In this article, we'll discuss the 5 key downsides of investing in dividend stocks for income. While dividends play an important role in a diversified stock portfolio, there are significant drawbacks to consider. These become more relevant if your strategy heavily emphasizes dividend stocks.

These drawbacks start with the discretionary nature of dividends and the widespread but mistaken belief that dividends equate to "free" money. Behavioral tendencies influenced by receiving dividends will also be examined, as they can adversely affect spending habits. Additionally, we will address limitations tied to diversification in dividend-focused strategies, specifically the underrepresentation of key market sectors and the potential neglect of empirically-proven factors that explain investment returns. Lastly, we'll discuss tax implications and other economic variables that frequently go unnoticed due to the allure of receiving cash without selling any stock.

Downside #1: Discretionary Nature of Dividends

As a dividend investor, it's essential to recognize that dividends are discretionary payments, not obligations. This is outlined in the issuing company's dividend policy, which sets both the dividend amounts and any potential future increases based on earnings.

Although dividend-paying companies are usually less volatile than those that don't pay dividends, they can't promise consistent income. This issue becomes more relevant during economic slumps or when a company is underperforming, as limited free cash flows put them at a crossroads: either keep up dividends to help stabilize the stock price or save cash for future growth. Since dividends are optional, they're often the first to get cut, which usually leads to a drop in the stock price. This is explained by the "clientele effect," where stock prices are tied to how investors respond to company policy changes.

Many investors also overlook the risk of dividend reductions, especially when focusing on established stocks like those on the Dividend Aristocrats List. This list includes S&P 500 companies that have raised dividends for at least 25 years. However, even these firms can face cuts. For example, AT&T (T), after increasing its dividend for 35 years, reduced its dividend in 2021 due to its Warner Media spinoff.

It's also important to consider the broader market trends and research on dividend cuts and reductions. A study by Kevin Krieger, Nathan Mauck, and Stephen W. Pruitt titled "The Impact of the COVID-19 Pandemic on Dividends" sheds light on this. The paper found that out of nearly 1,400 dividend-paying firms, 213 (~15%) cut dividends and 93 (~6.7%) omitted them entirely in Q2 2020. This rate of cuts was three to five times higher than any other quarter since 2015. During the 2008 crisis, it was mainly financial firms that cut dividends, while non-financial firms largely kept them intact. This is particularly relevant for those invested in dividend-focused ETFs, which often have a heavy concentration in the financial sector.

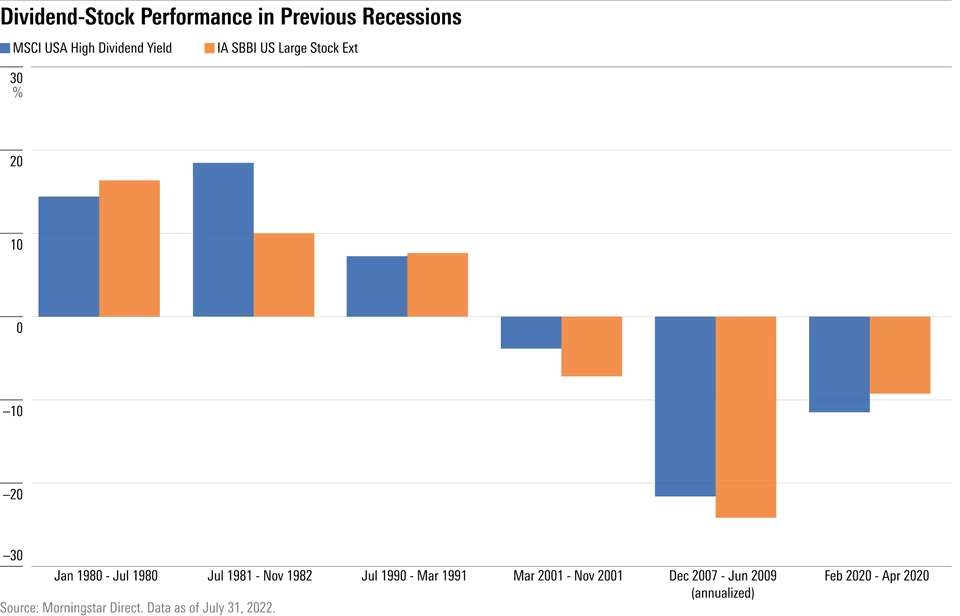

The chart below provides further clarity on how dividend stocks in the U.S. have performed in prior recessions. It compares the MSCI USA High Dividend Yield Index, focused on high dividend income and quality, with the IA SBBI US Large Stock Ext Index, a U.S. large-cap stock benchmark:

