In this article, I will show you how to track and evaluate insider trading purchases. Insider trading can provide valuable insights into a company's prospects, particularly during times of stock market uncertainty. By tracking the trading patterns of company insiders, such as officers, directors, and large shareholders, investors can gain a better understanding of a company's potential value.

This article explains insider trading, its significance to investors, and differentiates between legal and illegal insider trading. We'll then discuss how to read Form 4 SEC filings, which insiders must file with the SEC when buying or selling shares of their company's stock. Afterward, we'll explain how to filter insider purchases relevant to investors, and conclude by exploring how to evaluate broader market insider transactions.

Insider Trading Explained

Insider trading refers to the buying and selling of company stock by individuals who have access to material, non-public information about the company. This typically includes:

- Officers

- Chief Executive Officer (CEO)

- Chief Financial Officer (CFO)

- Chief Operating Officer (COO)

- Chief Technology Officer (CTO)

- Chief Marketing Officer (CMO)

- Chief Information Officer (CIO)

- Chief Legal Officer (CLO) or General Counsel

- President

- Vice President(s)

- Directors

- Shareholders who own more than 10% of the company's stock

- Other insiders as defined by regulations

When these insiders trade their company's securities, they are required to report their transactions to the Securities and Exchange Commission (SEC) through the filing of Form 3, Form 4, and Form 5 documents, as described further below.

Importance of Insider Trading for Investors

Insiders, especially CEOs and other top executives, possess a deeper knowledge of their company’s operations, financial health, and future outlook than any external investor. While insiders can sell their shares for a number of different reasons (financial needs, portfolio diversification, compensation, etc.), they typically buy shares for two main reasons (with the former generally being more common):

- Signal Confidence: Insiders may purchase shares to signal to the market that they believe the company is undervalued. This indicates confidence in the company's future prospects and may influence other investors to drive the stock price up.

- Unlock Milestones: Buying shares can help insiders meet specific conditions related to compensation plans or corporate governance criteria, such as achieving certain ownership levels required for bonuses or other incentives.

For instance, if a stock drops by 30% and appears undervalued but insiders aren’t buying, it might suggest not to invest, indicating the company could have underlying issues or the stock isn’t cheap enough. Conversely, if executives start purchasing shares, it likely indicates they view the stock as undervalued with potential for long-term growth, possibly due to inside knowledge of upcoming developments like new products, acquisitions, or distribution channels.

Moreover, companies with substantial insider ownership typically exhibit a stronger alignment between the interests of shareholders and the motives of management. With more personally at stake, insiders participate in both the potential rewards and risks, leading to decisions that promote long-term value.

Legal vs. Illegal Insider Trading

Insider trading is a term that encompasses both legal and illegal conduct, as described below:

- Legal Insider Trading: Occurs when corporate insiders, such as officers, directors, and beneficiary owners, buy and sell stock in their own companies and report these trades to the SEC.

- Illegal Insider Trading: Involves buying or selling securities while in possession of material, non-public information, in breach of a fiduciary duty or other relationship of trust and confidence.

The line between legal and illegal insider trading can be blurry, as the definition of "material" information is often open to interpretation. Material information can include pending acquisitions, significant customer losses, unknown supply chain constraints, or any other event that could substantially impact the stock price once publicly announced.

The SEC closely monitors unusual trading activity and has a history of taking enforcement actions against those engaging in illegal insider trading. These enforcement actions are documented on the SEC's website, with press releases detailing the specifics of each case. Penalties for illegal insider trading can be severe, including criminal charges, substantial fines, and being barred from trading or working in the finance industry. Investors should be aware that while small-scale illegal trades may go unnoticed, the potential consequences far outweigh any short-term benefits.

It's important to note that not all information gathering by investors constitutes illegal insider trading. For example, hedge fund managers are permitted to interview former employees, executives, suppliers, and customers to inform their trading decisions. This practice is considered legal, as the hedge fund has exerted effort and incurred costs to obtain the information. However, if an employee directly tips off a hedge fund about a material event before it is publicly announced, it could be considered illegal insider trading.

How to Track Insider Buying

Insider transactions can be found on the SEC's EDGAR database, where insiders' purchases, sales, and holdings of their company's securities are reported. Additionally, most companies provide these filings on their investor relations pages, which can be found on their respective company websites.

To track insider buying, investors can monitor the Forms 3, 4, and 5 filed by company insiders with the SEC, as described below:

- Form 3: Filed within 10 days of becoming an insider (e.g., officer, director, or 10% holder), disclosing initial ownership of company securities.

