In this article, I will show you how to evaluate and compare exchange traded funds (ETFs). With more than 2,204 ETFs in the U.S. alone, identifying the right ETFs in every area of the market (equities, fixed income, gold, commodities, etc.) can be a daunting task. This article will therefore provide a comprehensive framework that you can use to compare similar ETFs and select the best one(s), depending on your investment time horizon, goals, and portfolio.

Although many investors have exposure to the S&P 500 Index through an ETF (e.g., the SPY), more active investors and/or those looking to diversify, hedge, or allocate their portfolio in a more strategic manner may find this article to be more worthwhile reading through.

As presented in this article, ETF selection matters a lot, regardless of the area of the market you're looking to invest in. Among the many misconceptions and distortions about ETFs, few investors truly understand how to evaluate and compare ETFs. Therefore, understanding how to evaluate, compare, and pick the right ETFs, regardless of the market segment, can improve your chances of greater realized returns in the future.

ETFs Explained

Exchange traded funds (ETFs) are baskets of securities that provide broad exposure to a range of assets and industries. The primary purpose of an ETF is to track the performance of a particular market index.

For instance, the first U.S. listed ETF was SPDR's (SPY) in 1993, which tracks (aka "is benchmarked to") the Standard & Poors (S&P) 500 Index. Therefore, anyone who invests in the SPY can expect to gain near-perfect exposure to the S&P 500 Index, without having to buy and allocate each and every single S&P 500 company themselves.

In many ways, ETFs are just like mutual funds. From how they're structured, managed, and even regulated, ETFs and mutual funds are practically identical. However, the fact that ETFs can be bought and sold like stocks on the stock market (unlike mutual funds) provides all the core differences (benefits and risks) to separate it from mutual funds.

ETF Creation/Redemption Mechanism

To understand how to evaluate and compare ETFs, it's useful to know how ETFs function altogether, primarily through understanding how the creation/redemption mechanism works for ETFs.

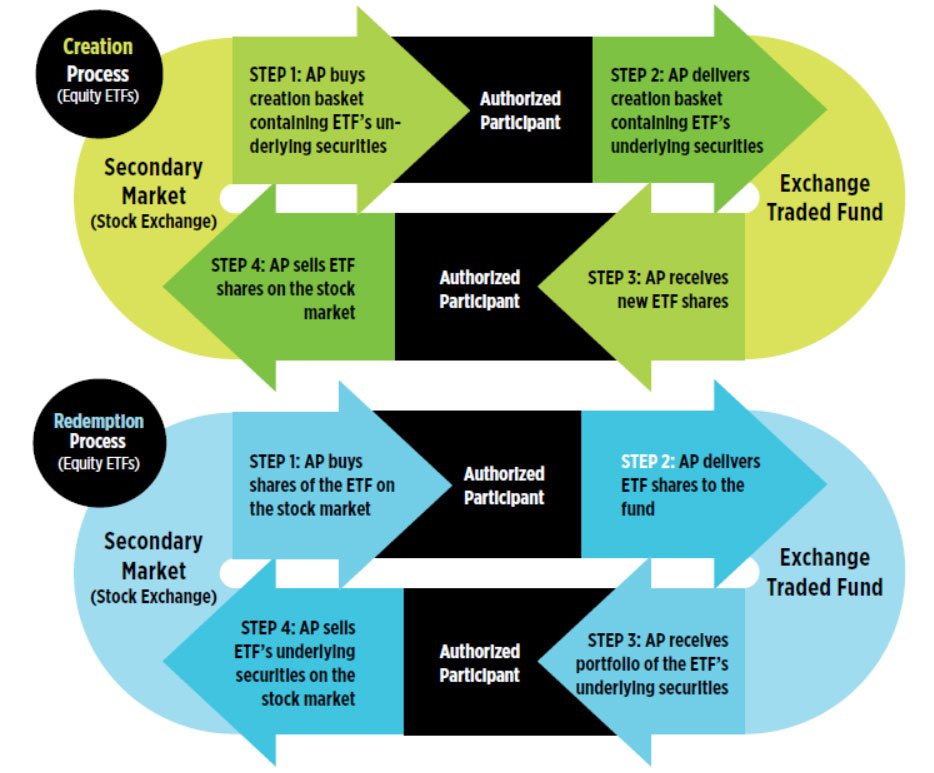

The creation/redemption mechanism is shown below:

To elaborate on this image, for any ETF on the market, there are a series of institutional investors called "authorized participants" (APs), who are authorized to create and redeem shares directly with ETF companies.

Before a new ETF launches, an AP will form an agreement to create a basket of ETF shares containing the underlying securities the ETF company wants. For example, let's say an AP wanted to create $2.5M worth of shares for a new S&P 500 ETF (e.g., 100,000 shares priced at $25 each). Every day, the S&P 500 publishes the list of securities it wants to own in its index, and the exact percentages of each security within its index. To create this basket of ETF shares, the AP would then acquire those securities from the market at the same exact percentage that the ETF wants. It will then put them into what's called a "creation basket," send that creation basket to the ETF company, and get an equal value in shares for that ETF.

Now, the ETF company gets the exposure it wants, and the AP gets the shares that it needs to sell on the open market. This process would then continue for the entirety of the ETFs life. However, because an ETF is traded like a stock, its price will fluctuate throughout the trading day, simply due to supply and demand in the market. This causes ETFs to switch between being "overpriced" (aka trading at a premium) and "underpriced" (aka trading at a discount) on a regular basis.

