In this article, I will show you how to effectively read and analyze a balance sheet. This sheet is a snapshot of a company's financial position, and shows investors and analysts the worth of a company, also known as the "book" value. Typically, this sheet will be shared in quarterly (10-Q) and annual (10-K) reports, and every balance sheet will list the value of a company's assets, liabilities, and shareholders' equity. To comprehensively understand the balance sheet, I'll be going through the major line items in the balance sheet, discussing what's most important for investors, and will analyze the balance sheet of a real publicly traded company to determine its financial position.

For this article, I'll be using the balance sheet from Johnson & Johnson (JNJ) as an example. Its stock price performance can be seen in the chart below:

Introduction to the Balance Sheet

The balance sheet is a snapshot of a company's financial position, and shows investors and analysts how much a company is worth. Therefore, all important information related to a company's assets, debts, and capital will be found in the balance sheet. Unlike the income statement and cash flow statement, the balance sheet shows financial performance at a specific point in time, NOT over a specific period of time.

The balance sheet is also known as the "statement of financial position" or "statement of financial condition." If you're looking at the official financial statements of a company (e.g., in a 10-Q or 10-K), it may be called the consolidated balance sheet (or something very similar).

You can locate the most accurate balance sheet of any publicly traded company in the U.S. by searching for it on SEC.gov, and looking under the "Financial Statements and Supplementary Data" category in the most recent 10-K annual report. You can also Google "company name + investor relations" and locate the most recent 10-K annual report from the company's website. Regardless, it's fairly simple to identify a balance sheet as it'll always have assets, liabilities, and shareholders' equity listed (in this same order).

The balance sheet formula is below, and is also known as the "fundamental accounting equation" as it provides a foundation for the double-entry bookkeeping system:

Assets = Liabilities + Shareholders' equity

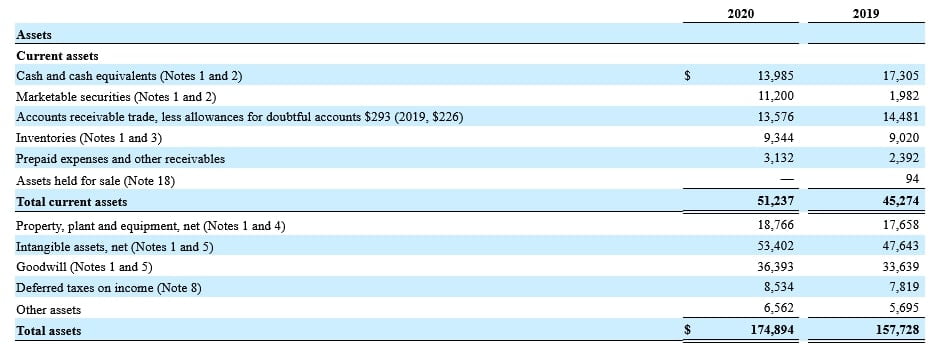

We can locate total assets, liabilities, and shareholders' equity on any publicly traded company's balance sheet. For our example, we'll examine JNJ's balance sheet from its most recent 10-K annual report:

