In this article, I will explain the difference between enterprise value and equity value. Equity value shows how much a company's shares are worth on the market. Enterprise value goes a step further by adding in the company's debt and subtracting its cash. The main difference is that equity value looks at what's available to shareholders, while enterprise value considers the total value of the company, including what it owes and owns.

This article will describe equity value and enterprise value, compare them in detail, and show how to calculate both with a real-world example. We'll also cover how to move from one value to the other, which is useful for various valuation purposes.

Equity Value

Equity value focuses on the worth available directly to the company's shareholders. This valuation measure accounts for the market value of all shares, both common and preferred. It goes beyond just looking at the value of common shares, like market capitalization does, thereby offering a more inclusive measure of a company's worth to its equity investors.

This inclusivity makes equity value a dynamic metric, sensitive to potential shifts in a company's financial structure brought about by options, convertible securities, and other strategic financial instruments.

Essentially, equity value represents the net value that would theoretically remain for common stock shareholders after the company's debts and preferred stock have been paid off, reflecting the residual claim over the company's assets. It's this residual value that highlights the real stake of the owners in the company's net assets, calculated as total assets minus total liabilities.

When using the discounted cash flow (DCF) model with levered free cash flow (LFCF), equity value is derived by discounting future cash flows, indicating how much of the company's value belongs to equity holders.

Equity value is fundamentally about ownership. It serves as a measure of the shareholders' claims on the company's assets and cash flows, providing a snapshot of what is effectively left for common stock shareholders under current market conditions. This valuation approach captures the market's current valuation of equity interests, reflecting investors' perceptions and expectations, including the company's potential for future value generation.

How to Calculate Equity Value

The standard equity value formula is shown below:

Equity Value = Share Price × Number of Diluted Shares Outstanding

where:

- Share Price: Current market price of a single share of the company's stock. This price fluctuates based on market conditions and investor sentiment.

- Number of Diluted Outstanding Shares: Refers to the total shares currently owned by all shareholders, including institutional investors and company insiders. "Diluted" signifies that this count incorporates not only the basic shares outstanding but also any in-the-money options, warrants, and convertible securities, providing a comprehensive view of the company's equity.

For an accurate calculation of equity value, it's essential to use the total number of diluted shares outstanding rather than just the basic shares. This approach accounts for the potential impact of dilutive securities such as options, warrants, and convertible debt. Overlooking these instruments could result in an understated equity value, as they represent potential equity that could dilute the value of existing shareholders' stakes.

Unlike enterprise value, equity value does not account for debt or cash positions and solely represents the market's valuation of the company's equity at any given time. This measure is particularly significant for shareholders and potential investors, as it directly influences the price at which they can buy or sell shares of the company.

Equity Value Example

We'll calculate the equity value for Apple (AAPL) for our example, a multinational technology company famous for creating the iPhone, iPad, and Mac.

Equity value is calculated by multiplying the company's current stock price by its total number of diluted shares outstanding, as described earlier.

At the time of writing this article, Apple's current share price is ~$171.56. This can be found on most stock market platforms or financial news websites.

Total number of diluted shares outstanding is usually reported in the company's 10-Q (quarterly) and 10-K (annual) reports, at the bottom of the income statement (where earnings per share (EPS) is discussed). It can also be calculated by following the treasury stock method (TSM), which estimates the number of additional shares that could be bought back by the company using the proceeds from exercised options, effectively minimizing the net increase in shares outstanding.

The image below outlines Apple's diluted shares outstanding for FY 2023, as detailed in the most recent income statement of its 10-K annual report:

As you can see, Apple has 15,812,547 thousand in diluted shares outstanding in FY 2023. We can multiply this by the company's current stock price to calculate Apple's equity value, as demonstrated below:

Equity Value [AAPL] = $171.56 × ~15.8B --> $2.71T

Thus, Apple's equity value is ~$2.71T. This represents the market's valuation of the company's total equity.

Enterprise Value

Enterprise value, also known as firm value or asset value, represents the total worth of a company's assets, excluding any cash. This metric is key in understanding the overall value of a business beyond just its equity. When using the discounted cash flow (DCF) model with unlevered free cash flow (FCFF), the goal is to determine the enterprise value, which offers a broad perspective on the company's valuation.

Enterprise value is important because it includes more than just the market value of a company's outstanding shares. It suggests a theoretical acquisition price, covering the total cost to an acquirer, which involves taking on the company's debt and acquiring its cash reserves. The addition of debt means an increased acquisition cost, while the presence of cash lowers the total expense. Therefore, enterprise value is also a useful metric for comparing companies with different capital structures, as it's unaffected by the way a firm is financed.

Thus, enterprise value provides a clear indication of what it would cost to buy the company outright. It reflects the value of a company's core business operations to all investors (e.g., equity, debt, preferred, and possibly others), offering a full picture of its worth. This comprehensive approach ensures a fair comparison across firms, irrespective of their financing decisions.