So, when there's excess demand for an ETF in the market (the ETF is "overpriced"), an AP can buy the underlying shares that compose the ETF and sell the ETF shares on the open market, thereby driving down the ETFs share price back toward fair value. On the other hand, when there's less demand for an ETF in the market (the ETF is "underpriced"), an AP can buy these cheap ETF shares and redeem them for the underlying securities, which can be resold later. This drives up the ETFs share price back toward fair value.

To provide an example, if a large group of investors wanted to buy an ETF with a fair value of $50 all at once, its price on the stock market may rise to $52 (with its fair value remaining at $50). Multiple APs would see this ETF premium develop and would begin buying the underlying securities that make up the ETF. Simultaneously, they would sell the appropriate number of ETF shares directly on the open market. This large sell-off of ETF shares will put downward pressure on the ETFs price, and the purchase of the underlying securities puts upward pressure on the stocks themselves. This will push the ETF price and fair value back into equilibrium.

With this example, the AP made $2 in a more-or-less riskless trade. However, ETFs often remain at fair value and any difference is only a few pennies. Regardless, with the creation/redemption process, the AP has access to many ETF shares which it can resell for profit, and earn a basically risk-free arbitrage profit. The ETF company benefits as well, as it receives the shares it needs to track its underlying index.

Ultimately, this process is the key that makes everything to ETFs great, and everything that introduces risks to ETFs. These advantages and disadvantages to investing in ETFs, particularly when compared to mutual funds, are summarized in the sections below.

Advantages of ETFs

Below are the main advantages or reasons to purchase ETFs:

- Lower Costs: A well-diversified portfolio of ETFs can be put together for a weighted-average expense ratio of below 0.10%, if not lower. On the contrary, the average expense ratio, including the average invisible trading costs for 1800 mutual funds in 2019 was 1.44% altogether. Therefore, in terms of costs to the investor, mutual funds are for more expensive to investors. Put simply, this is because ETFs are cheaper to run than mutual funds, due to the nature of how they operate.

- Tax Efficiency: ETFs are also more tax efficient for investors, particularly when it comes to capital gains distributions. When an investor sells an ETF, it's sold to another investor in the market. Therefore, unlike a mutual fund, the ETF company doesn't have to play a role with selling a portion of their securities and providing you with your returns. Given, in the fixed income space and with more complex ETFs, ETFs are not as tax efficient as their equity counterparts. Regardless, ETFs are generally tax-efficient vehicles.

- Liquidity and Flexibility: ETFs can be traded anytime the market is open, just like a stock. This gives investors the power to buy, short, or even margin trade ETFs. Ultimately, this provides a great deal of liquidity and flexibility to investors that no mutual fund can offer. This is largely due to the creation/redemption mechanism, which does not exist for closed-end funds. Clearly, this can be more of an advantage to more hands-on investors.

- Transparency: The vast majority of ETFs show their full portfolios every day, as they're on public stock market exchanges. Mutual funds are completely different, and are only required to report their complete holdings on a quarterly basis by the U.S. Securities and Exchange Commission (SEC).

- Access: ETFs provide exposure to virtually all areas on the market, including equities, fixed income, commodities, currency, levered and inverse products, volatility, and more. In 2021 alone, 250 new ETFs were launched. Although mutual funds can provide more specialized access, because they're not designated to track an index (but rather beat it), ETFs generally provide this exposure at a much cheaper cost to investors.

Disadvantages of ETFs

Below are the main disadvantages or reasons to avoid ETF investing:

- Difficulty: Although ETF investing may appear simple, and has been made easier through various ETF research tools, identifying the right ETFs for your portfolio can be a difficult process. Many investors default to selecting the lowest expense ratio and best-performing ETF in whatever asset category they're looking at, but this can often lead to lackluster results. What's more important, is to find the ETF that tracks its index the best, while considering its tradability and portfolio fit, and then making your best judgement call thereafter.

- Active Management: On top of the difficulty ETF investing provides, investing in ETFs is something you have to manage (unless you hire someone), which mutual fund investors are not concerned with. Proper asset allocation, which will likely change depending on the market environment, your age, and/or investment goals, is another difficulty factor to consider here. Even if various investment brokerages have made ETF investing easier, a mutual fund investor can simply purchase a target-date mutual fund based on when they expect to retire, for example, and not have to worry about asset allocation afterwards.

- Tracking Error: The entire purpose of an ETF is track its underlying index to the best of its ability, which only becomes more difficult with more specialized and smaller ETFs. Generally, the further the ETF strays from its intended index, the worse it's for you as investor who may be receiving far inferior returns that similar ETFs.

- Flash Crashes: "Flash crashes," although rare, are instances where a stock or ETF rapidly declines in price, but then quickly recovers shortly thereafter (usually within less than an hour). The biggest drop occurred on May 6, 2010, largely due to high-frequency trading glitches. The point here, is that ETF investors would've seen their ETF price on the market plummet momentarily, while mutual fund investors would've seen no difference. This is simply because mutual funds are traded once per day at the closing net asset value (NAV), unlike ETFs.

- Commissions and Spreads: Although a majority of investment brokerages offer commission-free trading now, if you pay a commission to trade an ETF but not for a similar mutual fund, this is a clear disadvantage if you are to invest in the ETF. What's more relevant now, however, are ETF spreads. Many ETFs trade at spreads of a penny or less, as they're very liquid, and therefore are trading at fair value. Others have wide spreads (>4%) and are considered illiquid. In other words, this means you have to pay a percent to buy and sell your ETF shares, which may make its lower expense ratio not as important.