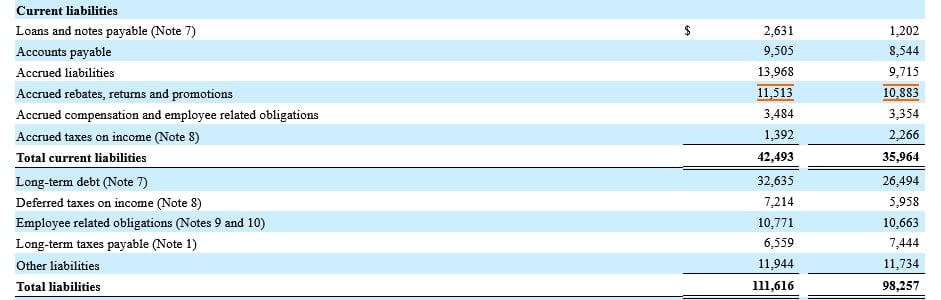

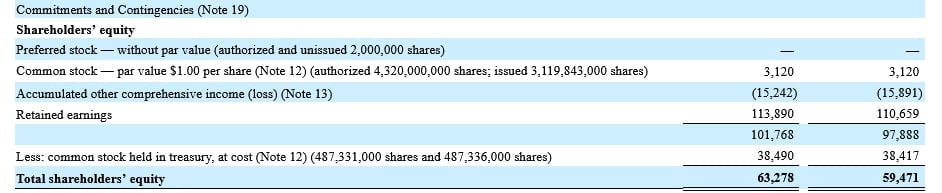

Most recently, it was on January 3, 2021 and December 29, 2019 when JNJ decided to provide a snapshot of what it owns (assets) and owes (liabilities), as well as the amount invested by shareholders (shareholders' equity). As you can see, JNJ had $174.894B in total assets, $111.616B in total liabilities, and $63.278B in total shareholders' equity. Clearly, you can see how total assets are equal to the sum of total liabilities and total shareholders' equity ($174.894 = $63.278 + $111.616), as is the case for every company adhering to reporting procedures.

The three components of a balance sheet (assets, liabilities, and shareholders' equity) are described, broken down, and analyzed in more detail below.

Assets

Assets are inherent and quantifiable resources that a company owns, that are bought or created with the expectation that it will produce some type of positive economic value in the future. These assets are paid for with debt and by the equity owned by shareholders, which balances the balance sheet equation.

Assets are broken down into current (short-term) and non-current (long-term) assets. As you can see with JNJ's balance sheet (below), assets are listed in order of liquidity, depending on the amount of time it would usually take for the resource to be converted into cash. Therefore, "cash and cash equivalents" will (almost always) be the first line item listed (under current assets), whereas a fixed asset such as "goodwill" will be listed further down the balance sheet (under non-current assets).

Current Assets

Current assets include short-term economic resources that are expected to be converted into cash within the next 12 months.

Common examples of current assets are listed and summarized below:

- Cash and Cash Equivalents: Cash or company assets that can be converted into cash quickly. The most liquid current asset.

- Marketable Securities: Very similar to cash equivalents, and refers to equity and debt securities that can be quickly liquidated. This includes common stock, Treasury bills, and various money market instruments.

- Accounts Receivable: Money customers owe a company that has not been paid yet.

- Inventory: A company's products that are awaiting to be sold to customers, along with raw materials and work-in-progress that will eventually become finished goods.

- Prepaid Expenses: Prepaid expenses are any future expenses that are paid in advance. The value of these prepaid expenses are expensed over time on the income statement.

- Non-Trade Receivables: These are receivables that exclude accounts receivable, such as interest receivable, income tax receivable, insurance claims receivable, and receivables from employees.

Note that "Other Assets" may be another line item. This refers to any other type of current asset that does not fit any of the above-mentioned categories. Read the "Notes to the Financial Statements" section in the 10-Q or 10-K reports to understand what these are.

In general, the most important current assets to examine are described in more detail below.

Cash and Cash Equivalents

Cash and cash equivalents refer to cash on hand and debt securities with maturities of less than 90 days that can quickly be converted into cash. Cash refers to checking accounts, coins and paper money, undeposited receipts, and money orders. Cash equivalents include bank accounts, commercial paper, bank certificate of deposits (CDs), Treasury securities (three month maturities or less), money market mutual funds, and can include marketable securities as well.

Because cash is the most liquid asset in a company, if the cash balance is low, this is likely a sign of a company with poor financial strength. To verify this, you should question whether the company can pay off its short-term debts and whether it can cover its monthly expenses. Obviously, companies that do not have enough cash on hand may face more financial problems than those that do.

On the other hand, if the cash balance is too high, this is not always a good sign. Put simply, this may indicate that the company is struggling to expand and grow its operations. As an investor, you would expect the managers of the company to initiate projects and deploy excess cash to grow the business and ultimately provide more value to shareholders. However, if the cash balance appears too high, this may be a sign of an incompetent management team that is not adequately reinvesting into the business.

Accounts Receivable

Money that customers owe a company due to products/services delivered or used, but not yet paid for, is known as accounts receivable. If accounts receivable appears high or grows at a rate higher than sales, this is not a good sign, because it indicates that a company fails at collecting money for the products/services that it provides to customers. If receivables are not paid within a particular time frame, they can turn into "bad debts," which is an expense the business will incur. Ultimately, this results in less money for the company.

