapid growth, perhaps due to new product launches or market advantages, and are moving towards a period of stable expansion. In these contexts, the H-Model offers a nuanced and accurate approach to valuation, making it an invaluable tool for analyzing companies at a pivotal stage in their growth trajectory.

Limitations of the H-Model

While the H-Model presents a refined approach for evaluating companies with changing dividend growth rates, it is essential to acknowledge its limitations for a balanced perspective. These limitations are vital in determining the model's effectiveness and accuracy under various business scenarios, as described below:

- Rigidity in Growth Rate Change: The model prescribes a uniform linear change in growth rates over a set period, referred to as 2H. This structured approach can prove to be a limitation if a company's dividends don't follow this expected pattern, particularly if the deviations are significant.

- Constant Payout Ratio and Cost of Equity Assumption: The H-Model is based on the assumption that the dividend payout ratio and the cost of equity remain constant throughout both phases, an approach that can result in inaccuracies. In reality, as dividend growth rates decline, companies often raise their dividend payout ratios. This is a dynamic that the H-Model does not inherently consider.

- Impact of Long Extraordinary Growth Periods: The model's accuracy may be compromised in situations where a company enjoys an extended extraordinary growth phase. This can create a large gap between the initial extraordinary growth rate and the long-term sustainable rates, challenging the model's assumption of a steady transition.

In conclusion, the H-Model, despite offering a more detailed approach than other valuation methods, comes with notable limitations. Its assumptions about growth rate change patterns and dividend payout ratios can impact its accuracy, particularly in scenarios where these factors vary significantly. As a result, while the H-Model is a valuable tool, it should be applied with a degree of caution and in conjunction with other valuation methods for a more comprehensive analysis.

H-Model Example

For our example of valuing a dividend-paying company using the H-Model, we'll use Lockheed Martin (LMT) as our case study. Lockheed Martin specializes in defense, aerospace, and security, focusing on advanced technology systems and products. Their core areas include aeronautics, missiles, fire control, rotary and mission systems, and space systems.

This is an appropriate company to use for the H-Model due to several key reasons:

- Decelerating Dividend Growth Rate: Lockheed Martin's dividend growth, which was around 15% annually in 2013 and 2014, has not seen an increase since then. In fact, the rate of dividend growth has been gradually decreasing, with the 2023 dividends growing at a rate of just 6.6%. This pattern of high initial growth gradually slowing down aligns perfectly with the H-Model's emphasis on modeling companies experiencing a transition from higher to more stable growth rates in dividends.

- Established Market Position: As a leading company in the defense, aerospace, and security sectors, Lockheed Martin operates in a mature market. This positions it well for the H-Model, which assumes a transition from high growth to more stable growth phases.

- Predictable Cash Flows: Lockheed Martin's long-term contracts and stable demand in its industry sectors contribute to predictable cash flows, a key aspect for applying the H-Model effectively, which relies on the ability to forecast future dividends.

For the H-Model, we'll first need to find LMT's most recent dividend payment (DPS0); the high initial dividend growth rate (g1), representing the rate at which dividends have been growing in the recent past; the lower, perpetual dividend growth rate (g2), indicating the expected stable rate at which dividends will grow over time; the discount rate (re), which is the minimum yield investors seek, tied to the stock's risk profile; and the half-life of the anticipated transition period (H), which is the time it takes for the dividend growth rate to transition from g1 to g2. We'll determine these inputs for LMT in the following sections and then apply them to the H-Model formula.

Step #1: Current Dividend (DPS0)

To obtain Lockheed Martin's current dividend, consult their latest financial statements or press releases in the investor relations section of their website. Alternatively, financial news sites and stock market analysis platforms frequently update dividend data for publicly traded companies. These resources will indicate the most recent dividend payment, serving as the DPS0 value required for the H-Model calculation.

According to the company's historical dividend information page, the company's 2023 annual dividend is $12.15, which will be our "DPS0" in the H-Model calculation.

Step #2: Discount Rate (re)

The discount rate (aka required rate of return) is typically derived using the Capital Asset Pricing Model (CAPM), a critical tool in calculating the present value of future dividends in models like the H-Model. CAPM correlates investment risk with expected return, highlighting that higher-risk investments should generate higher returns. This principle is crucial in assessing the influence of market risks on investment valuations. It also plays a pivotal role in the H-Model, where it is applied uniformly across both the initial and final stages of the calculation.