ETF Research Websites

Below is a list of free-to-use websites and tools I recommend to research and evaluate ETFs:

- ETF.com

- ETFDB

- ETF Trends

- Morningstar

- Fidelity

- iShares

- Vanguard: For Vanguard ETFs

- Charles Schwab: Must make an account to access their research platform.

- WisdomTree: For WisdomTree ETFs

In short, you can use these websites to speed up the ETF evaluation process. Note that I will primarily be using ETF.com in this article.

Tracking Efficiency

Tracking efficiency refers to how well a particular ETF tracks the underlying index it's designated to track. In large, this is the entire reason ETFs exist (to deliver identical returns for a particular index), so ensuring that an ETF closely tracks its underlying index is crucial. This section of the article will therefore explain what to examine to best evaluate tracking efficiency. Typically, an ETF should only be considered for further evaluation if it manages to pass this check.

To begin evaluating whether an ETF efficiently tracks its underlying index, you can examine "tracking error" and "tracking difference."

Tracking Error

"Tracking error" is the standard deviation of returns between the ETF and what the ETF is designated to track. In other words, tracking error is about the volatility in the difference of performance between an ETF and its index. Tracking error therefore does not provide any insight on an ETF's performance.

Tracking error can be calculated using the formula below:

Tracking error = Standard deviation of (P - B)

where:

- P = portfolio return

- B = benchmark return

Calculating the standard deviation of a data series for daily differences in tracking error will result in a number, which can then be used to compare against other ETFs who are tracking that same index. Obviously, the lower the tracking error number, the better.

Tracking Error on Excel

The average investor can use Excel to calculate r-square, beta, and standard error, all of which can be used to indicate how well a particular ETF tracks its benchmark index. Follow the steps below to know how:

- Use sites like Yahoo Finance or Nasdaq to download 1-year+ closing price data for an ETF and its benchmark index.

- Extract data for dates and closing prices for the ETF and its index.

- Calculate percentage returns for each fund in separate columns ((new/old) - 1)).

- Install the Data Analysis tool pack on Excel.

- Once installed, click on Data Analysis button on the "Data" tab, and select "Regression."

- For "Input Y Range," select the return percentages column for the ETF. For "Input X Range," select the return percentages column for the benchmark index.

- Select where to output the data and click "OK."

- You should now see r-square, beta, and standard error, among other statistics.

For r-square, the closer this number is to 1, the better. With regression analysis, you can also calculate beta, which is a measure of risk. Ideally, the beta of an ETF should be identical to the benchmark index beta, as this indicates a similar risk profile. Standard error is also another factor you can examine, with a smaller number indicating less tracking error.

These statistics are shown below for 1-year performance between the SPY and the S&P 500 Index (SPX):

You can view this spreadsheet below:

Tracking Error Shortcut

To speed things up, you can also just look up an ETF (e.g., the SPY) with Fidelity's Screener, and see that (as of writing) the fund has a tracking error of 0.02, which is negligible.

Tracking Difference

Tracking difference (aka performance difference) is the difference between ETF performance and index performance. In other words, with tracking difference, you can determine whether an ETF outperformed its benchmark index or not. Typically, most ETFs trail their underlying index, and the difference is almost never equal to zero.

Tracking difference can be calculated using the formula below:

Tracking difference = Fund performance - Index performance

Many investors, media outlets, and financial data websites discuss performance on a point-by-point basis. For example, media outlets may report things like: "The index was up 10% in 2020 and the ETF was up 11% in 2020." However, this can be misleading because you're really just looking at a basic percent change, and there will be periods when an ETF fund is outperforming or underperforming its index.

The more viable option, particularly when it comes to evaluating fund performance, is to calculate performance on a rolling basis:

- Rolling returns: Measures average annualized returns over a particular period.

- Trailing returns: Measures point-by-point returns generated over a particular period.

Calculating rolling returns will provide you with a more comprehensive view on ETF performance and returns when compared to its index, unlike trailing return calculations.

Tracking Difference on Excel

Using Excel, you can calculate the rolling returns (e.g, 1-year, 3-year, 5-year, etc.) for an ETF in comparison to its benchmark index. For example, I calculated the 1-year rolling returns for both the SPX and the SPY using Excel, which I could then use to calculate an accurate tracking difference percentage. Here's how:

- Use sites like Yahoo Finance or Nasdaq to download 1-year+ closing price data for an ETF and its benchmark index.

- Extract data for dates and closing prices for the ETF and its index. Organize closing prices for both indices chronologically (e.g., today's date should be on the last row).

- In a new column, calculate the date one year ago using the =DATE function.

- Find today's date and locate the row that has the same (or closest) date, based on how far you want to calculate rolling returns (e.g., locate the row where 10/15/2020 is located to calculate 1-year rolling returns from 10/15/2020 to 10/15/2021).

- In a new column, use a =VLOOKUP function on the 'date one year ago' cell (10/15/2019 in our example) and select the entire array for fund dates and closing prices.

- In a new column, calculate the percentage change between the closing price and the calculated VLOOKUP value.

- Copy these formulas all the way until today's date.

- Repeat steps 5-8 for the index/ETF you want to calculate tracking difference for.

- Calculate the average (=AVERAGE) of each rolling return percentage column (for each fund).

- Subtract average rolling returns for the index from average rolling returns for the ETF to calculate tracking difference over the given period (e.g., over 1 year).

