In this article, I'll show you how to effectively analyze company debt through analyzing the three primary financial statements (income statement, cash flow statement, and balance sheet) for a real publicly traded company. I'll also highlight the ratios we can use to further determine whether a company is capable of managing its debt. Understanding how to effectively analyze company debt is especially important in an environment where interest rates are low, as debt is cheaper to borrow. Therefore, we'll also take a look at the benefits and risks of companies taking on more debt.

Debt is not always a bad thing, and if companies are able to leverage this debt to grow at a higher rate than what is owed from the debt, then this debt is beneficial and likely manageable. In fact, debt is almost a requirement for early-stage companies and can significantly improve a company's chance of success.

Ultimately, it's important that investors know how to analyze a company's debt obligations, as companies with large amounts of debt and little cash flow are at risk of bankruptcy, or at the very least, are limited in the growth opportunities they can invest in to grow their company further and increase shareholder value.

Nike (NKE) Analysis

In this article, we'll use Nike (NKE) as an example to understand how to effectively analyze company debt. Nike is one of the largest sellers of athletic footwear and apparel in the world. Its stock price performance is shown in the chart below:

The most popular type of debt is when a company takes out a bond, or when they issue a bond to the public. Therefore, when it comes to debt, I'll primarily focus on bonds.

Bonds affect all three primary financial statements, so it's important that we look at these when analyzing debt.

Nike's Income Statement

First, let's look at the income statement, which describes the revenues, expenses, and profitability of a company over a particular period. This is where we can see the impact of debt on net earnings.

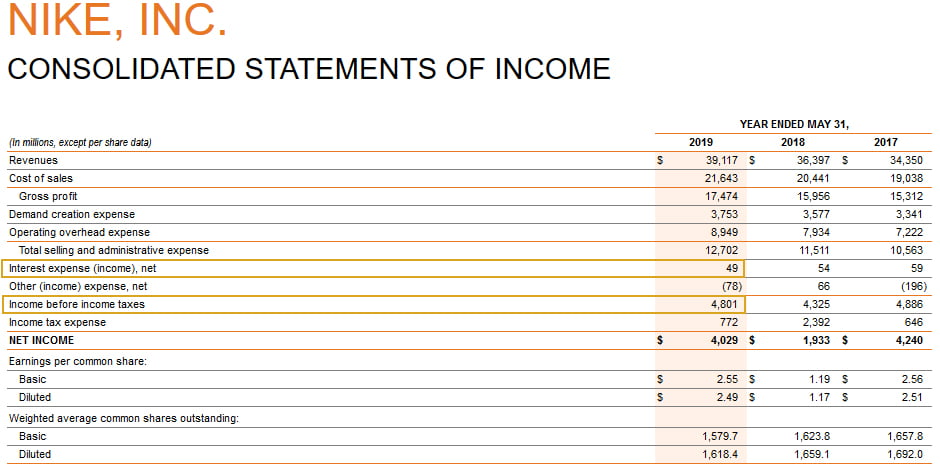

Interest expense represents the cost of borrowing money, and is the primary line item you should analyze on the income statement. Nike's income statement is shown below, with interest expense outlined ("Interest expense (income), net"):

Sometimes, this interest expense is not shown on the income statement, and when this is the case you should check the financial statement footnotes and it'll likely be there. One thing to note here is that positive interest expense reduces income, while negative interest expense (in parentheses) increases income.

For reference, the interest expense calculation is shown below, although it's unnecessary for you to calculate it as it's explicitly provided on the income statement:

Interest expense = Total debt x Interest rate

After you find this interest expense number, you should seek to understand whether these interest payments are manageable for the company. In Nike's case, they have $49 million in interest expense.

Now, if this interest expense was negative on the income statement, then the company is generating more in income through interest (e.g., interest earned through issuing bonds) than from its debt obligations, which is clearly a sign of a company that can manage its debt.

However, for most companies that are less-profitable due to interest expense payments, earnings before interest and taxes (EBIT) is one line item we can find or solve for to better evaluate whether interest payments are sustainable or not for the company. In Nike's case, EBIT is equal to $4,801 million, as outlined below:

The question now is whether the interest expense of $49 million is manageable or not for Nike. Given the size of their EBIT, even if they took their interest expenses and grew it by a factor of 10, they would still have a lot of EBIT to cover this increase. Therefore, based on the income statement alone, you don't have to worry about Nike's ability to pay back its debt obligations.