The CAPM formula is shown below:

re = rf + β*(rm - rf)

where:

- re = cost of equity

- rf = risk-free rate

- β = beta

- rm = expected market return

Solving for the cost of equity (re) provides the discount rate necessary for application in your present value dividend discount formulas.

Locating the three inputs to the CAPM for Lockheed Martin is fairly straightforward:

- Risk-Free Rate (rf): Commonly represented by the yield on the 10-year U.S. Treasury Note, the risk-free rate is considered a benchmark due to its high safety, backed by the U.S. government with minimal default risk. This rate serves as a foundation for comparing investments with higher risks. Currently, the risk-free rate stands at 4.39%.

- Beta (β): Beta reflects a stock's volatility in relation to the overall market, indicating the stock's systematic risk, or the risk associated with the entire market or a specific sector. A beta above 1 suggests higher volatility compared to the market, while a beta below 1 implies lower volatility. Financial websites such as Yahoo Finance list a company's beta under "Beta 5Y Monthly." Currently, Lockheed Martin's 5-year monthly beta is 0.60.

- Expected Market Return (rm): The standard figure used for expected market return is often 10%, mirroring the historical average yearly return of comprehensive market indices like the S&P 500. This rate acts as a conventional gauge for anticipated market returns over an extended period.

Using these inputs, we can calculate the CAPM for Lockheed Martin:

re [LMT] = 4.39% + 0.60*(10% - 4.39%) --> 7.76%

The calculated CAPM for Lockheed Martin stands at 7.76%, indicating the minimum return investors should expect when considering the associated risks and market conditions. This rate sets the benchmark for the acceptable return on investments in the company, aligning with the risk levels involved.

It's important to note that while CAPM is a standard tool for calculating a company's discount rate in frameworks like the H-Model, it isn't the exclusive option. Other strategies, like using your personal required rate of return for the company, can be utilized as well. These alternative approaches help to cross-check or provide a more comprehensive view of the company's risk-return profile.

Step #3: Extraordinary Dividend Growth Rate (g1)

In the H-Model, the extraordinary growth rate (g1) represents a period of higher (or lower) than average dividend growth, occurring in the model's initial phase. This rate is particularly important for companies such as Lockheed Martin, which has experienced significant dividend growth in certain periods. Estimating this rate accurately requires careful consideration of various factors:

- Examine Historical Dividend Growth: Begin by examining Lockheed Martin's historical dividend growth, focusing on the period of high growth. Look at annual reports and dividend announcements for the past several years to understand the pattern of dividend increases.

- Review Management Forecasts and Statements: Assess management's future expectations regarding dividend policies and growth, as these can provide valuable insights into the anticipated rate of growth.

- Analyze Industry and Economic Factors: Understand the broader defense and aerospace industry trends and economic conditions that may impact future dividend growth.

These steps will assist in accurately estimating Lockheed Martin's initial extraordinary growth rate for the H-Model. In this article, we'll concentrate on analyzing the firm's historical dividend growth rate to estimate its extraordinary growth rate (g1). To start, the illustration below plots the firm's annual dividend and dividend percentage growth each year from 2004 to 2023:

Clearly, while Lockheed Martin's (LMT) dividend continues to grow, its growth rate has notably decelerated over the past decade. We could consider the average dividend growth rate of ~15% experienced by the firm in 2013 and 2014, but this may not accurately represent the company's current state or market conditions. A more suitable choice for the H-Model's extraordinary growth rate is 10%, capturing the consistent, relatively high annual dividend growth Lockheed Martin (LMT) experienced from 2016 to 2019, followed by a gradual decline starting in 2020. This rate aligns well with the H-Model's objective to depict a shift from an initial high growth rate to a more sustainable, lower growth rate moving forward.

Note that when estimating the H-Model's extraordinary growth rate, it's important to avoid using a recent year's declining dividend growth rate, such as Lockheed Martin's 6.6% in 2023. This is because the H-Model is designed to model a transition from higher to lower growth rates. A recent declining rate may not effectively represent the initial period of higher growth, which is essential for the model's accuracy. Instead, selecting a rate from a period of stable, higher growth is preferable to reflect the model’s transition phase accurately.

