In this article, I will show you how to estimate the expected return of a stock investment. "Expected return" is an estimation of the long-term returns a stock is likely to generate if purchased at its current stock price. Often times, investors fail to estimate the return they'll be expecting on a stock investment, thereby not having any idea on the future potential return they may be able to achieve. Ultimately, failing to take into account the expected return of a stock investment can limit one's realized returns and expectations in an investment over the long-term.

To understand how to estimate the expected return of a stock, it's recommended that you have already completed some type of intrinsic/fair value calculation or model. Most commonly, this can be accomplished through the discounted cash flow (DCF) model, which I will briefly explain in this article. I will also walk through an example from a real publicly traded company on the stock market to show how you can apply the expected return calculation to make better investment decisions.

Expected Return

Expected return is an estimate of the long-term returns a stock investment is likely to generate, assuming it's purchased at its current stock price. This estimation is also based on how long you expect to hold the stock. For example, you may expect to hold a high-growth tech stock for a shorter period (e.g., 5 years) than a consumer staple stock that pays dividends (e.g., for 10+ years). Clearly, this estimation will be heavily based on your investment evaluation and understanding of the business.

As previously stated, prior to estimating the expected return of a stock, you must already have some kind of model or analysis done that estimates the company's cash flow growth and intrinsic/fair value buy price. Using this model, we can work backwards to estimate the expected return for a stock, based on the price we pay for the investment today. In other words, we can use the DCF model to figure out what the current stock price is offering us today, in terms of annualized returns.

One final note when estimating expected return, is that even when investors are conservative with their DCF models and expected return calculations, the future cannot be predicted. Therefore, it's in good practice to apply a "margin of safety" in your DCF model so that you can account for the unexpected. This should be standard practice in a DCF model, but it's important to reiterate.

Discounted Cash Flow Model

In many cases, the discounted cash flow (DCF) model is the most accurate approach to estimating a company's intrinsic/fair value, at which a company is worth buying. In other words, the DCF model will provide you with a buy price range in which the company will be considered "undervalued" and potentially worth buying. This approach works best for larger companies and has been covered thoroughly in the two articles linked below (on StableBread):

- How to Value a Company Using the Discounted Cash Flow Model

- How to Calculate the Intrinsic Value of a Company Like Warren Buffett

In this article, I’ll be using Texas Instruments (TXN) as an example. This company generates a majority of its revenue from semiconductors and calculators. Its stock price performance can be seen in the chart below:

For clarity purposes, the simplified four-step approach for the DCF model is discussed below.

Step #1: Free Cash Flow

The first step in the DCF process is to calculate “free cash flow” or FCF for short. This is the amount of cash a business generates for its shareholders. Therefore, if FCF is strong and growing, then the company can be considered more valuable to shareholders.

The simple FCF formula is below:

FCF (simple) = Cash flow from operations - Capital expenditures (CapEx)

To calculate FCF, we can look at the company’s cash flow statement, which QuickFS shows for free. Deducting capital expenditures (aka property plant and equipment) from the total operating cash flow number will give us FCF. Doing this for Texas Instruments for its most recent year will give us $5.49B in FCF.

Step #2: Growth Rate

The second step is to estimate a growth rate at which the $5.49B in FCF will grow. Typically, this will be over a 10-year period. Unless you know a business inside-out, you should estimate the FCF growth rate for a company based on the historical growth rates of FCF or net income.

Here’s a chart of Texas Instruments’ FCF and net income (NI) growth over its last 10 years:

Calculating the annual percent change and taking the average over this 10-year period will provide us with 10.04% (FCF) and 12.63% (NI) respectively. To be conservative, we can use 10% for the annual FCF growth rate.

Step #3: Terminal Growth Rate

The third step is to estimate a terminal growth rate, at which FCF will grow forever after the 10-year forecast period. Because these cash flows will be growing forever, this rate should be below the risk-free rate. Therefore, because the current risk-free rate (on the U.S. 10-year Treasury Note) is 1.28% (as of writing), I’m going to use 1% for the terminal growth rate.

Step #4: Discount Rate

The fourth step is to determine a discount rate (aka personal required rate of return). This is the annual return percentage an investor should expect to receive if they were to buy the company today. Therefore, this rate will be used to discount future cash flows to account for the "time value of money." To keep things simple, because the S&P 500 has a 10% average annual return, we can use 10% as well.

