In this article, I will show you how to calendarize financial data in valuation models. Calendarization directly adjusts financial data from companies with differing fiscal year ends to match a standard calendar year. This adjustment is essential for ensuring accurate financial comparisons and analyses, especially when evaluating companies within the same industry that operate on different fiscal timelines.

This article will explain calendarization, the difference between calendar year (CY) and fiscal year (FY), and the calendarization formula. Then, it will offer two real-world examples, including calendarizing historical financial data and calculating forward multiples based on current and forecasted financial data.

Calendarization Explained

Under U.S. GAAP accounting, public companies must file quarterly (10-Q) and annual (10-K) reports, with many using December 31st as the fiscal year-end to align with the calendar year. For companies on different fiscal schedules, calendarization adjusts their financial reporting to match the standard calendar year, ensuring consistency and comparability.

This process is especially important in sectors like retail, where the timing of sales, such as during the holiday season, can significantly impact financial outcomes. Without calendarization, financial comparisons could be misleading due to differing reporting periods. By standardizing financial statements to a uniform period, calendarization facilitates accurate and fair comparisons.

Calendar Year (CY) vs. Fiscal Year (FY)

Understanding the distinction between a calendar year (CY) and a fiscal year (FY) is crucial for grasping the concept of calendarization. A calendar year extends from January 1st to December 31st. In contrast, a fiscal year, relevant for accounting and financial reporting, spans 12 months but does not necessarily coincide with the calendar year.

Companies and governments select their fiscal year-ends based on operational cycles, often influenced by seasonality. This strategy allows for reporting financials after key business periods, providing a more transparent view of performance and easing financial reporting after peak seasons. For instance:

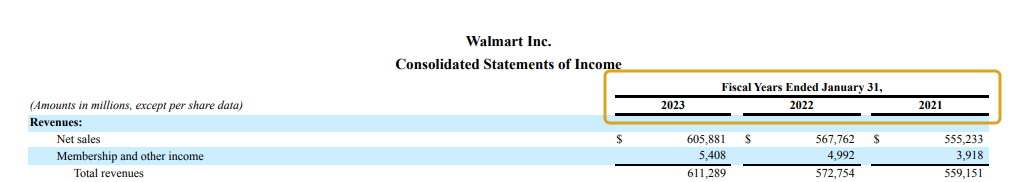

- Walmart (WMT): Reports on January 31st, capturing the post-holiday season.

- H&R Block (HRB): Reports on April 30th, following the tax season.

- U.S. Federal Government: Reports on September 30th, aiding in the federal budget's timely finalization.

In short, calendarization aligns financial data from companies with varied fiscal year-ends, ensuring accurate and fair financial comparisons by standardizing reporting periods.

How to Calendarize Financial Data

Calendarization aligns the financial performance data of companies across different fiscal years, primarily for items on the income statement or cash flow statement, such as revenue. This ensures an accurate comparison. It's not used for balance sheet items, as these reflect a specific point in time, not a period.

The formula for calendarizing financial data is shown below:

Calendarized Financial Data = [(Overlapping Months Prior FY / 12) × Prior FY Financial Data] + [(Overlapping Months Current FY / 12) × Current FY Financial Data]

In this formula:

- "Overlapping Months Prior FY" and "Overlapping Months Current FY" indicate the number of months in the prior and current fiscal years, respectively, that overlap with the calendar year being analyzed.

- "Prior FY Financial Data" refers to the financial data from the fiscal year before the current one.

- "Current FY Financial Data" is the financial data from the ongoing fiscal year.

The calendarization process follows two main steps:

- Calculate Prior FY Contribution: Multiply the prior year's financial data by the fraction of the year that overlaps with the calendar year to determine the contribution of the prior fiscal year that overlaps.

- Calculate Current FY Contribution: Multiply the current fiscal year's financial data by its respective overlapping fraction to determine the contribution of the current fiscal year that overlaps with the calendar year.

By using this formula, financial data such as revenue is adjusted to align with a standard calendar year. This adjustment is essential for comparing companies with different fiscal year-ends. It compensates for seasonal variations and timing differences, ensuring that comparisons are based on consistent and comparable periods, thereby facilitating more accurate financial assessments and valuations.

Calendarization Example

Let's consider a scenario where we need to compare the revenue of Microsoft (MSFT), with a fiscal year ending on June 30th, to Google (GOOGL), which ends on December 31st. To facilitate this comparison, we must calendarize Microsoft's revenues.

For our example, we aim to adjust Microsoft's FY 2022 and FY 2023 revenues to align with Google's FY 2022 calendar year.

First, identify the number of months Microsoft's fiscal year overlaps with the standard calendar year used by Google. Since Microsoft's fiscal year ends in June, the 6th month, there are 6 months of overlap for both FY 2022 and FY 2023 with the calendar year.

To calculate the overlap as a percentage, we divide the number of overlapping months by 12. F or Microsoft, this results in a 50% overlap for both fiscal years when compared to Google's calendar year.

These steps are visualized below:

Next, gather the revenue figures for the relevant fiscal years. These can be sourced from financial data websites or the companies' 10-K annual reports available on the SEC. For private companies or internal analysis, this information might need to be requested from the accounting department or the client.

Microsoft's reported revenues are shown below (in USD millions):

- FY 2022 Revenues: $198,270

- FY 2023 Revenues: $211,915

Applying the overlap percentage to Microsoft's revenues for FY 2022 and FY 2023, we calculate the calendarized revenue for 2022 as follows:

Calendarized Revenue [MSFT] = [(6 / 12) × $198,270] + [(6 / 12) × $211,915] --> $205,093

Therefore, Microsoft's calendarized revenue for 2022 is $205,093 million.