Step #4: Perpetual Dividend Growth Rate (g2)

To estimate the perpetual dividend growth rate (g2) in the H-Model, which forecasts the ongoing, indefinite increase of dividends at a sustainable level, it's required to choose a rate that is realistically lower than the growth rate in the extraordinary growth phase. A good starting point for this estimation is to review management's future dividend policy, as it provides direct insights into the company's dividend intentions. Along with this, the two methods outlined in this section typically offer a solid foundation for most cases, ensuring a balanced and informed approach to determining this crucial rate.

For a more comprehensive understanding, I recommend reading my article on estimating the perpetual dividend growth rate. It offers additional methods beyond those discussed here and delves deeper into these topics.

Method #1: Historical Dividend Growth Rates

Assessing a corporation's perpetual dividend growth rate can involve examining its historical growth rates over a substantial period, such as five years or more. This method sheds light on enduring trends and underlines recent patterns in dividend growth, both of which are essential for evaluating the company's present financial health.

Employing the compound annual growth rate (CAGR) for this evaluation instead of a straightforward average provides a truer picture of the dividends' growth on a compounded annual basis.

The CAGR formula is shown below:

CAGR = [(Ending Value / Beginning Value)(1 / Number of Years)] - 1

If we calculate the CAGR over four different periods during the last decade, we can assess how the CAGR has trended over time for Lockheed Martin, as shown in the table below:

As you can see, although the company's dividends are growing, they have slowed down in recent years in terms of growth. This should not come as a surprise given what we saw prior when estimating the extraordinary growth rate (g1) in the H-Model.

We can also cross-reference historical average growth rates. If we take the average dividend growth rate over the 5-year, 3-year, and 1-year periods, we get 8.2%, 7.4%, and 6.6% respectively, also clearly showing a decline in the firm's dividend growth rate.

Thus, by solely considering the company's historical pattern of declining dividend growth rates, it is reasonable to assume that the firm's perpetual dividend growth rate will not exceed ~6%.

Method #2: Augmented Sustainable Dividend Growth Rate

The sustainable dividend growth rate method evaluates the rate at which a company can raise its dividends continuously, using internal funds without the need for additional financing. It factors in profitability and the earnings distributed as dividends, providing a practical growth rate estimate.

The sustainable dividend growth rate formula is shown below:

Sustainable Dividend Growth Rate = ROE * (1 - (DPS / EPS))

where:

- ROE = return on equity (net income / shareholders' equity)

- DPS = annual dividend per share

- EPS = earnings per share ((net income - preferred dividends) / weighted average outstanding shares)

Enhancing the traditional method, the augmented approach integrates stock buybacks into the sustainable dividend growth rate calculation, refining the estimate by considering cash returned to shareholders through buybacks. If a company, however, hasn't engaged in share repurchases, this method essentially aligns with the standard sustainable rate. The applicability of the augmented approach is contingent on the company's share buyback activities. Given Lockheed Martin's significant share repurchases in recent years, this method is preferred over the standard sustainable dividend growth rate for a more accurate analysis.

To include buybacks, add them to dividends and divide by net income, adjusting for new long-term debt, which can affect financial leverage. This augmented dividend payout ratio reflects the company's commitment to shareholder returns and its financial strategy's impact on leverage.

The complete augmented dividend payout ratio is shown below:

Augmented Dividend Payout Ratio = (Dividends + Stock Buybacks - New Long-Term Debt Issued) / Net Income

This ratio indicates the portion of profits allocated to shareholders, considering debt and equity adjustments. It informs the sustainable growth rate adjustment in dividend discount models (DDMs), vital for companies using buybacks in their return strategy. It's crucial, however, to discern if buybacks signify financial strength or mask underlying issues.

