In this article, I will show you how to calculate and analyze Warren Buffett's owners earnings figure. Owners earnings, or cash flow for owners, is a figure that is commonly used for intrinsic value calculations, and is one of the best figures to depict how much cash one can get out of an investment. It was popularized by Warren Buffett in his 1986 Berkshire Hathaway shareholder letters.

Many investors use earnings per share (EPS), net income, or some other figure to assess the cash generated for investors. However, the number that Warren Buffett uses is called "owners earnings," which is a term that many investors are unfamiliar with.

Investors make money in the stock market in two ways:

- Capital appreciation: When the stocks an investor owns appreciates in value over time, and the investor sells the stocks to profit the difference.

- Dividend payments: Payments that dividend-paying companies give out to investors for holding their stock.

As an investor, you can analyze the cash flows a business generates to see how these internal cash flows convert into capital gains and dividends. In the process, you'll be able to better assess the value of a company and determine its earnings, which can lead to more confident investment decisions.

Owners earnings is therefore one of the best figures you can use to determine how much cash goes back to the company's owners, and the real dollar amount owners can withdraw without harming operations.

So, in this article, I will show you how to calculate and analyze owners earnings, and make sense of all of its components. I will also provide you with several examples along the way.

Warren Buffett's Owners Earnings

Finding owners earnings will provide you with a more accurate depiction on how much cash is left over after the normal operations of the business.

Warren Buffett's first mention of the phrase "owners earnings" was in his 1986 Berkshire letter, as quoted below:

"If we think through these questions, we can gain some insights about what may be called "owner earnings." These represent (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges such as Company N's items (1) and (4) less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume. (If the business requires additional working capital to maintain its competitive position and unit volume, the increment also should be included in (c). However, businesses following the LIFO inventory method usually do not require additional working capital if unit volume does not change.)"

— Warren Buffett | 1986 Letter to the Shareholders

The formula below captures what Buffett is saying here about calculating owners earnings:

Owners earnings = Net income + Non-cash charges - Maintenance capital expenditures (CapEx)

where:

- Non-cash charges: Includes depreciation, depletion, amortization, impairment charges, and any other non-cash charges.

- Maintenance CapEx: Money a company spends to maintain the normal operations of the business.

Buffett's formula for owners earnings can also be simplified into the formula below:

Owners Earnings = Operating cash flow - Maintenance capital expenditures (CapEx)

where:

- Operating cash flow: Cash generated from the normal operations of a company.

The difference here is that "net income + non-cash charges" in the formula above is replaced with "cash flow from operations," from the cash flow statement. This alternative owners earnings formula is typically more accurate as net income can be manipulated and non-cash charges often differ between companies. This formula also happens to be easier to calculate, which is ideal. Now, let's go through each of these two components and understand what they are in more detail and how you can go about finding them.

Operating Cash Flow

Operating cash flow is otherwise known as "net cash provided by operating activities," "net cash generated by operating activities," or something similar along those lines.

This is the easier component of the formula, as this figure is already calculated and provided to us by companies in their annual reports. Simply go to your chosen company's investor relations page, click on any 10-K annual report, and navigate to the cash flow statement.

If you're having trouble finding your company's annual report or want to become more familiar with 10-K annual reports before proceeding, I would recommend reading this article on How to Read and Analyze Any 10-K Annual Report.

The statement of cash flows has three sections:

- Operating Activities: Includes the real cash inflows and outflows that are related to the normal operations of the business. This includes the costs of running the business on a day-to-day basis, and includes the costs associated with sustaining the company's core business model.

- Investing Activities: Includes cash flows that are used to purchase assets that the company expects to produce value for many years to come. This is where companies spend their money and invest it on purchasing buildings, machinery, and even making acquisitions.

- Financing Activities: Includes all the cash flows related to financing. This includes raising debt, paying down debt, delivering capital to shareholders, paying dividends, raising shares, and buying back shares.

The number we're looking for is the "cash from operating activities" (or something very similar). This is shown on the last line under operating activities, or the first section of the statement of cash flows.