This chart reveals two key trends about dividend stocks: their relative performance in market downturns and their vulnerability during specific recessions. Dividend stocks generally outperformed the broader market during the downturns that began in July 1981, March 2001, and December 2007. However, they underperformed in the short-lived recessions of 1980 and 2020. Specifically, the MSCI USA High Dividend Yield Index declined by 11.5% between February and April 2020, lagging the broader market by about 2%.

This underperformance was largely attributed to dividend cuts from major companies like Disney, Shell, and General Motors, as well as a lack of exposure to high-growth tech stocks. To put this in perspective, the most dramatic reduction in dividends happened during the 2008-09 financial crisis, when S&P 500 dividends fell by 24%. Despite this significant drop, investors would have still retained 76% of their dividend income.

In summary, while the optionality of dividends and the risk of dividend cuts are real and do pose a considerable downside to investing in dividend stocks, these factors alone should not deter one from including dividend stocks in a diversified portfolio. This is especially true given the historical importance of dividends in total returns (contributing to 69% of the total return of the S&P 500 Index), and their relatively limited downside risk in past recessions.

Dividend Income vs. Capital Growth

The discretionary nature of dividends, as explored earlier, hints at a broader financial narrative within companies. The payout decisions reflect a balance, or sometimes a tension, between distributing earnings to shareholders and retaining earnings for future growth. Investors should be cognizant of this trade-off between enjoying dividend income and the possibility of limited capital growth. Companies that distribute a large portion of their earnings as dividends often have fewer resources to reinvest in expansion opportunities.

Striking the right balance in dividend payouts is a complex task for companies. They aim to attract and retain investors with generous dividends while also preserving enough earnings for future growth and potential dividend increases. This balance becomes even more crucial during economic slumps or periods of underperformance, where the dividend policy could significantly impact a company's financial stability and long-term growth prospects.

It's important to note that an excessively high dividend payout ratio, often considered to be over 80%, can become unsustainable and suggests that there's not much room for the dividend to grow further in the future. This may force the company to reduce or even eliminate its dividends, hindering business growth and limiting stock price appreciation in the process.

In essence, companies that prioritize dividend payments may forgo opportunities for higher long-term returns, making them less attractive to investors seeking both income and substantial capital appreciation. The "clientele effect" mentioned earlier shows how investors react to changes in company policies. An unexpected cut in dividends could upset the market. This highlights the need for investors to understand a company's dividend policy and the wider market trends when shaping a dividend-focused investment approach.

Downside #2: Fungibility and Perspective

This section aims to dissect the relationship between the investor's perspective and the fungibility of dividends, questioning the common belief that dividends offer stability or downside protection.

Dividend Irrelevance Theory and Free Dividends Fallacy

The cornerstone of the "dividend irrelevance theory," laid out in the seminal 1961 paper by Merton Miller and Franco Modigliani titled "Dividend Policy, Growth, and the Valuation of Shares," is the concept of fungibility. This theory asserts that money should be treated equally, irrespective of its source (i.e., primarily stock buybacks and dividends).

This view often leads investors to think that dividends can serve as downside protection or a hedge in flat or falling markets. In this perspective, a dividend is seen as a stable asset separate from stock performance. However, this contradicts the principle of fungibility, as many investors treat dividends differently from capital gains.

This stance is further supported by a 2019 paper, "The Dividend Disconnect," by Samuel Hartsmark and David Solomon. The authors introduce the term "free dividends fallacy" to describe the tendency of investors to treat dividends as separate and "free" money, apart from capital gains.