For Lockheed Martin, gather the necessary figures from its financial statements to calculate the augmented dividend payout ratio. In FY 2022, with new debt of $6,211M, dividends of $3,016M, buybacks of $7,900M, and net income of $5,732M, the calculation is as follows:

Augmented Dividend Payout Ratio [LMT] = ($3,016M + $7,900M - $6,211M )/ $5,732M --> 82.1%

Next, apply this ratio to determine the augmented sustainable dividend growth rate:

Augmented Sustainable Dividend Growth Rate = ROE * (1 - Augmented Dividend Payout Ratio)

With LMT's FY 2022 ROE at 61.9%, the augmented growth rate is:

Augmented Sustainable Dividend Growth Rate [LMT] = 0.619 * (1 - 0.821) --> 11.1%

The augmented sustainable dividend growth rate, at 11.1%, includes dividends, buybacks, and new debt, providing a more detailed and conservative assessment than the standard method. However, considering Lockheed Martin's dividend growth has slowed to 6.6% in 2023, and our extraordinary growth period (g1) rate was set at 10%, this 11.1% rate may not be entirely applicable in our situation. A more modest rate would be advisable for reliable long-term valuations. To enhance accuracy and stability, averaging this rate over several years is recommended, particularly to mitigate any inconsistencies from variations in buyback activities.

Align Perpetual Dividend Growth With Economy's Growth Rate

When selecting the appropriate perpetual dividend growth rate for the H-Model, it's imperative that the perpetual dividend growth rate (g2) remains below the discount rate (re) to avoid unrealistic valuations. Additionally, this growth rate should not surpass the growth rate of the economy in which the company is based. To adhere to this, one can:

- Cap at Economy's Growth Rate: Limit the dividend growth rate to not exceed the economy's overall growth, possibly allowing a marginal increase of 1-2% if justifiable by the model's parameters. This practice ensures that the company's growth projections remain realistic and aligned with the broader economic environment, preventing overestimation of its future performance.

- Risk-Free Rate as Benchmark: Adopt the interest rate on the 10-year U.S. Treasury Note as a prudent reference point for setting the growth rate. Using this rate as a benchmark provides a conservative and stable basis for estimating growth, reflecting a low-risk scenario that is widely accepted in financial modeling.

- Combine Inflation and Economic Growth: Combine the expected long-term rate of inflation with the historical average economic growth rate to attain a comprehensive gauge for setting the growth rate. This approach offers a balanced view that incorporates both the influence of inflation and economic trends, leading to a more realistic and holistic growth rate estimation.

Overall, these approaches help maintain a realistic growth rate, as no firm can indefinitely outgrow the economy or risk-free rate.

For our example, if we consider the 10-year breakeven inflation rate (the market's expected average inflation over the next 10 years), currently at 2.22%, and add it to the average 10-year GDP growth rate in the U.S. of 2.40%, we arrive at a rate of 4.62%. This indicates that Lockheed Martin's perpetual growth rate should not exceed 4.62%, regardless of the higher estimates suggested by our two previously discussed methods.

Factoring in the recent downward trend in Lockheed Martin's dividend growth since its high-growth phase from 2016 to 2019, we observe an average annual decline of -0.8% from 2020 to 2023. Extending this trend, if Lockheed Martin’s 2023 dividend of $12.15, which increased by 6.6%, continues to decrease by 0.8% each year, it is expected to dip below a 4.62% growth rate by 2026. Specifically, the projected rate for 2026 stands at 4.2%. This rate, being the closest to our higher estimates from both methods for perpetuity growth and still under the combined U.S. inflation and economic growth rate, is a practical choice for the perpetuity growth rate in the H-Model.

Step #5: Half-Life (H)

Determining the half-life, or the number of years for the transition period in the H-Model, is an important step in the valuation process. The half-life reflects the time it takes for a company's dividend growth rate to transition from the extraordinary growth rate (g1) to the sustainable dividend growth rate (g2). Here’s a general approach to estimating the half-life:

- Review Dividend Growth Trend: Analyze the historical dividend growth pattern to understand how quickly the growth rate has been changing. Look for the point where the growth rate starts to decline from its peak.

- Consider Company and Market Dynamics: Understand the factors influencing the change in dividend growth rate, such as market conditions, industry trends, and company-specific strategies or financial health.

- Estimate Transition Duration: Based on the rate of change observed in the historical data and the influencing factors, estimate the number of years it might take for the dividend growth rate to transition from g1 to g2.

For Lockheed Martin, our analysis has already effectively determined the half-life. We observed a high growth rate of 10% from 2016 to 2019. Starting from 2020, the dividend growth rate averaged an annual decline of -0.8%, reaching 6.6% in 2023. This downward trend, along with our projection that the growth rate will reduce to 4.2% by 2026 and needs to stay below the economy's overall growth rate, informs our half-life calculation.

