In this article, I will discuss how interest rates affect the economy and how changes in interest rates can affect the decisions and factors investors have to account for before making an investment decision. Over the past decade, those living in the United States have been accustomed to low, almost zero interest rates. Regardless, the Federal Reserve (aka the Fed) will always continue to make changes to the interest rate to keep the economy in balance, especially in times of economic uncertainty. Therefore, it's crucial that investors understand what changes in interest rates mean and how they may affect the markets and our purchasing decisions.

Interest Rates and the Cost of Borrowing

To begin, the current interest rate affects the cost of borrowing money. In other words, if we had a lower interest rate, it would make it easier for individuals and businesses to borrow money. The opposite would also hold true for higher interest rates.

Therefore, if someone wanted to purchase a house, a lower interest rate may convince them to actually make the purchase. The same concept would apply if someone was considering a car purchase, or really any big purchase. In short, lower interest rates can help sway individuals who were on the fence before.

Lower interest rates can also benefit businesses as well. If a business was looking to expand their business, through upgrading their equipment, making a new acquisition, or possibly expanding into a new market, sometimes lower interest rates can provide them with the capital needed to fund these activities.

The actions taken by individuals and businesses after an interest rate cut can help spur the economy forward, simply because money is being spent in larger amounts. The Fed commonly uses interest rate cuts if an economy is in a recession or severe market downturn, with the hope being that it will encourage spending. This, in theory, should eventually lead the country out of a recession, or at least delay a foreseeable recession.

Interest Rates and Currency Value

Along with affecting the cost of borrowing for both individuals and businesses, lower interest rates can affect the decisions made by global investors. These global investors, regardless of where they live, have the option to invest in the U.S. dollar, or invest elsewhere if they choose, such as in something that is tied to the Euro or the Yen. This matters to investors because lower interest rates can often lead to a lower currency value.

To illustrate this concept, the chart below compares the DXY, one of the dollar indexes, and the 10-year treasury yield rate (TNX):

As better seen in the 5-year and 10-year ranges (if you zoom in), as treasury rates decrease, the U.S. dollar does as well. The opposite also holds true.

This relationship doesn't hold true all the time, however, because a currency's value is relative to other currencies. In other words, central banks and other countries besides the U.S. play a role in the relationship between interest rates and the dollar. Regardless, as a general rule, when interest rates are lower, the currency is weaker.

Weaker U.S. Dollar and Gold

When the U.S. dollar is weaker (less valuable), often times gold prices will increase. The opposite tends to hold true as well, as a stronger or more valuable U.S. dollar implies lower gold prices.

To illustrate this concept, the Great Recession in 2008 is a great example to look at. During this recession, when the U.S. dollar fell, gold prices would rise. This was partially because gold became more expensive in other non-dollar denominated currencies.

This can be somewhat identified in the chart below, comparing DXY, once more, to the gold price:

In 2008, the International Monetary Fund (IMF) estimated that 40-50% of the movement in gold prices since 2002 could be explained by the movement of the U.S. dollar. This percentage, in part, is due to investor fears and future uncertainties. Therefore, as investors fear a pending recession or further stock market crash, gold may be seen as an attractive investment to hedge against risk if interest rates continue to drop.

Interest Rates and Bond Prices

In addition to affecting the cost of borrowing and the U.S. dollar, falling interest rates typically move bond prices higher as well. In other words, bond prices are inversely correlated with interest rates.

Bond prices vary on a day-to-day basis. If the price of a bond is higher, due to falling interest rates, the yield will decrease. This is because the bond owner will be receiving the same guaranteed amount on an asset that is worth more.

iShares Barclays 20+ Year Treasury Bond ETF (TLT) is one chart we can use to illustrate this concept. TLT tracks U.S. treasuries which have a maturity of more than 20 years. The prices of these bonds has, in general, consistently risen. iShares AAA ETF (QLTA) is an index that tracks triple-A corporate bonds. In the chart below, you can see that triple-A corporate bonds have performed in a similar manner to U.S. bond treasuries with a 20+ year maturity:

In short, keep in mind that interest rates and bond prices are inversely related. As interest rates go one way, bond prices will tend to move in the opposite direction. So, keep this in mind before you purchase a bond.

Based on the bond performance shown in the chart comparison above, and the inverse relationship of interest rates and bond prices, you may feel inclined to allocate more of your capital towards bonds. However, it's important to keep in mind that we have no idea in which way interest rates are going to move in the future. Unfortunately, forecasting interest rates accurately is difficult to do (and not reliably accurate), as they change frequently, and depend on a large number of factors.