Inventory

Inventory refers to the company's products available for sale and any raw materials used to produce these products. Three types of inventory are finished goods, work-in-progress, and raw materials, which will likely be broken down in the notes to the financial statements. However, to quickly analyze a balance sheet, the overall inventory figure on the balance sheet is all you need to look at.

If the inventory line item appears high, this may imply the company has inferior products, product deficiencies, out-of-favor products, or a similar factor which is causing its products to not sell in stores. Moreover, this may be a sign of poor sales and/or marketing departments. Naturally, if products are not needed from the company's inventory, this can lead to higher storage costs for the company, thereby reducing profit margins.

Non-Current Assets

Non-current assets are long-term resources that are expected to provide benefits for more than 12 months, and aren't expected to be converted into cash in the next 12 months.

Non-current assets can be classified into three groups:

- Tangible Assets: Physical assets that can be touched. This includes plant, property, and equipment (PP&E). Most tangible assets depreciate in value over time as well.

- Natural Resources: Assets that provide economic value and come from the Earth. Examples include fossil fuels, timber, and mines.

- Intangible Assets: Identifiable assets that do not exist in physical form but provide economic value to the company. This includes investments, patents, trademarks, goodwill, copyrights, and brand names. These are all rather self-explanatory, except goodwill, which is a miscellaneous category that accounts for the excess purchase price of another company.

To further elaborate, PP&E and goodwill are described below:

- Plant, Property, and Equipment (PP&E): These are the company's assets that are essential to the normal operations of the business. Typically, this will be a large figure on a company's balance sheet and includes land, office, machinery, vehicles, factories, and other physical assets that cannot be easily converted into cash.

- Goodwill: Goodwill is an intangible asset that is present on a balance sheet when a company acquires another company. Therefore, goodwill cannot be self-created. To calculate goodwill, the fair market value of identifiable assets and liabilities of the acquired company is subtracted from the purchase price.

In terms of intangible assets, large intangible asset values (e.g., brand names) can indicate that a company has a strong competitive advantage (aka economic moat) over its competitors, which may lead customers to favor the company over its competitors. Obviously, this is something you should be looking for as an investor.

Liabilities

Liabilities are anything the company owes, which will be a cost for the company in the future. Liabilities are also broken down into current (short-term) liabilities and non-current (long-term) liabilities. Liabilities are also listed in order by how soon they are to be paid back by the company. In other words, liabilities are recorded on the balance sheet in the order of shortest term to the longest term. This can be seen with JNJ's liabilities section below:

Current Liabilities

Current liabilities refer to any debts or obligations a company owes to its borrowers within the next 12 months or within a normal operating cycle.

Current liabilities can be classified into three groups:

- Non-Interest-Bearing: Liabilities that represent the normal operations of a business. Examples include any accounts that reflect short-term expenses and debts that do not accrue interest.

- Interest-Bearing: Debts the company must pay with interest to finance themselves. Examples include commercial paper, short-term debt, and the short-term portion of long-term debt.

- Deferred: Cost that is due for the current period but has not yet been paid. Examples include salaries, taxes, and other amounts due in the short-term.

To further elaborate, common examples of current liabilities are listed and summarized below:

- Accounts Payable: Represents payment due to lenders. Raw materials purchased from a supplier, but not yet paid for by the company, is a common example of what will be recorded as accounts payable. Companies are responsible for paying their suppliers, and if accounts payable appears too big, this may be a warning sign to not invest in the company. Put simply, this indicates that a company cannot pay its short-term debts as it owes its suppliers a lot and may fail at settling its debts. Obviously, if a company regularly fails to pay off its short-term debts, it may become bankrupt rather quickly.

- Notes (Bills) Payable: These are known as "written promissory notes" that a company receives when it decides to borrow money from a lender. Notes payable are therefore written and formal agreements, unlike accounts payable, and the lenders are generally institutions, financing, and credit card companies. Notes payable may also arise from the same sources as accounts payable, but are typically reported separately because they are negotiable instruments.

- Interest Payable: Represents the amount of accrued interest expense to date that is currently owed to lenders. Clearly, you'd want this number to be as low as possible because it's a burden to any company.

- Wages and Salary Payable: Wages earned by employees but not yet paid (aka unclaimed wages) are included in this line item.

- Current Portion of Long-Term Debt: This is simply a portion of the long-term debt (principal) that is due for payment, typically within the next 12 months.