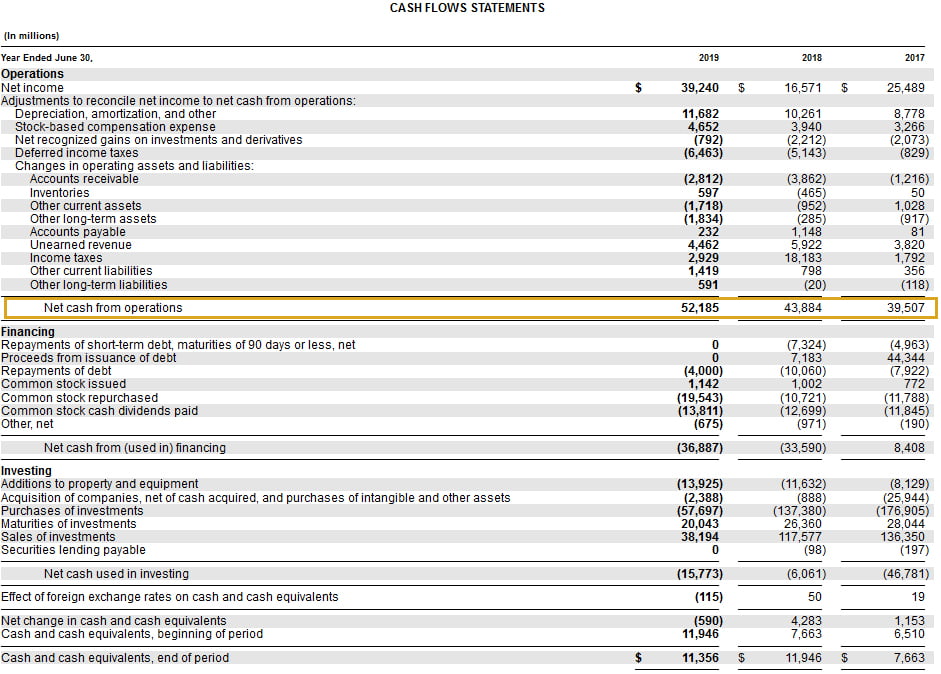

This is also outlined below, with Microsoft's (MSFT) most recent cash flow statement as an example:

For the first component of the owners earnings formula, you should look at the net cash generated from your company's normal operations. In our case, I will use the most recent figure ($52.185 Bil.) for this example.

Capital Expenditure Overview

After locating the operating cash flow from the operating activities section of the cash flow statement, the next step is to find and subtract the maintenance CapEx. Again, this is needed to compute owners earnings.

Unfortunately, companies typically do not outright provide maintenance CapEx in their 10-K annual reports. Therefore, this number is a little bit trickier to solve, unlike the operating cash flow number which is always provided.

But first, before learning how to compute maintenance CapEx itself, it's important to begin with just total CapEx.

Capital Expenditure

Capital expenditure (total CapEx) is considered an investing cash flow on the cash flow statement.

As mentioned before, this is where companies are spending their money and purchasing long-term assets which they hope to provide value for the business over the long-term. Total CapEx is therefore considered as an investing activity and relates to buildings, property, plant, and equipment. This is commonly referred to on the cash flow statement as property, plant and equipment (PP&E).

Therefore, if you see a line on the cash flow statement called "cash spent on property, plant and equipment," or something similar, this is essentially what capital expenditure is.

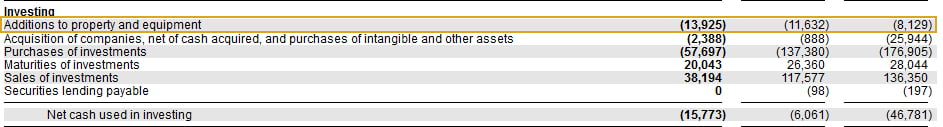

For Microsoft, this is shown as "Additions to property and equipment" as outlined below:

As you can see, Microsoft had $13.925 billion of total CapEx in 2019.