- Form 4: Filed within two business days following an insider transaction, reporting purchases, sales, and price per share. Includes transactions in common stock, options, warrants, and convertible securities. Each transaction is coded to indicate its nature.

- Form 5: Filed annually, no later than 45 days after the company's fiscal year-end, reporting transactions not previously disclosed on Form 4 due to exemptions or failure to report. Transactions under $10,000 in a six-month period may be reported on Form 5 instead of Form 4.

When tracking and evaluating insider buying, investors typically focus on Form 4 filings, as they provide the most timely and relevant information about insider transactions, including the date, price, and size of each purchase or sale.

There are also some other SEC filings that may be relevant to insider trading in certain situations:

- Form 144: This form is required when an affiliate of a company (such as an executive officer, director, or large shareholder) wants to sell restricted or control securities. The form must be filed with the SEC before the sale can occur and provides information about the proposed transaction, including the number of shares to be sold and the expected sale price. While Form 144 is not directly related to insider buying, it can provide insight into potential insider selling activity and signal potential selling pressure from insiders.

- Schedule 13D: This form is filed by individuals or groups who acquire more than 5% of a company's outstanding shares. The form must be filed within 10 days of the acquisition and discloses the identity of the owner, the number of shares owned, the purpose of the acquisition, and the background and intentions of the shareholder. While not strictly an insider form, Schedule 13D can reveal important information about significant shareholders who may influence company decisions.

- Schedule 13G: Similar to Schedule 13D, this form is filed by individuals or groups who own more than 5% of a company's outstanding shares. However, Schedule 13G is used when the owners are passive investors and do not intend to seek to influence or control the company. The filing requirements for Schedule 13G are less stringent and less detailed than those for Schedule 13D.

There are also numerous third-party sites that aggregate data from SEC filings, making it easier to track and analyze insider transactions. Most of these sites focus on aggregating Form 4 data, with some also offering information from Forms 3 and 5. These sites typically update their data within two days of the filing date.

Below is a list of third-party sites for tracking insider buying:

- OpenInsider: Provides the latest cluster buys, latest insider buys/sales, top insider buys/sales, an insider buy-sell chart, and more.

- InsiderCow: Offers insider buys/sales information, institutional trading reporting, insider trading activity charts, and more.

- SECForm4: Features insider buys/sales information, along with 13D and 13G filings, and useful "I-Ratio" charts to account for seasonality in insider trading patterns.

- Dataroma: Provides insider buys/sales information, and options for filtering real-time insider transaction data.

- WhaleWisdom: Lists the top 50 insider open market buys, an insider stock screener, and charts for buys/sales that can be filtered by sectors. It also includes a calculation for rare/unusual buys, and top buys as a percentage of shares outstanding.

- InsiderTracking: Offers insider buys/sales information and notably includes Canadian SEDI filings (insider trades reported in Canada) as well. Features insider sentiment charts vs. the S&P 500 (U.S.) and TSX (Canada).

- Finviz: Displays the latest insider trades, top insider trades over the recent week, and top 10% owner trading for the recent week. It has minimal filtering options.

- Insider Monitor: Provides various insider trading reports to reveal the secrets of insider trading activities, as well as real-time and top 10 insider trading information.

These platforms offer a variety of features and tools for tracking insider buying, including real-time alerts, advanced filtering options, and data visualization. By leveraging these resources, investors can gain valuable insights into insider sentiment and make more informed decisions when evaluating potential investments.

How to Read SEC Form 4 Filings

When analyzing insider trading activity, understanding how to read and interpret SEC Form 4 filings is a must. As previously described, Form 4 is a document that company insiders, such as officers, directors, and large shareholders, must file with the SEC when they buy or sell shares of their company's stock. By carefully reviewing Form 4 filings, investors can gain valuable insights into insider sentiment and potential stock price movements.

Here's an example of a Form 4 document from the SEC:

When reading a Form 4, pay close attention to the following key components:

Reporting Person & Relationship to Issuer

These sections identify the insider who made the transaction, including their name, title, and relationship to the company. Focus on transactions made by high-level executives, particularly the CEO and CFO, who typically have the most comprehensive understanding of the company's prospects.

For our example, the Form 4 was filed by Gamgort R. James, the CEO & Executive Chairman of Keurig Dr Pepper (KDP).

Transaction Date

The transaction date is the earliest date on which the insider transaction(s) occurred. Insiders are required to report their transactions within two business days following the transaction day (the filing date). Transactions under $10,000 may be reported on Form 5 instead. Older Form 4 filings likely reflect trades already priced into the market, which is something investors should keep in mind.

For our example, the CEO reported transactions on 03/04/2024 and 03/05/2024.