See how all this works exactly in the attached spreadsheet below:

The chart below shows 1-year rolling returns between the SPY and the SPX:

Clearly, the tracking difference (calculated as -0.08%) is great for SPY investors who are seeking to efficiently track the SPX. Regardless, the tracking difference may be more substantial over the 3-year, 5-year, and/or 10-year rolling returns, which could be worth looking into to add another layer of analysis.

Tracking Difference Shortcut

To get an overall picture on tracking difference, you can use ETF.com and look under the "Efficiency" section for "Portfolio Management," as the image below shows:

As you can see, this will provide you with the 12-month median tracking difference, along with the worst-case and best-case scenario for holding the ETF over the last 12 months. Again, this provides a data point on how well a particular ETF tracked its benchmark index, which investors can then use to compare against similar funds tracking the same index.

Expense Ratios

An ETFs expense ratio is the annual amount deducted from an investor's account to cover the fund's expenses.

The expense ratio calculation is shown below:

Expense ratio = Operating expenses / Average assets

Regardless of the area of the market you're looking to invest in, you should always try to buy the cheapest ETF. Granted, this will become more challenging as you begin investing in more niche markets. Regardless, higher expense ratios can significantly reduce your returns over the long-term.

To understand why you should only invest in low-fee ETFs, see the comparison of realistic ETF expense ratios and the amount of money lost over the 10, 20, and 30-year periods. This is compared to the ending value (gross), assuming no fees or expenses whatsoever. The chart and table below begin with an initial investment of $10,000 and assume an average annual growth of 10% (the average historical rate of the S&P 500):

As you can see, the larger the expense ratio, the less efficient an ETF is from an investor's perspective. Clearly, selecting a low expense ratio ETF is important, especially over the long-term when your investment begins to compound and grow more rapidly. Therefore, if you're investing in an ETF, ensure the fund is really worth the fee it's charging.

I rarely buy ETFs with an expense ratio over 0.50%. If I do, it's only a small percentage of my portfolio. However, if an ETF promises more expected returns and/or if it's an area of the market that is harder to access, then it may be worthwhile paying more to own the ETF.

- Related: Expense Ratio Impact Calculator

ETFs and Passive/Active Management

ETFs are traditionally passively managed, but the space for active managed ETFs is growing. Passive ETFs track an index, such as the S&P 500 Index, and attempt to replicate the performance of the index by purchasing the exact same securities with the same weights found in the index.

On the other hand, active ETFs can either subjectively track an index or track a "category," which could be made up. For example, this category could be internet companies or even blockchain. ARK ETFs are popular examples of actively managed ETFs.

The point here, is that passive ETFs are almost always cheaper, more tax efficient, and lower risk than active ETFs. This is something investors should keep in mind as active ETFs grow in popularity.

Tax Efficiency

Before we discuss ETF tax efficiency, note that taxes on long-term capital gains are currently 0%, 15%, and 20%, depending on your taxable income. Additionally, individuals earning $200,000 or more, and married couples earning $250,000 more, pay an additional 3.8% on investment income, including qualified dividends.

Capital Gains

ETFs are generally tax efficient vehicles due to their transparency. Therefore, most ETFs you look into will likely not have any tax efficiency concerns. Regardless, if an ETF is not tax efficient, it will fall short in tracking its index efficiently.

To evaluate an ETFs tax efficiency, capital gains is the first thing to look at here, in terms of whether the fund has paid out significant capital gains in the past or not. Capital gains are realized when an ETF sells securities in its portfolio that have appreciated in value. Typically, ETFs sell securities for a tactical purpose, such as a portfolio rebalancing effort. However, because ETFs are index funds, there's little turnover and this will not occur often. Regardless, when ETFs accrue capital gains, they are required by law to pay them out to shareholders by the end of each year.

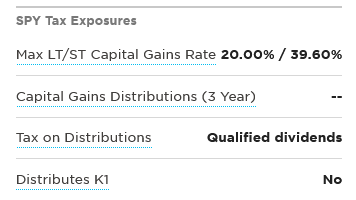

Fixed income ETFs are not as tax efficient as their equity counterparts, as they have more turnover and redemptions. This can be seen in the image comparison below between the SPY and the BND (Vanguard Total Bond Market ETF):

For capital gains distributions, ETF.com looks at the average amount of capital gains distributions paid out to shareholders over the last 36 months, as a percent of NAV at the time. Comparing capital gains distributions between ETFs tracking the same index will help you understand the potential tax consequences you may have to pay for investing in a particular ETF.

Distribution Taxation

Taxation on distributions (i.e., dividends and interest) works just like how mutual fund dividends are treated. There's two types of tax distribution classifications: qualified dividends and ordinary income (aka ordinary dividends). Qualified dividends fall under capital gains tax rates (tax rates as high as ~20%), which gives them a more favorable tax treatment. Ordinary income, on the other hand, are taxed as ordinary income (tax rates as high as 37%).

Note that even if tax distributions claim to be considered qualified dividends for an ETF, investors will only receive this qualified dividend consideration if they hold the ETF for more than 60 days before the dividend was issued. Otherwise, the dividend income will be taxed at the investor's ordinary income tax rate.

