In this article, I will show you how to calculate and interpret the Single Index Model (SIM). The SIM claims that the returns on a stock are driven largely by its sensitivity and responsiveness to the returns on the market index. For investors interested in asset pricing, understanding the SIM is important, given that it offers one of the most simplest approaches for portfolio analysis. The purpose of this article is to therefore explain the premise of the SIM, followed by an example of how to calculate and interpret the SIM from running a regression on Excel.

Single Index Model Explained

The single index model (SIM) was developed by William F. Sharpe in 1963, who's most notable for his development of the capital asset pricing model (CAPM), for which he won the Nobel Prize in Economics in 1990. Sharpe found that instead of finding the relationship between every pair of stock returns to find their covariance (how two variables differ) or correlation (how two variables are related) as proposed in the Markowitz model, this relationship can more simply be found through a market index (e.g., the S&P 500 Index), thereby reducing the number of required calculations in a portfolio analysis exercise.

To further elaborate, the SIM proposes that a firm's returns are due to a single factor, being the market factor. In other words, the SIM states that the returns of a stock can be found through its relationship to some market index. This makes the SIM useful in basic event studies, where investors are seeking to gain the ability to predict a firm's returns on any given day. However, this differentiates it from multifactor models, which assert that the firm's returns are due to more than one factor.

There are two ways the SIM can be expressed, either in "raw returns" (aka ordinary returns) or in "excess returns."

The SIM formula expressed in raw returns is shown below:

Ri = αi + βiRm + εi

where:

- Rit = total return of a stock or portfolio i

- βi = investment beta.

- Rm = market portfolio return

- αit = time regression investment's alpha

- εit = time regression residuals

This formula is saying that the returns of the firm is equal to the alpha plus its beta multiplied by the returns in the market index plus the residual. When this formula is adjusted for the risk-free rate, you'll get excess returns.

The SIM formula expressed in excess returns is shown below:

Ri - Rf = αi + βi(Rm - Rf) + εi

where:

- Rit = total return of a stock or portfolio i

- βi = investment beta.

- Rm = market portfolio return

- Rf = risk-free rate of return

- αit = time regression investment's alpha

- εit = time regression residuals

This formula is saying that the excess returns on the firm is equal to its alpha plus the beta multiplied by the excess return on the market plus the residual.

Regardless of which formula you use, you're going to get very similar outputs. The alpha output may differ slightly, but the beta is generally always going to be relatively the same. This is primarily because the risk-free rate typically does not change frequently and/or by any significant margin. Therefore, including the risk-free rate will likely not have much of an impact on the beta you ultimately end up getting. For this reason, there's nothing wrong with investors using the ordinary returns formula instead.

Both formula approaches have the market portfolio return and the risk-free rate of return as formula inputs. These are described more in-detail below:

- Market portfolio return (Rm): Market portfolio return is typically represented by the S&P 500 Index, but can also be represented by any other index for portfolio analysis, so long as it's not price-weighted (e.g., the DJIA). Otherwise, this can cause misleading appearances of alpha. If you're using the S&P 500, then on a historical basis, this returns about 8-10% annually.

- Risk-free rate of return (Rf): This is the rate an investor can expect to earn an investment with "zero risk." Clearly, nothing of the sorts exists, so the standard approach is to use the rate on the 10-year Treasury Note or the 3-month T-bill rates from the U.S. Department of the Treasury as a proxy to represent a risk-free investment. You only need to worry about the risk-free rate if you're using the excess return SIM formula.

Now, when you estimate the SIM regression, you're going to get outputs for alpha and beta, which will enable you to calculate the residual. Beta, alpha, and the residual are important to understand and interpret the SIM and are described below.

Beta

Beta (β) represents the sensitivity and responsiveness of the firm's returns to the returns on the market index. More technically, beta is defined as the "slope coefficient that relates the returns for security i to the returns for the aggregate stock market." Therefore, beta measures systematic risk, which means macroeconomic risk (e.g., inflation, interest rates, market news) that affects all securities in the market.