Completed DCF Model

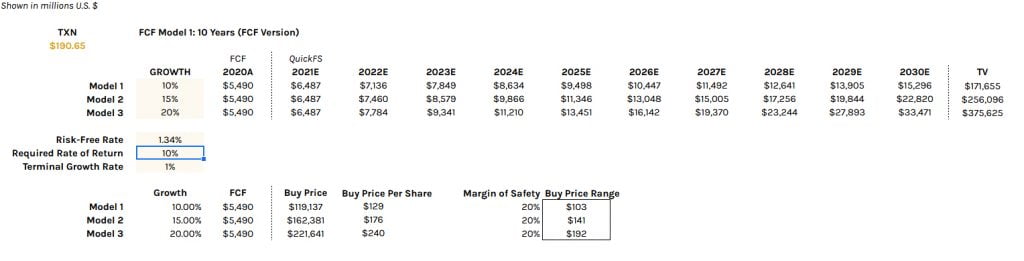

Now, we can put this all together in a spreadsheet. To provide a range of buy prices, I’ve used the 10% growth rate we found before, along with 15% and 20% if the company happens to perform above expectations. I’ve also included all the other inputs (FCF, risk-free rate, terminal growth rate) we previously discussed.

This can be seen in the linked spreadsheet or in the image below:

As you can see, the model shows FCF growing at 10%, 15%, and 20% over the next 10 years. Afterwards, the model assumes FCF to grow at 1% indefinitely.

Margin of Safety

Because many inputs in this model are based on assumptions, you should reduce this buy price range by anywhere between 10 to 50%, (I used 20%), which is called the “margin of safety.” This will then give you the real buy price range from $103 (expected growth) to $192 (high/unexpected growth).

Ultimately, because Texas Instrument’s current stock price is $196, and I expect Model 1 (10% annual FCF growth) to be the most likely outcome, Texas Instruments is currently overvalued and not worth buying at its current price.

How to Estimate Expected Return

Now, I will show you how to estimate the expected return for Texas Instruments, continuing with the example above.

To begin, you must find the current stock price for your company. For Texas Instruments, this price is currently $196. Next, select the model with the most likely outcome from your DCF model. As stated before, for Texas Instruments, this will be Model 1 (with 10% annual FCF growth).

Afterwards, simply change the discount rate (required rate of return) that you used in your DCF model until the buy price per share, for the most-probable model you selected, is roughly equal to the company's stock price today. Keep in mind that the lower the discount rate, the higher the buy price per share.

In Texas Instruments' case, I had to change the discount rate from 10% to 6.2% to result in a buy price of $196 (with a 20% margin of safety). Therefore, the DCF model is suggesting that the buy price per share ($196) is equal to the current stock price ($196), in order to achieve a 6.2% annual required rate of return (approximately).

How to Calculate Realized Returns

Calculating realized returns from a stock investment is rather straightforward, but should be done to compare with your initial expected return estimate.

Returns from stock investments are through capital gains (selling the stock for more than what you bought it for) and/or dividends (cash payments from the company).

Percent returns can be calculated by using the formula below:

Return (%) = (Capital gains + Dividends) / Purchase price

Dollar returns can be calculated by using the formula below:

Return ($) = Capital gains + Dividends

Calculating the capital gains from a stock is straightforward. Simply deduct the purchase price from the selling price of the stock. Dividends can be calculated by taking the annual dividend per share and multiplying it by the length of your holding period.

For example, if you bought a stock for $20 and sold for $40, perhaps 5 years later, your realized capital gains will be $20 ($40 - $20). If this stock issued $5 in dividends over 5 years, you would have $25 in total ($20 + $5). Multiplying this number by the number of shares you own will result in your realized total return. Therefore, if you bought 100 shares, you would've made $2500 in profit.

The Bottom Line

You can estimate the expected return of a stock investment by using the discounted cash flow (DCF) model, applying the most likely growth rate for free cash flow (FCF), and altering the discount rate (required rate of return) until it hits the stock's current stock price. Once the stock is sold (after 1+ years), you can calculate the real return on your investment.

This process is particularly useful when the market crashes and you have a watch list of companies that may have previously been too expensive to be considered worthwhile investing in. In other words, when the market crashes and stocks can be bought at much cheaper levels, investors can calculate the expected return for each company in their watch list, and simply purchase those that are offering the best deal (expected return) to you as an investor.

In closing, this approach should enable better investment decisions by helping you determine (approximately) the annualized return you can be expecting from a stock investment. Moreover, understanding how to estimate the expected return of a stock can contribute to more confident investment decisions.