ETF Liquidation

ETFs can close if they're small (have a limited amount of assets), losing money, too complex, and/or do not have much momentum/popularity in the space. Therefore, you want to invest in ETFs with more inflows than outflows. When an ETF closes, it creates a taxable event for shareholders, thereby forcing these investors to pay capital gains taxes on any profits received that would have otherwise been avoided. Reviewing the ETF's prospectus document and following the guidelines discussed in this article should keep you far from ever having to be stuck with ETF closing costs or unexpected capital gains distributions.

Leveraged/Inverse ETF Taxation

Leveraged/inverse ETFs are generally the least tax-inefficient ETF vehicles. This is because these funds use derivatives, such as swaps and futures, to gain exposure to the index. Gains from derivatives generally receive a 60/40 treatment by the IRS, which means that 60% are considered long-term gains and 40% are considered short-term gains, regardless of the contracts holding period. In short, flows into these leveraged/inverse ETFs have historically been volatile, and the daily repositioning of the portfolio to achieve daily index tracking results in significant potential tax consequences for these funds.

Exchange Traded Notes (ETNs)

ETNs are unsecured debt securities provided by banks that also track an underlying index of securities and trade on the stock market, much like ETFs. Think of ETNs as a type of bond that doesn't pay any interest or dividends. At maturity, they will pay the return of the index it's designated to track. Unlike ETFs, ETNs do not provide investors ownership of the securities whatsoever, investors are simply paid the return that the index produces.

Unlike ETFs that regularly distribute dividends, ETN investors are not subject to short-term capital gains taxes. Therefore, ETNs are classified as being more tax-efficient than ETFs. But like conventional ETFs, when the investor sells the ETN, they are subject to a long-term capital gains.

Gold Taxation

Commodity ETFs, such as Gold ETFs, are classified as "collectibles" by the IRS, which results in unfavorable long-term tax rates. For example, popular gold bullion ETFs (GLD) and IAU provide great exposure to physical gold. However, regardless of how long you hold these gold ETFs, they are taxed as a collectible. In other words, tax rates on gold ETFs can be as high as 28%, which is greater than the long-term capital gains tax (up to 20%) most ETFs have.

This is shown on ETF.com as well:

Tax differences for commodity-based ETFs do not stop here. More sophisticated investors may trade futures-based gold ETF products, which typically have a long-term tax rate of 23%. However, these gold futures products often lag the market if they are in "contango," thereby not implying any real tax benefit. Other gold ETNs could qualify for a long-term 15% tax treatment under certain conditions. Clearly, selecting funds based on their tax implications can result in significantly different after-tax realized returns.

Securities Lending

Securities lending is the practice of lending securities to other investors or firms, so that a short position can be placed on a stock. Managers that run ETFs can sometimes participate in securities lending, so that they can generate more in returns for investors by charging interest on the borrowed stock. If you're a shareholder in an ETF that takes part in securities lending, you should question whether you're getting the bulk of those proceeds returned and being treated fairly.

Tradability

ETF tradability examines how much someone could buy of a particular ETF before it begins to have a meaningful impact on the least liquid security in the ETF. In other words, ETF tradability refers to the implied liquidity of an ETF. ETF tradability is especially important to evaluate when you're regularly investing in an ETF.

For larger, more established ETFs (e.g., the SPY), with hundreds of millions of dollars in assets under management, ETF tradability and differences between similar funds is likely not an issue or comparison measure worth further evaluating. However, with ETFs that are less established and/or those with a smaller number of holdings, ETF tradability is likely worth examining.

Net Asset Value (NAV)

An ETFs net asset value (NAV) represents the underlying value of its portfolio. Unlike an ETFs market price, which is subject to the demand and supply from investors in the market, an ETFs NAV is calculated at the end of each trading day (at 4:00 p.m. EST) using the formula below:

NAV = (Assets - Liabilities) / Total number of outstanding shares

ETFs can be discussed as trading at a "premium" or "discount," depending on whether their current stock price is above or below the NAV. To elaborate, if an ETF is trading at a premium, then it's trading above the reported NAV during the period. When an ETF is trading at a discount, then it's trading below the reported NAV.

It's not uncommon to see ETFs trading at a premium during recessions and/or market crashes, in circumstances where investors are not willing to sell their ETF shares. At the same time, discounts can also be found in market pullbacks when people are selling their shares at the near-bottom of the crash.

Intraday Net Asset Value (iNAV)

For traders that want to have a more updated or "real-time" measure of an ETFs value, instead of waiting for the ETF to be calculated at its NAV at the end of each trading day, the intraday net asset value (iNAV) is a more useful (but unofficial) indicator. In specific, the iNAV for an ETF is available every 15 seconds, and liquidity providers use the calculation below (or a very similar one) to calculate the iNAV:

iNAV = [(Σ(Shares per underlying security * Latest price) / FX rate) / CU ETF shares] + (Est. cash component / CU ETF shares)

Note that if you make an account with Fidelity and log in, you can see the "Indicative Intraday Value" for an ETF fund, which is just the iNAV calculation. This will provide a useful reference point for intraday ETF traders. However, the accuracy of the iNAV calculation can be reduced in volatile markets, and more commonly with ETFs that trade in different time zones than their underlying securities, much like NAV. Moreover, iNAV is an estimation of the fair value of an ETF based on price movements, which can lead to significant premium or discounts relative to the quoted iNAV.

Volume and Liquidity

Investors should evaluate an ETFs volume to understand how the ETF itself trades, as well as to understand how the securities within the ETF trades. This is particularly important to evaluate if you're purchasing a large number of shares in an ETF.