If an investment's beta is equal to 1, then when the market goes up 1%, your firm (on average) will also be expected to go up 1%. Because this is an average prediction, beta will not tell you precisely what will happen on any given day. Rather, it will tell you what is expected to happen on average.

A higher beta coefficient means more risk in the portfolio or security. On the other hand, a lower beta coefficient means less risk in the portfolio or security, which can be more beneficial for an efficient portfolio.

Alpha

Alpha (α), over any given time period, tells you to what extent the security or portfolio has outperformed or underperformed the market index, adjusted for beta. Alpha can also be thought of the security's expected excess return when the market excess return is zero. Alpha therefore represents the expected return on a security (in excess of the risk-free rate) beyond any returns due to movements in the market.

To elaborate, any expected excess return on any individual security is due to firm-specific (aka nonsystematic or unsystematic risk) factors, denoted by the alpha coefficient, which refers to firm-specific events that would affect its market returns (e.g., poor financial performance, management turnover, credit rating downgrades). As the name suggests, these firm-specific factors would only affect the firm and have a negligible effect on the economy. Unsystematic risk can also be reduced to zero through portfolio diversification.

The alpha output you get in your SIM regression is only as good as your inputs. If your model inputs are misspecified, then you'll get a misleading alpha. For example, this could be the case if you believe more than one factor is driving the firm's returns, as the SIM only considers one risk factor. Regardless, investors should seek investments with a positive alpha, given that they're looking to invest in a security or fund to beat the selected index.

Residual

Residuals (ε) explain how much of your security or fund's returns are being driven by random miscellaneous movements in the market that cannot be explained by the asset-pricing model, also known as "idiosyncratic volatility". The residual represents the facts that are not being driven by the market returns of the alpha on any given day, but rather random firm-specific movements on any given day.

Greater residual values (positive or negative) translates to wider scatter returns and greater residual risk. Therefore, if the residual value is relatively high in your SIM output, then the risk-reward relationship for any individual security could be based slightly more on the impacts on firm-specific risk, and not so much on systematic risk. This can be useful to interpret and analyze in portfolio management scenarios, where you may want to examine the riskiness of an individual firm and perhaps construct a portfolio based upon these residuals.

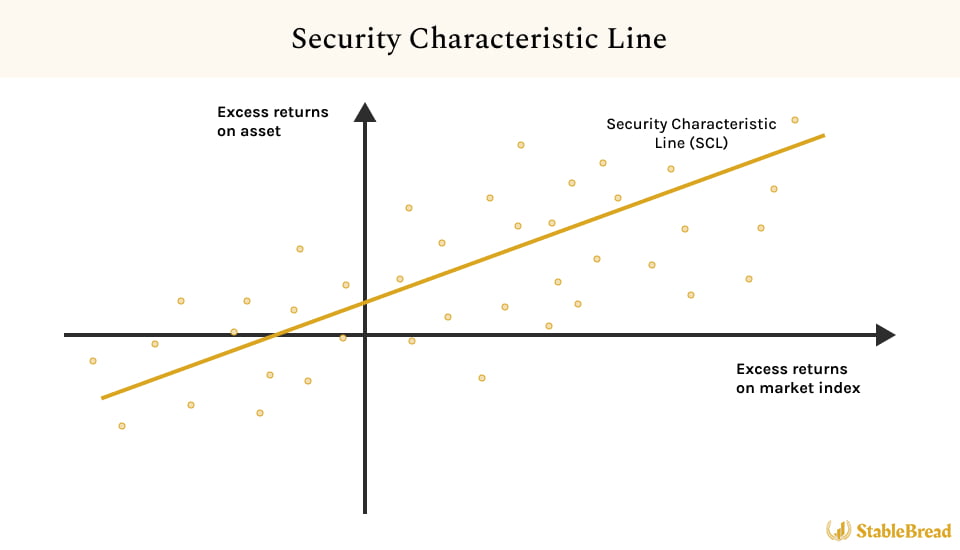

Security Characteristic Line

Now that you understand the SIM, another item worth discussing is that the relationship between the security's excess returns and the market's excess returns can be plotted on a scatter diagram. A line can then be constructed using linear regression to best-fit these plotted data points. What results from this regression line is called the "security characteristic line" (SCL), as shown below:

As you can see from the image above, the intercept of this regression line represents alpha and the slope represents its beta. This regression line is therefore a representation of both the systematic and unsystematic risk of a security. Investors can analyze this regression line to understand, on average, how much a security's stock price rises for every additional percentage return in the market index.