How to Calculate Enterprise Value

The standard enterprise value formula is shown below:

Enterprise Value = Equity Value + Total Debt - Cash and Cash Equivalents

where:

- Equity Value: Represents the total market value of a company's outstanding shares, including the value of unexercised stock options and securities convertible to equity. It's calculated by multiplying the current share price by the total number of diluted shares outstanding.

- Total Debt: Encompasses both short-term and long-term debt. This includes all obligations the company owes, such as bank loans, bonds, and other forms of debt financing. Total debt is crucial for understanding the full financial obligations of a company, as it represents the claims debt holders have on the company's assets.

- Cash and Cash Equivalents: Consist of all liquid assets that a company can quickly turn into cash. This includes physical cash, money in checking accounts, and short-term investments that can be easily liquidated within three months or less. Subtracting cash and equivalents from the calculation adjusts for the fact that cash on hand could be used to pay down some of the debt, thus reducing the actual cost to acquire the company

By combining these elements, the enterprise value formula provides a comprehensive snapshot of what it would cost to purchase the company outright, taking into account its equity, debt, and liquid assets.

Enterprise Value Example

We'll show an example of calculating enterprise value, using Apple as our same example company. Previously, we calculated an equity value of ~$2.71T by multiplying its current stock price by its number of diluted shares outstanding.

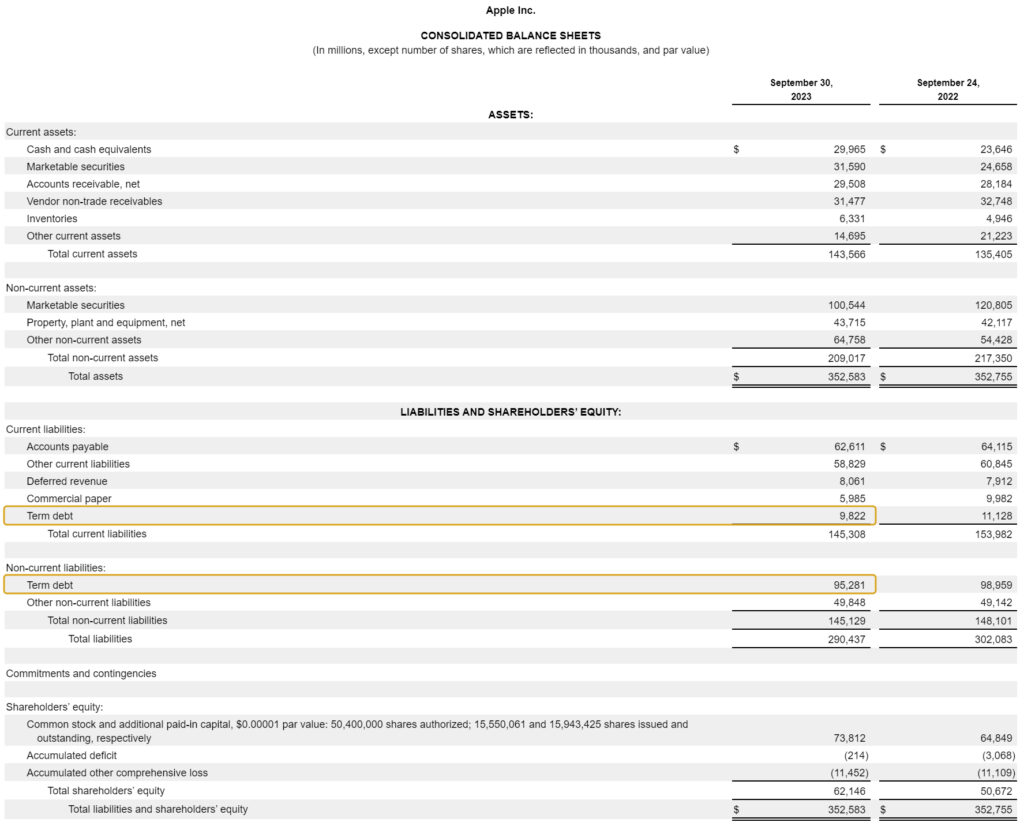

Next, we need to identify the company's total debt, which includes both short-term debt (such as notes payable) and long-term debt (like bonds or long-term loans). These figures can be found on the balance sheet under liabilities, as shown below from Apple's most recent 10-K annual report:

Thus, Apple's total debt in FY 2023 is $105,103M ($9,822M short-term debt + $95,281M long-term debt).

Finally, we need to identify Apple's total cash and cash equivalents. This figure is also found on the balance sheet, specifically under current assets. It includes items like cash on hand, demand deposits, and short-term, highly liquid investments that are easily convertible to known amounts of cash.

If we look at Apple's balance sheet again, we can see that "Cash and cash equivalents" and "Marketable securities," as outlined in the image below, should be considered in our enterprise value calculation:

Therefore, Apple's total cash and cash equivalents in FY 2023 is $61,555M ($29,965M + $31,590M).