Hartsmark and Solomon also argue that dividend-paying stocks gain particular appeal when interest rates are low. Investors appear willing to pay a premium for dividend cash flows, a premium that exceeds what rational investment theory would justify. According to their research, this behavior could diminish an investor's expected returns by 2-4% per year, especially when dividends are stable or have increased in the recent past and when interest rates are low. The takeaway here is that when dividends are in high demand, particularly in a low-interest-rate environment, there's a significant chance that dividend investors are overpaying for their dividend cash flows.

Dividends and Investor Spending Behavior

Many investors favor income-generating assets like dividend-paying stocks, believing they offer market stability and a steady income. The idea is that if you spend only the income and not the principal, you'll secure a financially stable retirement. However, behavioral finance studies challenge these assumptions, revealing complexities in how dividends influence consumer behavior.

In a 1984 paper by Hersh Shefrin and Meir Statman titled "Behavioral Aspects of the Design and Marketing of Financial Products," the authors offer several explanations for investors' preference for dividends. One key reason they highlight is poor self-control over spending, as the authors put it:

"If they have poor self control, and are unable to control spending, then a cash flow approach creates a spending limit -- they will only spend income and not touch capital."

Hersh Shefrin and Meir Statman

From a financial planning perspective, two noteworthy papers delve into the responsiveness of consumption to dividends. The 2020 paper "Stock Market Returns and Consumption" by Marco Di Maggio, Amir Kermani, and Kaveh Majlesi, finds that in Swedish data, household consumption is significantly more responsive to dividend payouts across all wealth categories. This is consistent with households treating capital gains and dividends as separate sources of income.

Similarly, the 2021 paper "Consuming Dividends" by Konstantin Brauer, Andreas Hackethal, and Tobin Hanspal, notes that based on detailed daily data from a German bank, private consumption is extremely sensitive to dividend income. They find that across all wealth, income, and age groups, spending spikes precisely around the days dividends are received. Their results suggest that this consumption response is part of a planned approach by investors who intentionally buy dividend-paying stocks, anticipate the dividend income, and plan their consumption accordingly.

Another explanation offered is that people are loss-averse. If the value of their stocks declines, they feel uneasy about selling to generate income. However, they are more comfortable spending dividends regardless of the stock's current value.

The issue here aligns with the findings in the studies: investors have a tendency to increase spending when receiving dividends. However, it's crucial to remember that the value of a company drops by the amount of the dividend paid. Essentially, dividends are not 'extra' money; they're part of your total return on investment. A more effective strategy is to have a solid financial plan that accounts for all types of returns, enabling sustainable spending over time.

Downside #3: Limited Diversification and Sector Concentration

Focusing solely on dividend-paying stocks can significantly narrow your investment opportunities and undermine portfolio diversification. It's important to acknowledge that many outstanding companies do not distribute dividends, and dismissing them based on their dividend policy, which holds no direct relevance to returns, lacks a logical foundation.

We can demonstrate this with Vanguard's sector ETFs, serving as a proxy for the 11 primary U.S. sector exchanges, to analyze the unique holdings across these sectors. This examination unveils the percentage of companies that paid dividends in 2023, offers a sector-wise breakdown of dividend-paying versus non-dividend-paying companies, and pinpoints sectors with minimal exposure when the investment focus is solely on dividend-yielding stocks.

To begin, the chart below delineates the percentage of stocks per sector that disbursed dividends in 2023:

Clearly, as indicated by the chart above, a significant risk associated with dividend investing emerges from sector concentration. While this approach may offer robust exposure to sectors like utilities, real estate, materials, financials, and energy, it inadvertently overlooks potential opportunities in typically higher growth sectors such as technology and healthcare.

Upon examining all sectors collectively, we found that there are 2,353 unique portfolio holdings across these 11 Vanguard ETFs. Among these holdings, 1,488 have paid dividends in 2023, translating to around 63% of stocks in the U.S. (1,488 / 2,353). This scenario implies that investors fixated solely on dividend-paying stocks are essentially sidelining nearly 40% of the available investment avenues in the market. Such a narrow focus could diminish diversification and potentially impact the long-term performance of their portfolios.