Using the SPY as our example again, ETF.com presents the following liquidity measurements (over the last 45 days):

Definitions (from ETF.com):

Avg. Daily Share Volume: Daily number of shares traded, averaged over the last 45 trading days.

Average Daily $ Volume: Daily dollar value of shares traded, averaged over the last 45 trading days.

Median Daily Share Volume: Median number of shares traded over the last 45 days.

Median Daily Volume ($): Median dollar value of shares traded over the last 45 days.

Average Spread (%): The bid-ask spread percentage averaged over the last 45 days.

Average Spread ($): The bid-ask spread dollar value averaged over the last 45 days.

As you can see, ETF.com shows both median and average trading day measures, because ETFs are often inconsistent with how much they trade. Generally, the two median statistics aim to provide insight on what a normal trading day looks like for the ETF. Besides looking at the assets under management (AUM) for an ETF fund, these volume statistics will tell you how large and popular a particular fund is. Comparing these volume measures to similar funds tracking the same index will help you avoid investing in smaller funds that may have a greater risk of closing, which as discussed before, can lead to unexpected taxes for investors.

Bid-Ask Spread

The difference between the NAV of an ETF and its market price is known as the "bid-ask spread." The higher the spread, the more the broker of the ETF makes. If you place a market order for an ETF, you'll buy the shares at the ask price (the higher price). If you then sell these ETF shares, you'd be selling at the bid price (the lower price). This difference can especially add up if we're buying multiple shares of an ETF.

Therefore, as investors, we want the bid-ask spread for the ETF we're looking to invest in to be as low as possible. In specific, you can examine the "Daily Spread" chart on ETF.com and the "Average Spread (%)" table value, to help determine how liquid a particular ETF is:

Clearly, the fluctuation in spreads for the SPY are less than a basis point, which is hardly a reason for concern given the SPY is a very liquid ETF. This will often be the case for larger ETFs, as they will often trade at a minimal dispersion between the actual bid-ask spreads.

However, when you begin evaluating more complex ETFs and those that require more active management, this spread will be important to analyze for comparison purposes. Regardless, you should typically set limit orders when you purchase ETFs, so that you're paying what you want for a number of ETF shares, and not what the broker decides.

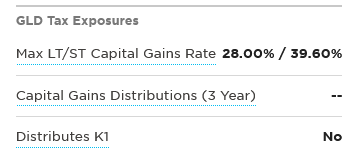

Premiums and Discounts

Premiums and discounts, as previously discussed, represent how the ETF has performed versus its real underlying NAV. Although evaluating the max premium and discount spread can be a useful measure of ETF liquidity, investors should understand that they're not applicable for all ETFs.

Premiums and discounts are calculated by comparing the closing price of an ETF at 4:00pm EST, when the market closes, to the NAV of the ETF's underlying portfolio. This works well with an index like the SPY, as every company in the SPY also happens to close trading at 4:00pm EST. In cases like these, you should place a higher score on the fund with a lower spread between the premium and discount (e.g., over the last 12 months).

However, for any ETFs with companies outside of the U.S., these ETFs may trade all day in the U.S., but the underlying securities within their portfolios may not trade at all during the market's open hours. Therefore, when you compare the closing price of Schwab Emerging Markets Equity ETF (SCHE) to its closing NAV, they can differ wildly, as presented in the chart below:

This doesn't tell you anything about SCHE's tradability, besides that it happens to be trading in U.S. markets. Therefore, there may be nothing wrong with SCHE's implied liquidity whatsoever, even though it may appear the contrary.

In short, keep in mind that premiums and discounts can often be looked at incorrectly. On ETF.com for a given ETF, if the "Market Hours Overlap" under the "Tradability" section is less than 100%, then these premiums and discounts are a false measure and can often be ignored altogether. This will often be the case for ETFs that have exposure to international securities, bonds, and commodities, among other complex ETF products.

ETF Creation/Redemption Process Factors

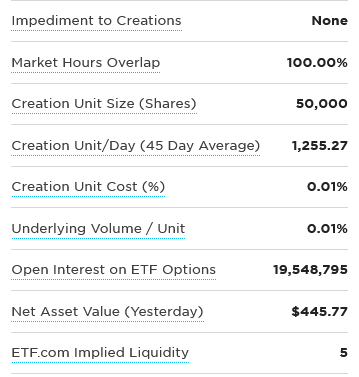

You can examine the factors that impact how the ETF creation/redemption process works on ETF.com after searching for a particular ETF, such as the SPY:

Definitions (from ETF.com):

Impediment to Creations: Any systematic issues that have restricted the ability to create or redeem shares of the fund.

Market Hours Overlap: Percent of the time that underlying securities in the ETF are open to trading while U.S. exchanges are open.

Creation Unit Size (Shares): The smallest block of ETF shares that an AP can either create or redeem at NAV with the issuer in exchange for the underlying shares of the fund.

Creation Unit/Day (45 Day Average): The median 45 day share volume divided by the creation unit size of the fund. The higher the number, the more likely that liquidity providers will trade the fund in size, or in odd lots.

Creation Unit Cost (%): The standard fee to create or redeem 1 creation unit of an ETF as a percentage of the dollar value of 1 creation unit.

Underlying Volume / Unit: The percentage of the median daily volume in underlying securities represented by one creation unit.

Open Interest on ETF Options: The total number of net outstanding option contracts for an ETF.

Net Asset Value (Yesterday): The total market value of the assets that an ETF holds less fund expenses.

ETF.com Implied Liquidity: An estimate of liquidity for the underlying baskets of securities, scaled from 1 to 5.