Excel Calendarization Model

We can also build a calendarization model in Excel to simplify this process, as shown below for our GOOGL and MSFT example:

All you need to do is input the calendarization year, the stock tickers (optional), select the fiscal year month for the respective stock ticker, and input the relevant financial data for each fiscal year. As you can see, this model also outputs $205,093 as Microsoft's calendarized revenue for 2022.

Here's the free calendarization model for your use:

How to Calendarize and Calculate Forward Multiples

In valuation models, such as the comparable company analysis, valuing a company involves using forward-looking multiples. These are often preferred over historical multiples, because they offer insights into future performance and potential growth. It's therefore important to understand how to calendarize and calculate these forward multiples.

Forward multiples are a vital valuation metric in comparative company analysis. They link a company's market value (such as enterprise or equity value) to a value driver (like EBIT, EPS, etc.), enabling the assessment of a company's valuation relative to its peers. Calendarization is necessary when earnings value drivers are not directly comparable across different fiscal periods, ensuring that multiples reflect a consistent timeframe for accurate comparison.

Calculations for forward multiples are based on future assumptions derived from an investor's understanding of a business or analyst estimates, which are widely available from various online sources.

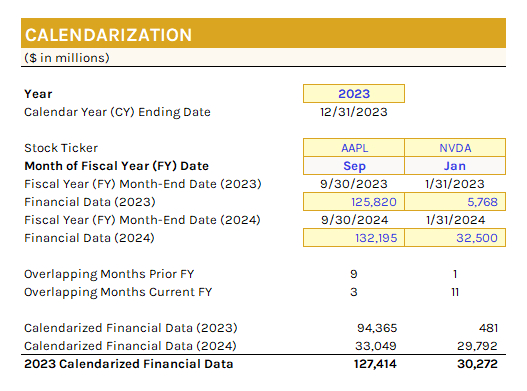

Consider calculating forward enterprise value (EV/EBITDA) multiples for Apple (AAPL) and Nvidia (NVDA), with fiscal year-ends in September and January, respectively. To align their financials for 2023, we require both fiscal year 2023 and forecasted 2024 data, necessitating calendarization for accurate analysis.

Here's the visualization for this scenario:

To calculate the EV/EBITDA multiple, we must begin with the enterprise value (EV), which is a measure of a company's total value and is often used in valuation comparisons. It can be sourced from financial data websites or derived from market data and financial statements.

The current enterprise values for Apple and Nvidia are shown below (in USD millions):

- Apple: $2,983,347

- Nvidia: $1,764,271

Next, we need to find the EBITDA (earnings before interest, taxes, depreciation, and amortization) for the 2023 fiscal year, which is found on the income statement. For the 2024 fiscal year, we either make an assumption or consult analyst estimates for the EBITDAs, as these are forward-looking. One financial data site that offers analyst estimates for EBITDA is TIKR, which we'll use for our estimates. This process must be completed for both Apple and Nvidia.

To begin, Apple's EBITDA's are shown below (in USD millions):

- FY 2023 EBITDA: $125,820

- FY 2024 EBITDA (estimated): $132,195

Calendarizing Apple's EBITDA for CY 2023 involves accounting for the 9 months of FY 2023 and 3 months of FY 2024 that overlap with CY 2023:

Calendarized EBITDA [AAPL] = [(9 / 12) × $125,820] + [(3 / 12) × $132,195] --> $127,414

Therefore, Apple's calendarized EBITDA for 2023 is $127,414 million.

Now, Nvidia's EBITDA's are shown below (in USD millions):

- FY 2023 EBITDA: $5,768

- FY 2024 EBITDA (estimated): $32,500

Calendarizing Nvidia's EBITDA for CY 2023 considers 1 month of FY 2023 and 11 months of FY 2024:

Calendarized EBITDA [NVDA] = [(1 / 12) × $5,768] + [(11 / 12) × $32,500] --> $30,272

Therefore, Nvidia's calendarized EBITDA for 2023 is $30,272 million.

Here's how these steps would appear in the Excel model provided in the previous example:

Now that we have the enterprise values and the calendarized EBITDA values, for both Apple and Nvidia, the EV/EBITDA multiples can be calculated as follows:

- Apple EV/CY 2023 EBITDA: 23.4x ($2,983,347 / $127,414)

- Nvidia EV/CY 2023 EBITDA: 58.3x ($1,764,271 / $30,272)

In closing, these calculations offer useful perspectives for relative valuation models, enabling comparisons of companies on an equal footing, regardless of their differing fiscal calendars.

The Bottom Line

Calendarization is key for comparing companies with different fiscal year ends, ensuring financial data aligns with a standard calendar year. This method is important for sectors with seasonal business cycles and for accurate financial analysis across companies. It's also used in mergers and acquisitions to align financial data for valuation and when comparing parent companies with their subsidiaries, ensuring correct financial statement consolidation.

The process of calendarization is specifically applicable to line items on the income statement and cash flow statement. It employs a straightforward formula to adjust financial data for periods that overlap between different fiscal years. Additionally, calendarization is frequently utilized in the calculation of forward multiples within valuation models. This ensures a uniform method for assessing a company's valuation and potential for growth.

In summary, calendarization ensures accurate and fair financial analysis, serving as an essential tool for valuing and comparing companies.