- Bank Account Overdrafts: Negative cash balances from cash overdrafts (negative cash balances) will be reported on this line item.

- Accrued Income Taxes or Current Tax Payable: Any income tax owed to the government but not yet paid. Calculation of income tax payable depends on the company's home country.

- Accrued Liabilities (Expenses): Any payments a company is obligated to make in the future for products/services that have already been received. Examples include accrued wages and compensation, accrued management bonuses, accrued interest on loans payable, and accrued advertising and promotion, among others.

- Unearned Revenue: Money received by a company for a product/service that has not yet been received by the customer.

- Dividend Payable: The amount of after-tax profit a company has declared to distribute as dividends to its shareholders.

With an understanding of the current assets and current liabilities, you can use the ratios below to help analyze a company's liquidity. This will help you determine how well a company can pay back its short-term obligations.

Current Ratio

You can calculate the current ratio to ensure the company you're evaluating has enough short-term assets to cover its short-term debt obligations. This ratio is shown below:

Current ratio = Current assets / Current liabilities

Although this liquidity ratio should be compared to its competitors and the industry, the current ratio should be above 2.0, and no less than 1.5. In general, this helps to prove that the company has enough cash to cover any debts that are due within the next 12 months.

Quick Ratio

If you want be more conservative, you can also calculate the quick ratio, as shown below:

Quick ratio = (Current assets - Inventory) / Current liabilities

Ultimately, this liquidity ratio is more conservative than the current ratio because it doesn't include inventory, which is more difficult to liquidate, thereby focusing on the company's more liquid assets.

Working Capital

Working capital, as another liquidity figure, is simply the difference between a company's current assets and current liabilities, as shown below:

Working capital = Current assets - Current liabilities

Clearly, if working capital is greater, it means that the company has more current assets than current liabilities. If this number seems too high, this may be an indication of a company that is not investing its excess cash. However, a positive working capital number is generally good, as it means the capital can fund the company's operations and invest in future growth opportunities.

If working capital is negative, this may be a sign of short-term liquidity issues with the company. For example, this may be due to a large cash outlay purchase for raw goods, with the accounts payable account increasing substantially.

Non-Current Liabilities

Non-current liabilities refer to any debts or obligations a company owes to its borrowers after the 12-month period.

Common examples of non-current liabilities are listed and summarized below:

- Long Term Debt: Refers to a catch-all phrase for when a company takes on a loan and repayments are made for multiple years to pay down the loan. Types of long term debt include bank debt, mortgages, bonds, and debentures.

- Provisions: These are funds set aside to cover anticipated future losses. Examples of provisions include bad debts, warranties (guarantees), future litigation fees, income tax liabilities, asset impairments, doubtful debts, etc.

- Secured/Unsecured Loans: Secured loans require borrowers to offer collateral, unlike unsecured loans. Secured loans include debentures, loans from banks, and interest accrued and due on secured loans. Unsecured loans include fixed deposits, short-term loans, loans from banks, and others.

- Derivative Liabilities: Derivatives are commonly used by companies to hedge from transaction exposure, which comes with a risk. Therefore, if a company is "mark to market" negative for its derivative instruments, this must be disclosed in the balance sheet as a derivative liability.

- Deferred Tax Liabilities: Represents when a tax is due for the current period but has not yet been paid. This deferred tax is therefore due to the timing difference between when the tax is accrued and when the tax is actually paid.

- Long Term Lease Obligations: This is the amount due for asset lease agreements. Lease payments are common expenditures for companies.

Note that "Other Long Term Liabilities" may be another line item. This refers to any other type of long term liability that does not fit any of the above-mentioned categories. As previously mentioned, you can read the "Notes to the Financial Statements" section in the 10-Q or 10-K reports to understand what these are.

Shareholders' Equity

Following the balance sheet equation, if you were to add up all the resources a company owns (assets) and subtract all of the claims from others (liabilities), what remains is shareholders' equity. Shareholders' equity, as the name suggests, refers to the amount owners of a company (e.g., investors, managers, institutions, etc) have invested in the business, through investments and by retaining earnings over time. So, when you purchase stock in a company and gain partial ownership, the money that goes into the company is considered shareholders' equity.

Below are two formulas to calculate shareholders' equity:

Shareholders' equity = Total assets - Total liabilities

Shareholders' equity = Share capital + Retained earnings - Treasury shares

Share capital is just the money raised by a company through issuing common or preferred stock.