We can further explore the dividend yields across these 11 sectors in the U.S. for 2023, as illustrated in the chart below:

As illustrated, sectors such as real estate, utilities, and energy are notably associated with high dividend yields. The issue arises when dividend investors, attracted by these higher yields, allocate a significant portion of their portfolios to these sectors. However, this method of investment decision-making often proves to be unsustainable, especially when considering the risks associated with high-yield dividends.

This over-concentration in particular sectors exposes the portfolio to sector-specific risks and market volatility. For instance, the utility and energy sectors might exhibit sensitivity to regulatory changes, while real estate can be influenced by fluctuations in interest rates. During economic downturns, these sectors may face challenges, resulting in lower dividend yields and the possibility of capital losses.

In conclusion, if your portfolio heavily emphasizes dividend growth investing and/or dividend ETFs, it is inherently less diversified. This lack of diversification may result in increased variability and could potentially undermine the reliability and long-term performance of your portfolio in comparison to the market.

Diversification Challenges in Small Cap Dividend Strategies

Investment strategies centered on dividends frequently bypass smaller companies. For instance, ETFs crafted for "dividend growth" strategies tend to underweight small-cap stocks, a significant exclusion. This is highlighted in the 2020 paper "Settling the Size Matter" by David Blitz and Matthias Hanauer, where they demonstrate that small-cap stocks often carry higher risk premiums like value and profitability. Hence, by sidelining small-cap stocks, investors focused on dividends might miss out on better expected returns.

Although investing in small-cap dividend stocks is an option, insisting on dividends for your small-cap allocation can further impair diversification compared to other market segments. It's essential to recognize that individual small-cap stocks usually display more return volatility and are more susceptible to underperformance relative to their larger counterparts. Moreover, small-cap dividend growth funds often entail the drawbacks of higher fees and increased turnover.

The risk of concentration also permeates sector focus in dividend-centric portfolios. While certain sectors may present higher yields, others are recognized for appealing dividend growth. However, these inclinations inherently lead to skewed sector exposure. This aspect is particularly significant as such sector allocations may not align with the pursuit of value and profitability premiums — key factors that dividend investors might not realize they are actually targeting.

For a practical understanding of the differences among small-cap funds, we can analyze the prominent small-cap ETFs in the U.S., alongside the leading small-cap dividend-focused ETFs within the same market.

First, let's take a look at the top three small-cap ETFs in the U.S:

Top 3 Small-Cap ETFs in the U.S. Data Source: ETFdb (as of 10/31/2023)

Now, let's examine the three leading small-cap dividend ETFs in the U.S:

Top 3 Small-Cap Dividend ETFs in the U.S. Data Source: ETFdb (as of 10/31/2023)

In this high-level ETF comparison, it's apparent that small-cap dividend ETFs have expense ratios 25-30 basis points higher than their non-dividend counterparts. They also exhibit a slightly greater exposure to the financial sector and have higher concentrations in the utilities sector. This increased focus on these specific sectors aligns with what we discussed in the previous section, where many companies within these sectors distribute regular dividends.

Practically speaking, some level of industry concentration is often unavoidable when targeting value and profitability. However, making portfolio decisions based on a company's dividend policy, which doesn't correlate directly with expected returns, introduces an avoidable layer of risk that isn't compensated for. In essence, these funds do not offer any unique benefits in terms of expected returns. Similar investment outcomes could likely be achieved through more diversified, lower-cost, and lower-turnover small-cap value funds.

Downside #4: Tax Implications of Dividend Investing

A notable drawback of investing in dividend-paying stocks is the phenomenon of double taxation on your dividend income. Initially, the corporation disbursing the dividends is taxed on its annual net profits, which serve as the funding source for the dividends it distributes. Subsequently, you, as the investor, incur a second layer of taxation when you report these dividend earnings on your personal income tax return for the year. Thus, this double taxation effectively means you're shouldering tax burdens both as a stakeholder in the company and as an individual taxpayer.