With this pattern in mind, the half-life is the time it takes for the dividend growth rate to shift from 6.6% in 2023 to the predicted stable rate of 4.2% by 2026. This period is 3.5 years, half of the 7 years from 2020 to 2026, and is used as the half-life estimate in the H-Model for Lockheed Martin.

It's important to note that while this half-life estimate is based on current data and projections, it involves an element of speculation regarding future dividend growth patterns and company performance. However, it's advisable to maintain a shorter half-life period, as longer durations may increase the risk of the model yielding misleading results.

Step #6: Calculate and Interpret the H-Model

Now that we have all the inputs, we can calculate the H-Model for Lockheed Martin (LMT). To simplify this calculation, let's begin by calculating the value of extraordinary growth:

Next, we can calculate the value of stable growth:

Now, if we sum these two values, we'd solve for LMT's H-Model's fair/intrinsic value, which is $424.90 ($69.28 + $355.63).

To visualize the growth in annual dividends (DPS) and earnings per share (EPS) for this model over the next 15 years, assuming consistent payout ratios as per the H-Model (where EPS growth mirrors DPS growth), we can chart it as follows:

Now, in terms of interpretation, the H-Model calculates Lockheed Martin's intrinsic price at $424.90, while its current stock price is ~$448.27. This suggests the stock might be slightly overvalued. However, it's important to balance this view with other valuation methods and market factors, considering that the H-Model's assumptions may not fully reflect the company's market dynamics.

Moreover, applying a 20% margin of safety, a modest yet reasonable figure given the predictability of the company's dividends and its established market presence, can safeguard against potential downside risks and the limitations of the model's estimations. This adjustment sets the buy price at $339.93 ($424.90 * (1 - 0.20)), further indicating that Lockheed Martin's stock is overvalued, as this price is significantly lower than its current market price.

Lastly, conducting a sensitivity analysis is essential for precise valuations due to the H-Model's dependence on input variables. An iterative data table is an effective tool for this, allowing for the analysis of minor variations in two sensitive inputs of the H-Model. In this instance, we'll evaluate the impact of incremental changes to the discount rate and the perpetual growth rate on the intrinsic per-share value. Additionally, we'll examine how small adjustments to the discount rate and variations in the margin of safety influence the buy price.

To begin, the iterative data table below demonstrates how small, incremental changes of just 0.5% to the CAPM discount rate (7.76%) and the perpetual dividend growth rate (4.20%) significantly influence LMT's intrinsic value:

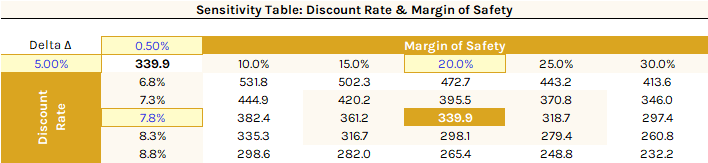

Next, the iterative data table below shows how 0.5% incremental changes to the CAPM discount rate (7.76%) and a more moderate adjustment of 5% to the margin of safety affect LMT's buy price:

Ultimately, these sensitivity analyses highlight the importance of carefully selecting the appropriate company, precisely estimating the discount rate, and choosing the most suitable dividend growth rates. These factors significantly influence our understanding of a company's valuation. This approach is highly recommended for accurately applying the H-Model in dividend discount valuations.

The Bottom Line

The H-Model, building on the Gordon Growth Model (GGM), is adept at evaluating companies transitioning from irregular to stable growth. It effectively encompasses this transition through two phases: an initial period of extraordinary growth followed by a phase of stable growth, offering a realistic assessment of dividend values over time. This model is particularly relevant for companies evolving from rapid to sustainable growth, underpinned by assumptions of declining earnings, consistent dividend payout ratios, and a stable cost of equity. It's ideally suited for firms in transitional phases or experiencing temporary surges in growth, with its structured methodology for dividend growth being a key strength.

The H-Model's inflexibility in the decline of growth rates and its assumptions of unchanging payout ratios and cost of equity can be seen as limitations, especially when compared to the more flexible Three-Stage Dividend Discount Model. It also might not accurately represent companies with unusual growth patterns or prolonged periods of high growth. Recognizing these limitations is vital for effectively using the H-Model in equity valuation and investment decision-making, ensuring a thorough and realistic assessment.