In short, large deviations from the norm for any of these factors (increased risks or costs) can limit how smooth the creation/redemption process is for a particular ETF. As investors, we want a smooth creation/redemption process because this leads to ETFs trading close to fair value, which ultimately makes an ETF more efficient.

Portfolio Fit

When you're looking to gain exposure within a particular industry (e.g., equities, fixed-income, gold, etc.), you may come across multiple ETFs that are tradable and are capable of efficiently tracking their underlying index. At this point, you're simply trying to select the best fund(s) to invest in, based on your investment criteria and goals as an investor.

This is when it becomes especially important for investors to understand what exactly an ETF holds, and why. From what you've learned, it should be apparent that ETFs can deliver very deliver patterns of returns, even if they're tracking the same underlying index. In retrospect, you want to invest in the ETF that performs the best over time, which is not as much of a concern for S&P 500 ETF investors. However, for lesser-known market areas, comparing different types of exposure and examining security tilts between ETFs is often necessary to identify the best ETF(s) within the industry.

For investors that don't have a specific opinion or investment goal in mind when seeking to gain exposure in a particular sector, the recommendation here is to just buy the broadest market-cap weighted ETF available. However, if you want to be more sophisticated and choose a specific type of exposure, I recommend spending the time to evaluate an ETF portfolio closely.

Portfolio Fit Shortcut

In most cases, whenever you land on a fund's page on ETF.com, you will be presented with a circle that has a letter grade and score inside (as seen in the following image).

The "A" grade refers to the overall score of the ETF, based on the average between the efficiency and tradability scores. However, the "95" is the number that represents an ETF's portfolio fit (out of 100). As you can see, if you don't want to perform any further diligence, you can use ETF.com's calculation instead.

For reference, ETF.com describes how they measure fit in equities below:

"To measure Fit in equities, ETF.com first defines each fund's market segment, and then compares a fund's performance and holdings with those of a benchmark that reflects the segment as a whole."

— ETF.com

Portfolio Composition

Understanding an ETF's composition is key to understanding if the ETF is providing the exposure you are looking for. In short, this can be accomplished by examining the portfolio sector/industry breakdown, the portfolio concentration, and the security market cap allocations.

Portfolio Sector/Industry Breakdown

To begin, investors should examine the sector/industry breakdown within the ETFs portfolio, and evaluate how this compares to funds tracking the same index, and the index benchmark itself. This will also help you assess risk, given that you're familiar with your risk tolerance, the current and future market outlook, and how different industries/sectors are performing or expected to perform.

Again, you can use ETF.com, and look under the "Fit" tab for a particular ETF page. Then, you will see the ETFs portfolio sector/industry breakdown. You can also see where the securities in the portfolio originate from, which is relevant for ETFs providing international exposure.

The SPY sector/industry breakdown compared to its index benchmark is below:

You should evaluate whether this sector/industry breakdown fits the amount of exposure you're looking for (e.g., whether you're comfortable owning a fund with 13%+ of its assets in financial services). Lastly, the sector/industry percent breakdown differences should be small, otherwise the ETF may not be able to track its index efficiently in the future.

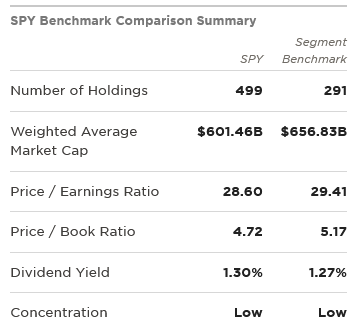

Portfolio Concentration and Size

Portfolio concentration is another important area to evaluate. Funds with concentrated holdings are more closely tied to the performance of the shares they own. Clearly, this can either be a good or bad thing for investors, depending on what the market is favoring.

Regardless, you should ensure that the weightings of an ETF's top securities (i.e., 10 or 15 securities) are not too high or too low, based on comparable ETFs tracking the same index. Personally, I look closer into any ETF portfolio concentration above 30-40%, although this may vary depending on the industry. If there appears to be a substantial difference in weightings, then this is likely due to the ETFs strategy, as outlined in its prospectus document, which will typically show performance-wise.

Another aspect to examine here is the size of the assets within the portfolio. Clearly, if an index is tracking a large-cap index, you'd expect the ETF to hold a majority of large-cap stocks. Obviously, if this is not the case, then the ETF is likely not tracking its index efficiently and is not worth investing in.

ETF Database has a "Concentration Analysis" portion of their website for different ETFs, which will answer most of the questions you have around portfolio concentration and size. This can be seen below for the SPY:

You can typically view the entire list of security holdings and their respective weights on ETF.com under the "Fit" tab on an ETFs page as well. Looking at the "SPY Benchmark Comparison Holdings" section will also tell you how many holdings the ETF and its underlying index share.

ETF Weightings

Investors should understand the different types of weighting ETFs can come with, as the exposures and risks for investing in one over the other can vary greatly. The most common ones are described below:

- Market Weighted: Funds that reflect each security's market capitalization and the total value of all shares of stock outstanding. Weightings of index components in a market cap weighted portfolio automatically adjust as stock prices change. These indexes are tilted toward large companies (aka top-heavy), so they will perform best when large-caps outperform mid- or small-caps. The SPDR S&P 500 ETF Trust (SPY) is one popular example of a market-weighted ETF.