In non-tax-advantaged accounts, dividends are subject to taxation upon distribution. U.S. investors should be aware of two key types of dividend qualifications:

- Qualified Dividends: These are paid by a U.S. or qualified foreign corporation and must be held for at least 60 days during a 121-day period that starts 60 days before the ex-dividend date. The tax rates on these dividends range from 0% to 20%, contingent on the investor's tax bracket.

- Non-Qualified Dividends: These dividends do not meet the criteria for qualified dividends and may come from certain foreign corporations or REITs. They are subject to taxation at the investor's ordinary income rate, which can go as high as 37%.

Differentiating between these two types of dividends is crucial for understanding their impact on your investment returns after taxes.

When it comes to retirement accounts like 401(k)s, traditional IRAs, and Roth IRAs, dividends are treated differently for tax purposes. In 401(k)s and traditional IRAs, dividends accumulate tax-deferred, allowing them to grow and compound without immediate tax implications. However, withdrawals from these accounts, including those sourced from dividends, are taxed as ordinary income. This deferral doesn't fully eliminate the tax inefficiencies tied to dividends. Roth IRAs offer a unique advantage: dividends not only accumulate tax-free but are also withdrawn tax-free, provided the withdrawals meet certain conditions.

Before taxes, returns generated from dividends and capital growth are essentially the same. However, the post-tax situation introduces a new dynamic. Investors who are not reliant on or interested in dividends have the option to defer their tax liability by refraining from selling shares, thereby affording them greater control over their tax obligations based on their expenditure needs.

In conclusion, the tax treatment of dividends varies according to the type of investment account in which they are held. Grasping these differences is important for fine-tuning your investment approach, particularly if dividends constitute a major component of your investment portfolio.

The Illusion of Dividend Tax Favorability

Adding to the diversification problem for dividend investing, domestic dividends are often more favorable from a tax perspective, making global diversification much more expensive for a dividend investor.

Take Canada as an example. Dividends can be taxed more favorably than other types of income in certain income brackets. This often serves as an argument for investing in Canadian stocks, especially for Canadian residents.

For illustration, let's consider someone with a taxable income of $100,000 in Ontario in 2023. The marginal tax rate on capital gains for this individual would be 18.95%, while the rate for eligible dividends would be 12.24%. At first glance, dividends might appear to offer a tax advantage.

However, let's delve into a hypothetical scenario in a non-tax advantaged account. If you receive $10,000 in dividends from Company 1, your tax liability would be $1,224 (12.24% * $10,000). Conversely, if you realize $10,000 in capital gains from Company 2, you wouldn't incur any tax until you decide to sell your shares.

The situation becomes nuanced when you decide to sell shares. You're not taxed on the entire sale amount, but rather on a proportional amount of the gain. For instance, if you initially purchased the shares for $100,000, and they are now worth $120,000, the capital gain on a $10,000 sale would be $1,666.67 — proportional to your total gains (($10,000 / $120,000) * $20,000). The tax you would owe on this gain would be $316.20 (18.95% of $1,666.67). This is significantly less than the $1,224 you would owe on dividends from Company 1.

Although the tax amount may increase over time due to the accumulation of unrealized capital gains, the prospect of dividends becoming more tax-efficient compared to capital gains is not immediate. Additionally, you maintain control over the timing of your tax liability, offering greater flexibility in tax planning.

In summary, even if you don't need the full $10,000 of income in a given year, you would still be obligated to pay tax on the dividends. This contrasts with capital gains, where you have the discretion to decide when to trigger the tax event.

Downside #5: External Economic Factors

While interest rate changes, inflation risk, regulations, and currency fluctuations are risks that affect all equities, they can have a significant impact on the realized returns of dividend-focused portfolios. These universal factors should be carefully considered by investors managing portfolios that are heavily weighted towards dividend-paying stocks for better investment outcomes.

Interest Rate Sensitivity

Dividend stocks are often favored for their income-generating capabilities, especially when interest rates are low and bonds yield less. However, the attractiveness of these stocks can wane as interest rates rise. Higher interest rates generally make bonds and other fixed-income securities more appealing, diverting investor interest away from dividend-paying stocks. This shift can lead to reduced demand for these stocks, consequently driving down their prices. The result is a potential decline in both the stock value and total portfolio returns for investors focused primarily on dividend stocks.