How to Calculate and Interpret the Single Index Model on Excel

To fully understand and interpret the Single Index Model (SIM), its best to run a regression analysis on Excel. For our example, I'll be looking at ordinary returns, not excess returns, because it's simpler and doesn't make much of a qualitative difference to the outputs you ultimately end up getting from the regression.

I will provide a step-by-step instruction below for the Home Depot (HD) company. To assist in this instruction, I've provided a completed Excel sheet model below:

Step #1: Setup, Download, and Organize the Data

The first step in calculating the SIM on Excel is to setup, download, and organize the data to perform our calculation and analysis. These steps are provided below:

- To perform any type of regression analysis, you must install the "Data Analysis" Excel ToolPak add-in program. Follow these steps to install the add-in on Excel: Open Excel --> File --> Options --> Add-ins --> Go --> Analysis ToolPak --> OK. Restart your Excel if the "Data Analysis" button/text doesn't initially show up under the "Data" tab on the Excel ribbon.

- Navigate to Yahoo Finance or some other data aggregator website for historical stock market financial data.

- Download the monthly, weekly, or daily adjusted close price data for your selected company. I typically use a 1-year period for the SIM and prefer using daily adjusted close price data.

- Sort your adjusted close price data by ascending order (meaning oldest dates come first). At this point, you should have a date column and a closing price data column.

- Calculate the monthly, weekly, or daily return percentage for your selected company in a separate column. This formula is simply: [(new date's adjusted close price / previous date's adjusted close price) - 1]. Drag/copy this percentage return calculation to the bottom of your data set.

By this point, you should have five columns on your spreadsheet: A column for date, stock price, stock percentage return, S&P 500 price (or another index of your choice), and S&P 500 percentage return. If you were using the SIM excess return formula, you would also have a column for the risk-free rate and a column for the excess return calculation (Rm - Rf).

Step #2: Run a Regression Analysis

After you run a regression, you will be able to analyze the relationship between the returns on the stock and the returns on the index. To run a regression on Excel, follow the steps below:

- Assuming you have the "Data Analysis" Excel ToolPak installed, navigate to Data --> Data Analysis --> Regression --> OK.

- "Input Y Range" is the dependent variable. This will be the percentage return on your selected stock, given that we believe it will be influenced by the independent variable.

- "Input X Range" is the independent variable, also called the "regressor." This is going to be the percentage return on the index, which we believe will influence returns on our selected stock.

- Select "Labels" if your column selections has labels in them and select "Regression" if you want to calculate idiosyncratic volatility. Choose an output location for your regression and click on the "OK" button. Don't select the checkbox that says "Constant is Zero," as this will effectively set the alpha to be equal to zero.

Once this step is completed, you should get a "Summary Output" and "Residual Output" table.

Step #3: Assess Idiosyncratic Volatility

The residuals output describes the random performance occurring on any given day. This is the difference between the predicted value and the actual value that is observed. If you wanted to evaluate "idiosyncratic volatility," which is really just the volatility of the residuals, you can accomplish this through this residual output. These steps are shown below:

- Calculate the variance of the residuals using the =VAR.P Excel formula. Reference the entire residuals column when doing so.

- Standard deviation is just equal the square root of the variance. Use the =SQRT function on the variance number you just calculated. With our example, we get a standard deviation of 1.34%, which appears to be relatively small. However, we should keep in mind that the average residual value should be zero, which the next step validates.

- Use the =AVERAGE function in Excel on the residuals column. Again, this should be equal to zero. Given that the average value for all of your residuals is practically zero, your residuals are outputted in an appropriate manner.