Interest Rates and Inflation

The consumer price index (CPI) is a measure of the average change in prices overtime that consumers pay for goods and services. The CPI measures inflation as experienced by consumers in their day-to-day living expenses.

Inflation is the rise overtime in the prices of goods and services, or when the value of cash falls. Normal inflation (1-3%) is a byproduct of a growing economy, and should generally not be thought of as a bad economic indicator. In a functioning economy, prices of goods and services will rise at the same rate as wages. Deflation, or the lowering of prices for goods and services, is a stronger indicator of a worse economy.

With this in mind, instead of predicting interest rates, one thing we can do as investors is to watch inflation rates. With lower interest rates and subsequent pickups in the economy, higher amounts of inflation could result. Higher inflation rates are of course bad for the economy, and the Fed will eventually act to increase interest rates to keep inflation at a manageable level.

How inflation occurs in the economy:

- Lower interest rates makes it easier for individuals and businesses to borrow and spend money. As consumers spend more, the economy will grow, and this will naturally cause inflation.

- When supply is less than demand for whatever reason, the prices of goods and services will rise and increase inflation.

- If the costs of doing business increase independent of demand, the costs of goods and services will go up, which leads to inflation.

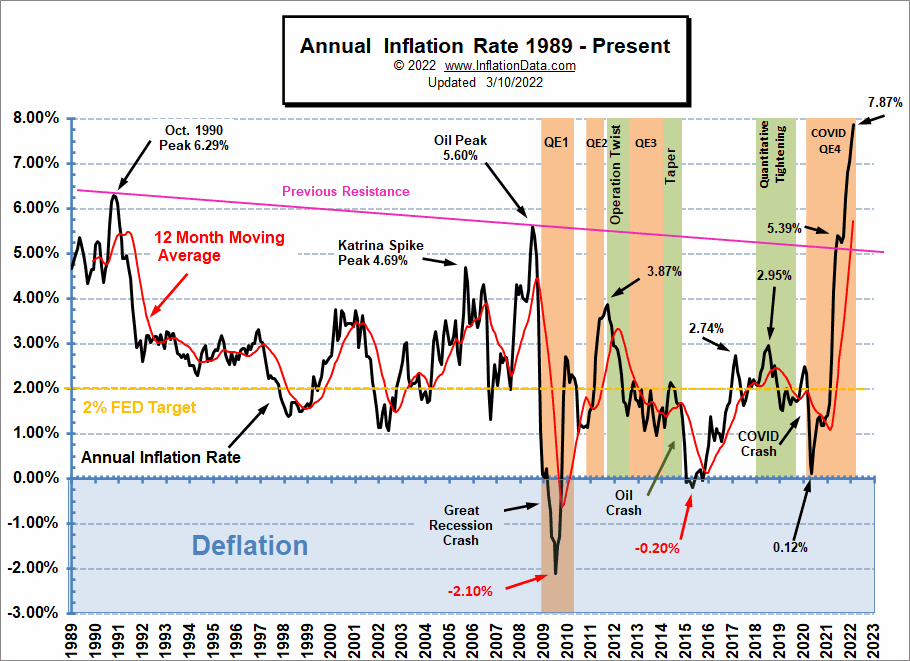

The annual inflation rates from 1989 to present day can be seen in the graphic below:

As of writing, inflation rates are rather high at 7.87%. What this 7.87% CPI tells us, is that the prices of goods and services in the economy are 7.87% higher than they were a year earlier.

Again, if the inflation rate were to continue growing, the Fed would likely step in to slow the rise of inflation, through increasing interest rates. On the other hand, if inflation rates were to fall steeply, the Fed may reduce interest rates instead to encourage spending. In addition, at lower inflation rates, investors would likely see gold and bonds as more attractive investments.

The Bottom Line

Through these four examples, you should now be able to understand the importance of changing interest rates, and how they may affect the decisions you make as an investor and consumer. From an investors perspective, all of this information can be used to better understand the stock market, bond market, commodity market, and their reactions to changes in interest rates.

As discussed in this article, due to the spur of spending initiated by lower interest rates, companies will likely experience higher revenues and profit margins. This, in theory, should encourage the overall stock market to move higher. The opposite holds true as well, where higher interest rates can slowdown the operations of more levered companies. Ultimately, this leads to lower expected profitability, which typically hurts the overall market (aka S&P 500) performance. In the long-term perspective, however, the market will likely adjust to higher interest rates.

In closing, in times of changing interest rates, the best investment decision we can make as investors is to make adjustments to our investment portfolios based on the big picture trends that we are observing.