Shareholders' equity can be broken down into four categories:

- Common Stock: Represents the shareholders' investment in the business. Common stock is sold, purchased, and resold in a stock exchange, and given a publicly listed price. Some pay dividends, typically on a quarterly basis, and ownership of common stock will give you voting rights in a company's policies and procedures.

- Preferred Stock: Also represents the shareholders' investment in the business, but with different rights. Preferred stockholders have a preference over common stockholders for dividends and for the assets of the company upon liquidation. However, preferred stockholders have no voting powers regarding important company matters. Many companies also do not issue preferred stock.

- Treasury Stock: Refers to shares that have been repurchased by the issuing company that were previously outstanding. Also known as "reacquired stock," and causes total shareholders' equity to be reduced.

- Retained Earnings: Amount of earnings a company has left over after paying dividends to its shareholders. In other words, retained earnings is any profit a company retains that has not been distributed to its owners, which can be used to buy assets and invest in the future of the company.

These line items will be listed under the shareholders' equity section in a balance sheet, as you can see with JNJ's Shareholders' Equity section:

To further analyze shareholders' equity, we can look at the debt-to-equity (D/E) ratio and can calculate shareholders' equity growth as well, as explained below.

Debt-to-Equity Ratio

To quickly analyze debt levels, you can use the debt-to-equity (D/E) ratio and look for a ratio close to 0.5. This ratio is shown below:

D/E ratio = Total debt / Shareholders' equity

Obviously, if the company you're evaluating has no debt, there's no risk of the company defaulting. However, there's always a risk of default if the company has debt, and the more debt a company has, the greater this risk.

Shareholders' Equity Growth

From a value investors perspective, you should look for companies that experience a 10% or more shareholders' equity growth every year, over the last 10 years. Ideally, this growth rate should be growing over time as well.

If a company can consistently grow shareholders' equity over the long-term, the company will likely perform well as an investment (given that it's bought at the right price). Again, this is because a growing shareholders' equity means that shareholders are investing more into the company, and/or that the company is effectively retaining its earnings. Therefore, over the long term, a company's stock price should move in the same direction as shareholders' equity growth.

We can examine JNJ's 10-year shareholders' equity growth below:

As the chart and table shows, JNJ has not been able to consistently achieve a 10% compound annual growth rate, which may not make it a worthwhile investment. After collecting 10-year data for total shareholders' equity (e.g., with QuickFS), you can calculate this by using the RATE function on Excel or Google Sheets. For example, the 5-year annual growth for shareholders' equity from 2011-2020 would look like: =RATE(5 ,, -2015 equity, 2020 equity).

If JNJ had compound annual growth rates of 10% or more, however, then this would indicate that the company is doing well to retain profits. Moreover, this growth rate would suggest that JNJ is effective at managing its debt obligations and investing in the right assets to generate real returns.

The Bottom Line

The balance sheet reports a company's assets, liabilities, and shareholders' equity at a specific point in time. Assets on the balance sheet refer to what the company owns, liabilities refer to what the company owes, and shareholders' equity represents the net worth of a company. Assets will always be equal to the sum of liabilities and shareholders' equity.

For current assets, cash and cash equivalents, accounts receivable, and inventory are the most important line items to analyze. For non-current assets, you should understand what types of long-term assets the company has (e.g., tangible assets, natural resources, and intangible assets) and whether these assets provide the company with any sort of strong economic moat.

Current liabilities are either non-interest bearing, interest-bearing, or deferred. To better understand a company's liquidity abilities, the current ratio, quick ratio, and working capital can be calculated. Non-current liabilities, at the very least, should be minimal and the company should have enough cash flow to continue to pay off these obligations without issues.

For shareholders' equity, the most important thing is to calculate the compound annual growth rates over the 10-year period, to better understand how well the company may perform in the future. The D/E ratio can be computed as well to better understand a company's debt levels.

In closing, the balance sheet is extremely important to analyze when evaluating a company's financial position and growth potential. However, as investors, analyzing every single line item on a balance sheet is not necessary. The most important line items and understanding how to analyze them are described in this article, which in general, is what you should focus on first before anything else. Finally, anything you don't understand will likely be discussed in the company's reports with the SEC, which will help when analyzing different companies and industries.