The idiosyncratic volatility itself is not necessarily what we're interested in. If you have a diversified portfolio, then the idiosyncratic volatility values will generally cancel one another out, leaving you exposed to only systematic risk from market movements. However, if your goal is to construct a portfolio based on low volatility effects, then evaluating the standard deviation value itself can be useful.

For most investors, what's more important here is to evaluate idiosyncratic volatility (based on the standard deviation output). You should look at how this number compares to other firms over the same exact date range, and rank the company's value accordingly.

Step #4: Interpret the Regression Output

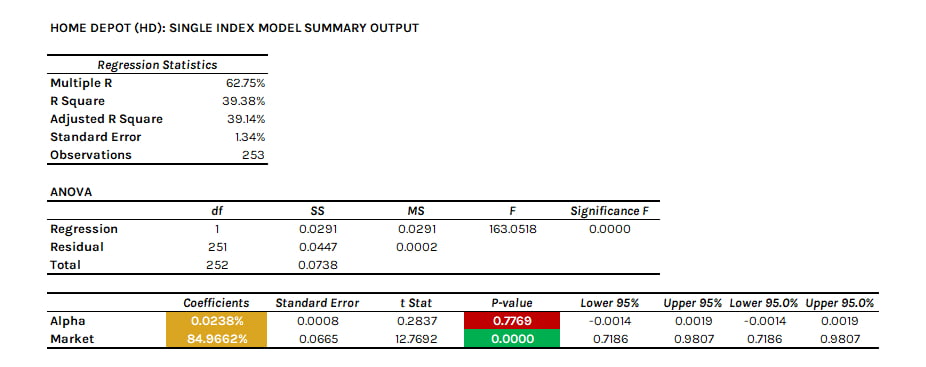

After a regression is completed, a summary output similar to the one shown below should result (without the formatting):

To interpret the SIM regression output, what's most important to analyze is the R Square, the p-values, the alpha and market beta coefficients, and the standard error discussed in step #3.

The "R Square" and "Adjusted R Square" value show how much of the change in our dependent y-variable is explained by the change in the independent x-variable. Here, it's 39%, which means that 39% of the changes/variations in Home Depot's stock return is explained by the market return over the last year. In other words, this means that the other 61% is not explained by the market and is due to firm-specific (unsystematic) risk.

As you'll see in the attached file, the alpha and market beta can also be represented in formula form through the security characteristic line (SCL). In our case, this formula would be "y = 0.8497x + 0.0002."

In terms of our regression table at the bottom, what's important to assess first is the p-value. A p-value greater than 5% is not considered to be statistically significant (given the null hypothesis is rejected). Therefore, our alpha is not statistically significant but our market beta is significant, given that the p-value is near-zero. Again, beta represents the sensitivity and responsiveness of the firm's returns to the returns on the market. Here it's 85%, which means that if the market goes up 1%, the market will (on average) go up 85%.

The Bottom Line

The Single Index Model (SIM) was proposed by William F. Sharpe in 1963, and states that the returns on a security are largely driven by its sensitivity and relationship to the returns on the market index. In formula form, the SIM states that the returns on a stock are a linear combination of its alpha plus the beta multiplied by the returns on the market index, plus a residual on any given day that represents the random movements on the firm on that day.

Prior to the SIM, investors were relying on Harry Markowitz's approach of finding covariance through calculating the relationship between every pair of stock returns in a portfolio. With Sharpe's SIM, covariance could simply be calculated through estimating the betas of the individual securities and the market variance, which significantly reduced the number of computations in portfolio analysis.

Following this article, investors should look into the "capital asset pricing model" (CAPM), given that it was also developed by Sharpe in the early 1960's alongside the SIM. The CAPM attempts to explain the relationship between stock market returns and market risk, by stating that returns on an individual security depends only on its non-diversifiable risk. Unlike the SIM, the CAPM assumes the market is perfectly efficient and no assumption is made that a security's return is linearly dependent on the market return.

Lastly, if you want to look at other factors, you can look into the Fama and French and Carhart multifactor models, which introduce additional factors to explain stock market returns. Although these models are more complex, they are proven to do a better job at explaining stock market returns and are worth exploring.