Transaction Code

The transaction code describes the nature of the transaction, which is one of the most important items in a Form 4. The most important codes to look for are "P" (open market or private purchase) and "S" (open market or private sale), to a lesser extent. Other common codes include "A" (grant or award), "M" (exercise of options), and "F" (payment of exercise price or tax liability using securities). The full list of the transaction codes and what they mean is provided further below.

Focus on "P" transactions, as they represent insiders buying shares with their own money, which may signal confidence in the company's future. "S" transactions are typically more common and can be a red flag if they're significant amounts relative to what the insider already owns.

For our example, we have two "M" codes, one "F" code, and one "P" code. Of these three, the "P" transaction is really the only significant one investors should take note of, given that "M" and "F" codes represent the exercise of options and the sale of shares to cover taxes or the exercise price, respectively. In this case, the CEO has restricted stock units (RSUs) that have vested, and the "M" and "F" transactions are related to the exercise and sale of those shares.

Amount of Securities Transacted

The amount of securities column shows the number of shares bought or sold in the transaction. Compare this number to the insider's total holdings (which you can also find to the right of the table) to assess the significance of the trade.

A large purchase (or sale) relative to the insider's existing stake may indicate a stronger (or weaker) belief in the company's potential.

For our example, the CEO only purchased 171,821 shares on the open market (at $29.10), which relative to his total share count of over 3 million, is not significant.

Ownership Type

The ownership type column indicates whether the securities are held directly by the insider (D) or indirectly (I) through a trust, spouse, or other entity.

Direct ownership (D) suggests that the insider has full control over the shares and bears the economic risk and reward associated with them. Indirect ownership (I) may imply that the insider has less direct control or has transferred some of the risk and reward to another entity.

For our example, the CEO only traded shares as a direct insider.

Price

The price at which the insider bought or sold the shares. Compare this price to the stock's current market price and recent trading range to gauge the insider's timing and potential profit or loss on the transaction.

For our example, the price at which the CEO bought shares on 03/05/2024 was $29.10.

Footnotes

Review any footnotes or additional information provided in the Form 4 filing. These notes may contain important context about the transaction, such as whether it was part of a pre-arranged trading plan (Rule 10b5-1) or if the shares were acquired through an employee stock option plan.

Non-scheduled purchases may indicate a stronger belief in the company's near-term prospects, as the insider is choosing to invest at a specific time.

Because you want to look for purchases ("P") on the open market, checking these footnotes, if it's not already clear, is another way to confirm that the purchase was made on the open market.

SEC Form 4 Transaction Codes

The full list of Form 4 transaction codes have been described by the SEC, and are provided in the tables below for your convenience.

General Transaction Codes

Rule 16b-3 Transaction Codes

Derivative Securities Codes (Except for Transactions Exempted Pursuant to Rule 16b-3)

Other Section 16(b) Exempt Transaction and Small Acquisition Codes (Except for Rule 16b-3 Codes Above)

Other Transaction Codes

How to Screen for Relevant Insider Transactions

When using third-party sites to screen for insider transactions, it's important to focus on the most relevant and meaningful data for the average retail investor. By applying the right filters and understanding the significance of different transaction types, investors can gain valuable insights into insider sentiment and potential investment opportunities.

Prioritize Open Market Purchases

When screening for insider transactions, prioritize purchases made on the open market ("P" transactions) rather than those acquired through company offerings or options exercises.

Open market purchases are more significant because they involve insiders using their own money to buy shares, indicating a stronger belief in the company's future prospects. Conversely, shares acquired through compensation packages or options exercises are less meaningful, as they don't necessarily reflect the insider's current sentiment.

Significant insider selling ("S") can also be a red flag worth investigating.

Restrict Transactions to C-Level Executives

Transactions by C-suite executives, particularly the CEO and CFO, carry more weight than those of directors or other insiders. Here's why and what to keep in mind when evaluating these executives' insider transactions:

- Chief Executive Officer (CEO): The CEO's view is essential, providing a comprehensive look at the company's strategy, operations, and market opportunities. Although CEOs usually have the most comprehensive information about the company, their optimism about the company's prospects and valuation might sometimes influence objective judgment.

- Chief Financial Officer (CFO): With a deep understanding of the company's financials, liabilities, customers, and lending relationships, CFOs focus on valuation due to their finance and accounting background. Their actions offer valuable insights into the company's financial health and outlook.

Other officers, directors, and 10% shareholders, in general, don't carry as much weight when assessing insider transactions as CEOs and CFOs do for several reasons:

- Other Officers: Officers such as the COO, CTO, or CMO may provide insights into their specific domains within the company, reflecting operational, technological, or marketing perspectives. However, their transactions might not provide as complete a picture of the company's financial stability and growth potential as those of the CEO and CFO, who have a broader overview of the entire organization's performance and strategic direction.