However, if the EBIT was only $80 million or so for Nike, they would not have a lot of wiggle room here. If an economic recession happened, for example, revenues would likely fall which could expose the company to default risk (with an EBIT of $80 million and interest expense of $49 million). In this hypothetical case, I would see Nike as a more risky investment as the company's debt payments are too expensive.

Nike's Cash Flow Statement

Next, let's look at the cash flow statement, which describes the sources and uses of cash over a particular period. The cash flow statement is divided into three different sections:

- Cash From Operating Activities: How much cash a company generates during the period for its normal business operations.

- Cash From Investing Activities: How much and where a company reinvests cash during the period to sustain and grow its business.

- Cash From Financing Activities: How much cash a company raised from or returned to its debt and equity investors.

If Nike were to issue $50 million in bonds, it would appear in the financing activities section of the cash flow statement. In particular, it would appear right on this line item titled "proceeds from the issuance of term debt," or in Nike's case, "net proceeds from long-term debt issuance:"

As you can see, the company has not issued any bonds in the last two fiscal years. If the company did, then "interest expense (income)" on the income statement would increase in dollar value.

Now, if they paid off debt instead, then it would appear on the line item below it, called "repayments of term debt," or in Nike's case, "long-term debt payments, including current portion:"

Besides examining the cash flows for issuing and paying-off debt for the most recent fiscal year, another important measure we can look at is the company's free cash flow (FCF). FCF represents the cash left over for shareholders after paying for the company's operating expenses and capital expenditures.

There are different ways of calculating FCF, but the simplest approach is to use the formula below:

Free cash flow (FCF) = Cash from operating activities - Capital expenditures (CapEx)

Note that companies usually refer to plant, property and equipment (PP&E) as capital expenditures. It's also important to remember that in lower interest rate environments, you will typically see higher free cash flow figures. Regardless, both of these inputs to calculate FCF can be found on the cash flow statement, as shown below for Nike:

We can come up with a rough estimate of FCF by subtracting this $1,119 million from the $5,903 million to get $4,784 million in FCF. When we compare this to their interest expense of $49 million (from the income statement), Nike has more than enough room to cover this interest expense.

Nike's Balance Sheet

The balance sheet is a snapshot of a company's financial position at a particular point in time and follows the formula below:

Assets = Liabilities + Shareholders' equity

Therefore, a company's balance sheet shows the total assets a company has and how the company has gone about financing these assets, either through debt or equity.

Often times, investors confuse liabilities and debt. Liabilities are a representation of what a company owes. This is divided into current liabilities and non-current liabilities.

Current liabilities are items owed by the company within the next 12 months. So, if interest has been accrued but not been paid yet, it would appear here. Otherwise, it would appear under "current assets" on the balance sheet as a prepaid item ("prepaid expenses and other current assets" for Nike). Anything beyond this 12 months is classified as a non-current liability.

If we were to look for debt, what we should actually look for is a line item called "current portion of long-term debt," "long-term debt," and/or "term debt" that falls into both the current liabilities and non-current liabilities sections:

The "current position of long-term debt" and "long-term debt" numbers combined equal the total debt Nike owes to its lenders. In other words, if you add up the current and long-term debt for 2019, you will get the total debt at $3,470 million.

So, if Nike were to issue $50 million in new bonds, this $50 million would show up under the non-current liabilities section for long-term debt. However, because they sold $50 million in debt, Nike would also receive $50 million in cash which would show up under assets for the line item "cash and cash equivalents." This would also balance the two sides of the balance sheet as both assets and liabilities moved in the same manner.

Outlined below are the two main things you want to look for in the balance sheet when analyzing a company's ability to pay back its current debts:

Under current liabilities, which are owed in the next 12 months, we can see that it's only $6 million for debt. We also know that Nike's interest expense is $49 million. This shows us that most of their bonds mature after 12 months, and explains why the $6 million in current debt is so much lower than the interest expense.

Regardless, we should still see if Nike has enough cash to cover any maturing bonds within 12 months. As we can see, Nike has $4,466 million in "cash and equivalents," which is more than enough to cover any short-term bonds maturing. If this cash figure happened to not be as big, another item we could check is the free cash flow (FCF) number we calculated before at $4,784 million. In other words, we should ask ourselves whether this FCF number is large enough to cover the current debt due in the next 12 months, which it certainly is for Nike.