- Equal Weighted: Funds that assign the same weighting to every single security. The portfolio is then rebalanced periodically (e.g., quarterly) to reflect changes in market values. Typically, this rebalancing makes these funds more costly for investors. Equal-weight ETFs also generally favor mid- or small-cap securities and are not excessively influenced by momentum-driven markets. The Invescore S&P 500 Equal Weight ETF (RSP) is one popular example of a equal-weighted ETF.

- Price Weighted: Funds where each security make up a fraction of the index proportional to its trading price. In other words, price-weighted funds can be thought of as a portfolio with one share of every security within its portfolio. As a result, these funds ignore the total market capitalization's of the constituent companies, as a stock trading at $50 will make up ten times more of the index than a stock trading at $5. Stock prices also change constantly and are influenced by stock splits and dividend payouts. These funds are also less tax efficient as they need to be constantly rebalanced to reflect changes in stock prices. The SPDR Dow Jones Industrial Average ETF Trust (DIA) is one popular example of a price-weighted ETF.

Other (less common) ETF weightings include fundamental weighted, volatility weighted, and dividend weighted.

The table below compares the performance of a market-cap weighted ETF (SPY) to an equal-weighted ETF (RSP). Both ETFs track the S&P 500 Index:

SPY vs. RSP Trailing Returns: Total Return % (NAV) from Morningstar data.

Clearly, performance differences between equal weight and market cap weighted indices can be substantial, which is why you should always read an ETFs weighting methodology before investing.

Portfolio Performance

To evaluate portfolio fit, it's helpful to examine an ETFs returns over time. Although past performance does not guarantee future performance, understanding a fund's performance provides insight on the fund's volatility and possible patterns of returns in the future.

This can be done with regression analysis and looking at rolling returns between the ETF and its index, as discussed under the Tracking Efficiency section in this article. In particular, you should examine whether the tilts made in the ETF portfolio (i.e., away from the market) have been rewarded with better risk-adjusted returns. This is particularly useful to look at during periods of market volatility and pullbacks, to examine whether the ETF is managing to outperform similar ETFs.

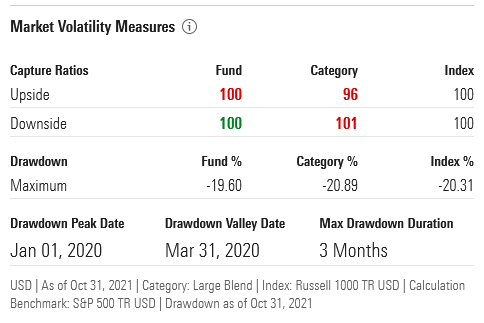

After reaching a fund's page on Morningstar, you can look under the "Risk" tab to examine various risk and volatility measures. For example, the SPY and its market volatility measures are shown below:

This page is explained more in-depth in this StableBread article on How to Evaluate and Compare Mutual Funds.

Portfolio Performance Shortcut

The shortcut to evaluating portfolio performance is to simply compare the ETFs trailing returns against the index and the category. This way, you can see how much the ETF would've grown if you invested in it. I tend to examine the 3-year, 5-year, 10-year, and 15-year annualized trailing return percentages. At the very least, your ETF should be closely trailing or beating its index, and performing close to or better than its category. In short, this is a rather straightforward approach, and you can use online security comparison tools to chart these differences.

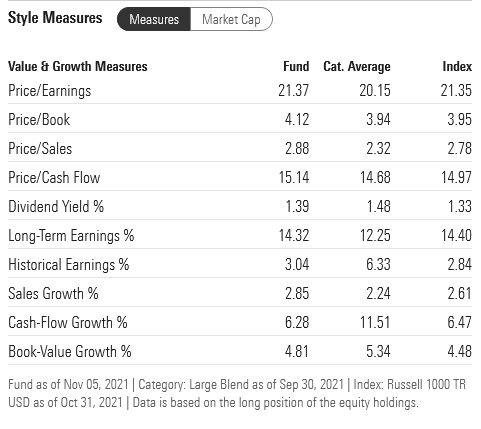

Portfolio Measures

One final item to examine regarding a portfolio's fit, are the various value and growth measures. I typically examine the differences in the price-to-earnings (P/E) ratio and the dividend yield percentage, versus that of similar ETFs and the index benchmark. The P/E ratio will help me understand whether a particular ETF is trading at a relatively cheap or expensive price. If applicable, the dividend yield percentage will give me an idea on whether I am receiving an appropriate amount of dividend income.

Multiple value and growth measures can be found on Morningstar after landing on a fund's "Portfolio" page, but ETF.com simplifies this to just three (P/E, P/B, and dividend yield). This can be seen below for the SPY:

Like previous sections have covered, if there's no substantial differences between the fund and its index and/or category, then it's not worth looking into further.

The Bottom Line

In closing, exchange traded funds (ETFs) are enormously valuable, efficient, and institutional quality instruments that can be used to build cost-effective portfolios. The fact that they're trading on an exchange allows them to be more flexible, transparent, tax efficient, lower cost, and in many ways, better than traditional mutual funds. However, just because ETFs are largely passive vehicles, doesn't mean they should be given less scrutiny.

ETFs are all about capturing different patterns of efficiency, tradability, and fit (as ETF.com teaches). The best ETF, at the end of the day, is the most liquid one that tracks its benchmark index the closest, at the cheapest price, while offering the exposure that you're looking for. Ultimately, understanding how to evaluate and compare ETFs, regardless of the area of the market, can result in above-average returns over the long-term with proper diversification practices.