- Directors: While companies typically have many directors, leading to frequent insider transactions, the relevance of these transactions varies with the directors' involvement in the company. Directors deeply engaged in the business offer more meaningful insights than those less involved, making their transactions less indicative of the company's future compared to the CEO and CFO. Moreover, transactions labeled "New" on OpenInsider often relate to newly appointed directors required to buy shares, which doesn't necessarily reflect strong confidence in the stock's value.

- 10% Owners: Transactions by 10% owners, who are typically institutional investors or wealthy individuals, may not provide as much insight as those made by company executives. These large investors have different motivations and face unique challenges, such as portfolio rebalancing, risk management, or liquidity needs, which may not align with the goals of retail investors. Their transactions may be influenced by factors other than a strong belief in the company's prospects.

In summary, while transactions by all insiders offer insights, those by CEOs and CFOs are often the most telling. Their deep knowledge and overarching view of the company make their transactions particularly noteworthy. Investors should consider the context of each transaction, looking beyond the surface to understand the motivations behind insider activities for a more informed investment decision.

Evaluate Transaction Size Relative to Compensation

While some investors may focus on the dollar amount of insider transactions, it's more important to consider the size of the transaction relative to the insider's compensation.

For example, a $50,000 purchase by an executive earning $250,000 per year is more significant than the same purchase by an executive earning over $1 million annually. OpenInsider offers a page for purchases greater than $25,000, which serves as a good starting point. However, it's important to remember that this criterion may exclude smaller transactions that could be significant relative to the insider's income.

Note that information related to the governance of a company, including executive compensation, equity compensation plans, and the makeup of the board of directors, among other details, can be found in the DEF 14A proxy statements. These statements are also available on the SEC's EDGAR database and are reported annually.

Consider Changes in Ownership Percentage

Similar to the previous section, it's important to consider the percent change in an insider's ownership resulting from a transaction. Substantial increases in ownership percentage can indicate a strong belief in the company's future, while significant decreases may suggest a lack of confidence.

How to Evaluate Broader Insider Transactions

Beyond filtering for relevant insider transaction filings, where you can then read the Form 4's for more information, it's useful to know how to evaluate the broader insider transactions occurring in the market. By examining aggregate insider trading activity, you might gain insights into longer-term market movements.

Monitor Cluster Buys

Look for cluster buys, instances where multiple insiders are buying shares within a short period, such as a week. This collective action can indicate a stronger signal than a purchase by a single insider.

OpenInsider provides information on "latest cluster buys," which indicates the number of insiders involved in a purchasing cluster. Cluster buys (or sells) suggest a consensus among insiders that the stock is undervalued (or overvalued) and poised for growth (or lack thereof). Ensure these purchases were made on the open market and are not part of a compensation plan or options exercise.

Here's an example of cluster buys for Keurig Dr Pepper (KDP):

When analyzing cluster buys, consider the following:

- Look for patterns or trends in insider trading activity, such as multiple insiders buying or selling shares around the same time.

- Compare the size and timing of insider transactions to the company's financial performance, industry trends, and overall market conditions.

- Be aware of potential limitations or biases in insider trading data, such as the impact of pre-scheduled trading plans or the fact that insiders may buy or sell shares for reasons unrelated to the company's prospects (e.g., personal financial needs).

Evaluate Aggregate Insider Trading

Analyzing aggregate insider trading activity can help investors gauge overall market sentiment. OpenInsider's "Insider Buy-Sell Charts," for instance, display the number of sales (in red) and purchases (in blue) over a selected time window, as shown below:

This data is based on the number of transactions rather than the dollar amount, to avoid skewing the data with large purchases by wealthy insiders. For a dollar perspective, you can reference the insider charts offered by WhaleWisdom.

During market downturns, an increase in insider buying relative to selling often signals that executives believe their companies are undervalued and poised for recovery. This was evident in the chart above during the Great Recession (2007 to 2009) and during the COVID-19 recession (early 2020), where the number of insider buys far outpaced the number of insider selling.

Thus, as markets fall and fear spreads, wealthier individuals like executives, who can better withstand downturns, often buy shares. The volume of insider buying can reveal executives' confidence, offering clues on whether to buy or hold the stock.