As an investor, you should invest in companies that have growing amounts of FCF. It goes without saying that companies with cash can spend this on potential acquisitions, new technology, dividends, talent, and many other items that increase shareholder value.

Debt Ratios

After looking through the three financial statements, you can use the four debt ratios described below to confirm or deny any of the findings you make, by providing you with a more thorough understanding of a company's debt management abilities. These ratios should be used together with your financial statement and company analysis to evaluate a company's financial well-being, and never just by themselves!

Note that you can find company ratios and compare them to the industry averages on ReadyRatios for free.

Current Ratio

The current ratio is a liquidity ratio that will give you an idea of how well a company is able to pay back its short-term obligations, or those due within 12 months:

Current ratio = Current assets / Current liabilities

The higher the current ratio, the better, as it indicates that a company is more capable of paying its creditor back.

So, you should calculate the current ratio for the company you're interested in and compare this to the industry average. If this current ratio is in line with the industry average, or if it's higher, then this is a good sign as the company is more likely to pay the creditor back.

However, if it's lower than the industry average, then the company may be at a higher risk of bankruptcy. This may also be a sign of a poor management team.

Debt Ratio

The debt ratio is a financial ratio that tells investors the proportion of a company's assets that are financed by company debt:

Debt ratio = Total debt / Total assets

In this case, a higher ratio is worse because it illustrates that the company is putting itself at risk of default with its debt if interest rates were to rise suddenly.

You should also follow these debt ratio measures:

- Ratio > 1: Greater portion of debt is funded by assets. In other words, the company has more debt than assets, which means more financial risk.

- Ratio < 1: Greater portion of a company's assets is funded by equity, which is ideal.

These debt ratios also vary depending on the industry, so you should compare the debt ratio figure you come up with to the industry average as well to assess what's normal for the industry.

Interest Coverage Ratio

The interest coverage ratio (aka times interest earned ratio), is a debt and profitability ratio that gives investors a good idea of how easily a company can pay the interest on its debts:

Interest coverage ratio = Earnings before interest and taxes (EBIT) / Interest expense

The higher the interest coverage ratio, the better. This is because the ratio measures the number of times a company can cover its current interest payments with its current earnings.

On the other hand, if a company's interest coverage ratio is lower than the industry average, then it will be burdened by any debt expenses. Often times, if this ratio is below 1.5, the company will struggle to meet its interest expense payments.

Debt-to-Equity (D/E) Ratio

The debt-to-equity (D/E) ratio reflects the ability of shareholders' equity to cover all debts if a decline in the business were to occur. This ratio identifies companies that are over-levered, and therefore, higher risk. The D/E ratio formula is shown below:

D/E ratio = Total liabilities / Total shareholders' equity

Clearly, the higher the ratio, the worse it's for the company. This ratio can also be compared to the industry average for companies of similar sizes.

The Bottom Line

The three financial statements and what to look for in each to assess a company's debt management abilities are summarized in the bullet points below:

- Income Statement: Investors should assess the cost of the interest expense payments relative to earnings before interest and taxes (EBIT). The interest coverage ratio can be used in this case.

- Cash Flow Statement: Investors should assess whether the company has issued any new debt or repaid its debt obligations (and see how much in dollar value). Investors can also calculate free cash flow (FCF), and see if this is a sizeable amount and whether it's growing over time.

- Balance Sheet: Investors can use the current ratio, debt ratio, and debt-to-equity ratio to understand the weight of the company's debt obligations. Investors can also quickly assess whether the company has enough cash to cover its short-term debt obligations.

A final note to keep in mind when analyzing company debt, is that companies often issue new bonds after paying off old bonds. In other words, companies simply put off paying bonds. For example, let's say that a company issued a bond 10 years prior with an interest rate of 6%. Today, the company may issue that very same bond at the same amount, but this time the interest rate would be 2%. If this were to happen, then the company would end up with a lower interest expense every year.

In short, you should be aware of possible causes of higher profits and higher FCF figures when analyzing a company's debt management abilities. Furthermore, if the Federal Reserve (aka the Fed) continues to drop interest rates, companies can continue putting off paying off bonds without any real problems.

Regardless, it's important that companies do not overload on debt because it may become very difficult for them to operate and grow their business once interest rates begin increasing. Fortunately, we can use the 10-K annual reports to tell us how much debt is due soon, along with the financial statements and debt ratios covered in this article to determine a company's debt management abilities, which will ultimately reduce our downside risk as investors.