In a low-yield environment, the challenge for investors is to find investment opportunities that offer a satisfactory return. When other asset classes are also providing low returns due to the broader economic climate, reinvesting dividends may not substantially increase your income or portfolio value. This is particularly relevant for investors who opt for automatic dividend reinvestment. In such a scenario, the dividends you receive could be competing for a limited number of high-quality investment opportunities, making it challenging to adequately grow your income levels through reinvestment.

Inflation Risk

Although dividend growth stocks often have sustainable cash flows, making them favorable investments during periods of rising inflation, inflation risk remains an overlooked factor. This risk can undermine the real value of income generated from dividend stocks.

For instance, if a dividend stock yields an annual 4%, but inflation is running at 5%, the real income effectively diminishes by 1%. Moreover, inflation can impact the operational costs of the dividend-paying company, potentially leading to reduced dividend payouts. This creates a two-fold challenge: the erosion of real income and the possibility of diminishing returns from the stock itself. Therefore, it's important that investors consider inflation-adjusted returns and the company's ability to sustain or grow dividends in inflationary environments when constructing a dividend-focused portfolio.

Regulatory Risk

Regulatory risk presents a unique challenge for investors focusing on sectors traditionally known for paying dividends. Changes in laws or regulations can have a direct impact on a company's operational costs and revenues, thereby affecting its capacity to maintain dividend payments.

For example, the utilities sector faced headwinds with the introduction of the U.S. Environmental Protection Agency's Clean Power Plan in 2015, which required companies to make significant capital expenditures for compliance. Similarly, the healthcare sector underwent a sea change with the enactment of the Affordable Care Act (ACA) in 2010. The ACA's stringent provisions led some healthcare firms to re-evaluate their dividend policies, affecting investors reliant on this income. In the telecommunications sector, regulatory shifts around net neutrality have posed challenges. The Federal Communications Commission's 2015 reclassification of broadband services created concerns about profit margins and, consequently, the sustainability of dividend payments.

These real-world instances emphasize the importance of considering regulatory risks when building a dividend-focused portfolio. Not only can such changes lead to adjustments in dividend policies, but they also introduce an element of unpredictability that income-focused investors must factor into their strategies.

Currency Risk

The allure of international dividend stocks comes from their potential to offer diversification and tap into growth in foreign markets. However, the risk of currency fluctuation can significantly impact the returns when converted to your home currency. For example, if you're a U.S.-based investor holding a dividend-paying stock from a European company, a strengthening U.S. dollar against the Euro could erode the value of your dividend income when converted back to dollars. Conversely, a weakening home currency could amplify your returns, but banking on currency movements is a speculative endeavor.

The Bottom Line

The appeal of dividend investing is undeniable. Often seen as more of a lifestyle than a mere investment strategy, it entices investors with the idea of acquiring reputable, well-known companies that regularly pay out dividends. While this method can help maintain investment discipline, particularly during volatile markets, its true efficacy requires careful evaluation.

Focusing on dividend-paying stocks can lead to various inefficiencies and limitations, including tax inefficiency for taxable portfolios and poor diversification. Additionally, this emphasis on dividends can result in missed opportunities in the broader market. The strategy also tends to overlook other empirically proven factors known to drive investment returns. These shortcomings become even more pertinent for investors who prioritize dividend-paying stocks, and they can depress expected returns, especially when yield is highly sought after. When aligned with specific financial planning objectives, such as maximizing net worth or achieving consistent consumption, a singular focus on dividends also usually turns out to be an inefficient approach.

In closing, while dividends are an integral component of a diversified stock portfolio, the limitations of a dividend-centric approach should not be underestimated. Effective portfolio management involves more than just selecting dividend-paying stocks; it calls for a comprehensive understanding of various elements that contribute to long-term investment success. A more discerning examination of dividend investing may lead investors toward a balanced approach rooted in empirical evidence, thus offering a more reliable route to meeting long-term financial objectives.