Consider Sector-Specific Insider Activity

Analyzing insider trading activity within specific sectors can provide valuable insights into industry trends and sentiment. For example, the chart below from WhaleWisdom shows the insider buys and sells over the past year (on a weekly time interval) for the finance sector:

By examining sector-specific insider activity, investors can gain a better understanding of the confidence levels and expectations of insiders within a particular industry. This information can be used to identify potential investment opportunities or to confirm existing investment theses. Keep in mind that sector-specific insider activity should be considered in conjunction with other market trends to make well-informed investment decisions.

Account for Insider Trading Blackout Periods

As Insider Monitor has observed, insider trading activity exhibits a seasonal pattern due to SEC regulations that prohibit insiders (company officers, directors, and 10% beneficial owners of a public company) from buying and selling their own company securities during certain blackout periods. Typically, insiders are more active in buying their company shares in the months of March, May, August, and November.

This seasonal pattern is important to understand, as it can help uncover the relationship between insider trading and stock market actions. Insiders tend to buy more frequently during these months because they are outside of the quarterly blackout periods surrounding earnings releases. During these blackout periods, insiders are restricted from trading to prevent them from exploiting material, non-public information that could influence the stock price.

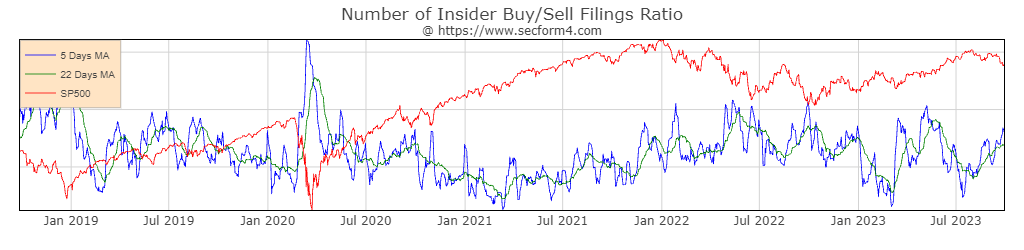

Charts like SECForm4's "Number of Insider Buy/Sell Filings Ratio" chart, also known as the "I-Ratio," account for the seasonal fluctuations in insider trading activity due to earnings-related blackout periods, as shown below:

The I-Ratio is designed to normalize the data and provide a more accurate picture of insider sentiment by comparing the number of insider buy filings to the number of insider sell filings over a given period.

Here's how the I-Ratio accounts for the seasonal buy/sell fluctuations:

- The I-Ratio focuses on the ratio of buys to sells, adjusting for the level of insider activity. During blackout periods, when buying and selling are restricted, the ratio remains stable, as both activities reduce equally.

- It's often calculated over a rolling period, like 30 or 60 days, to smooth short-term fluctuations and highlight overall trends in insider sentiment. This minimizes the impact of seasonal blackout periods by capturing broader patterns of activity.

- Some versions use statistical techniques like weighted averages to adjust for seasonal variations and emphasize recent transactions, enhancing the capture of shifts in insider sentiment while considering seasonal norms.

By normalizing data through the buy/sell ratio and using a rolling calculation, the I-Ratio offers a reliable indicator of insider sentiment. This helps investors interpret changes in the I-Ratio, where deviations from seasonal patterns might indicate shifts in insider views.

Understanding these patterns helps investors interpret the significance of insider buying. A surge in buying during an active month might be less meaningful than a similar surge during a typically quiet period, indicating a stronger sentiment signal.

The Bottom Line

Tracking and evaluating insider trading purchases can provide valuable insights into a company's prospects and help inform investment decisions. By understanding the factors that make insider transactions significant, such as transaction size, insider role, and timing, investors can better assess the potential impact of these trades on a company's stock price.

However, it's important to remember that insider trading should be just one of many factors considered when making investment decisions, and not all insider purchases guarantee future stock price appreciation.

Additionally, investors should be aware that insider trading regulations and reporting requirements may vary by country. The SEC's Form 4 filings are specific to the U.S., and other countries have different systems for tracking and disclosing insider transactions.

In closing, when incorporating insider trading analysis into your investment strategy, consider the following tips:

- Look for consistent, long-term insider buying patterns rather than focusing on a single transaction.

- Pay attention to the insider's role and level of access to company information.

- Consider the size of the transaction relative to the insider's compensation and total ownership stake.

- Monitor aggregate insider trading activity to gauge overall market sentiment, but be aware of seasonal patterns and other factors that may influence insider behavior.

- Use insider trading data as a complement to other fundamental analysis techniques, such as valuation models and industry research.

By carefully tracking and evaluating insider trading purchases, investors can gain valuable insights into a company's prospects and make more informed decisions when building their portfolios. However, it's crucial to approach insider trading analysis with a critical eye and to use it as just one tool in a comprehensive investment strategy.