Now, we can calculate Apple's enterprise value as follows:

Enterprise Value [AAPL] = $2.71T + $105,103M - $61,555M --> ~$2.75T

Apple's enterprise value of $2.75T, being slightly higher than its equity value of $2.71T, indicates the company has a small amount of net debt (total debt - cash and cash equivalents). This demonstrates Apple's strong financial health and effective management of its debt and cash reserves.

Enterprise Value vs. Equity Value

While enterprise value and equity value are both used to gauge a company's valuation, they serve different analytical purposes. Enterprise value gives a holistic view of the company’s total value, useful for potential acquirers or investors looking at the company as a whole, including its debt. Equity value, however, reflects what is directly available to shareholders and is often used by investors to determine if a stock is over or underpriced.

Here's a table summarizing the main differences between enterprise value and equity value:

How to Bridge From Enterprise Value to Equity Value

In discounted cash flow (DCF) and comparable company analysis, bridging from enterprise value to equity value is an important step for determining the value attributable to equity shareholders. This transition adjusts the enterprise value for debt, cash, and other non-operating assets to isolate the value that pertains directly to equity holders. The process involves a few key adjustments to ensure that the equity value accurately reflects the residual claims after satisfying all non-equity claims.

The formula for the transition between enterprise value to equity value is as follows:

Equity Value = Enterprise Value + Cash and Cash Equivalents + Short-Term Investments - Total Debt - Minority Interest

The steps below describe this process:

- Enterprise Value: Enterprise value represents the total value of the company, capturing both its operating business value and the net debt. It's the aggregate value ascribed to the company by both debt and equity holders.

- Plus: Cash and Cash Equivalents: Cash and cash equivalents are added back because these assets, while part of the company’s total assets, are non-operational and directly accessible to shareholders. Their addition adjusts the enterprise value downwards, reflecting that these assets can be used to pay off debt or be distributed to shareholders without affecting the operational value of the company.

- Plus: Short-Term Investments: Like cash and equivalents, short-term investments are liquid assets not required for the company’s immediate operations. They are added to the calculation for the same reason; they are readily distributable to shareholders and can reduce the net debt position, thereby increasing equity value.

- Less: Debt: Total debt, encompassing both short-term and long-term obligations, is subtracted from enterprise value. Debt is subtracted because it represents the prior claims on the company's assets before equity holders can stake their claim. This step ensures that the equity value reflects what is left for shareholders after debts are settled.

- Less: Minority Interest: Minority interest represents the equity in subsidiaries not wholly owned by the parent company but consolidated in its financial statements. Subtracting minority interest adjusts the equity value to exclude the value attributable to non-controlling interests, ensuring the equity value accurately reflects only the portion of equity available to the parent company's shareholders.

By applying these adjustments, we derive an equity value that accurately encapsulates the worth available to equity shareholders. This methodical approach ensures that investors can isolate the portion of a company's value that is attributable to its equity, an essential step for determining the estimate intrinsic share price of a company.

How to Bridge From Equity Value to Enterprise Value

Unlike adjustments from enterprise value to equity value, which aim to isolate shareholder-specific value, converting from equity value to enterprise value offers a holistic view of the company's valuation. This process is particularly valuable for comparing companies across various industries or with different capital structures, as it incorporates both debt and equity components of a company's financial structure.

Enterprise Value = Equity Value + Total Debt + Minority Interest - Cash and Cash Equivalents - Short-Term Investments

To convert equity value to enterprise value, the calculation essentially reverses the process used to derive equity value from enterprise value, as described below:

- Equity Value: This is the market valuation of the company's equity, determined by the current share price multiplied by the total number of diluted shares outstanding. It serves as the foundational figure from which adjustments are made.

- Plus: Total Debt: Total debt, including both short-term and long-term obligations, is incorporated. This addition acknowledges all financial claims on the company's assets before any distribution to equity holders, providing a fuller view of the company's financial commitments.

- Plus: Minority Interest: This component is factored in to account for equity in parts of the company not wholly owned by the parent but included in its consolidated financial statements. It ensures the enterprise value encompasses the total operational value of the company, reflecting a complete picture of its worth.

- Less: Cash and Cash Equivalents: This step removes liquid assets from the equity value. Despite being part of the company's total assets, these resources are non-operational and readily available for debt payment or distribution to shareholders, which adjusts the valuation downwards.

- Less: Short-Term Investments: Similar to cash, short-term investments are deducted because they are liquid assets not immediately required for the company’s operations. Their subtraction aims to refine the company's value to its core operational assets.

By applying these adjustments, the formula facilitates a conversion from equity value to enterprise value, yielding a complete view of a company's valuation. This approach is key in evaluating a company's overall financial health, the intrinsic value of its operations, and its standing relative to peers.

The Bottom Line

Understanding the distinction between enterprise value and equity value is fundamental for investors aiming to make informed decisions. Each metric offers unique insights into a company's financial standing and valuation. While enterprise value offers a broader perspective including debt, equity value focuses solely on shareholder interests. Bridging these two values in valuation models like DCF is important for accurately determining a company’s worth and making investment decisions.