Sometimes, the number shown here is not the actual total CapEx amount. For example, for Apple (AAPL), a massive multinational technology company (which I'm sure you've heard of), the number for capital expenditure (PP&E) that is shown on the cash flow statement is not accurate. Instead, you have to do a search for "capital expenditure" in their 10-K annual report to find the actual number.

Therefore, I would recommend searching the term "capital expenditure" or "capital assets" when you are seeking this information for any company, just to ensure that you're looking at the right number.

Components of Total Capital Expenditure

Now that we have the total CapEx number, the next step is to figure out maintenance CapEx. What this really means, is that we need a component of this total CapEx number.

In reality, total CapEx falls into two categories:

- Growth CapEx: When companies spend money to grow and improve their business, in an attempt to produce more cash in the future, this is considered as growth CapEx. This includes any investments made for building purchases or upgrading company equipment.

- Maintenance CapEx: This is the figure that we're trying to find, and it's how much money the company is spending just to maintain the business and its operations. For example, if a piece of machinery were to break down, the company would spend money to restore it. Because restoring this piece of machinery doesn't improve the cash flows of the business, and is not seen as an investment that grows the business, it's considered a maintenance CapEx.

Although rare, some companies actually make a distinction in their annual reports as to how much was spent on maintenance and how much was spent on growth.

For example, management in the annual reports may say:

"Total capital expenditure was $100 million for 2019. We spent about $60 million maintaining the business and $40 million on growth potential."

Below is an example of Phillips 66 (PSX), a large energy manufacturing and logistics company, where growth and maintenance CapEx are described and separated:

Outlined above are the total cash from operating activities number, which can also be seen on the cash flow statement, and the total $5.3 billion Phillips 66 expects to budget for its growth CapEx category.

The "Operating Excellence," or maintenance CapEx, is what we have to solve for. We can do this with the provided total CapEx ($5.764 Bil.) found in the cash flow statement:

Therefore, Phillips 66's maintenance CapEx for 2016 would be $464 million ($5.764 Bil. - $5.3 Bil). Then, using the $5.713 billion in cash from operating activities, we can subtract the $464 million to solve for owners earnings. This would result in $5.249 billion in owners earnings.

Unfortunately, most companies, including Microsoft, do not provide this much information in their annual report. Therefore, as investors, we have to make an educated estimate on what is maintenance and what is growth from the total CapEx number. This will provide us with a more accurate owners earnings calculation.

Shortcut to Maintenance Capital Expenditure

If you do not want to go through the trouble of estimating the portion of maintenance and growth from the total CapEx number, the most conservative method you can use is to simply assume that all of the total CapEx (aka PP&E) amount is maintenance.

If you solve for owners earnings in this manner, what results is a number called free cash flow (FCF):

Free cash flow (FCF) = Cash from operations - Total capital expenditures (CapEx)

FCF is the cash available to repay debt and make dividend payments after operating expenses and capital expenditure requirements are paid off. You can just use the FCF number if you don't want to spend your time figuring out the specifics of the growth and maintenance CapEx numbers.

However, I would highly suggest that if you want to more accurately value a business, then you should try your best to distinguish between growth and maintenance CapEx.

How to Find Maintenance Capital Expenditure

For companies where growth and maintenance CapEx are not distinguished, you'll have to estimate this maintenance CapEx figure to solve for the owners earnings figure.

If you have not already done so, the first step is to locate the total CapEx number, as previously covered. The next step is to figure out what proportion of this total CapEx number is maintenance, and what proportion is growth.

Besides management outright telling us the proportions of maintenance and growth CapEx (as shown in the Phillips 66 example), there are two ways management will talk about maintenance CapEx in the 10-K annual reports:

Maintenance CapEx is Implied

Management commonly implies the growth and maintenance CapEx figures. This is when maintenance CapEx is stated, in some way or another, but not in a clear fashion. In other words, maintenance CapEx is merely implied or suggested through the way management has written it, and not clearly given. Therefore, it's not clear on how much exactly goes towards growth or maintenance CapEx.

An example of this is Jack In The Box (JACK), a large fast food restaurant chain. As you can see in the image below, CapEx is broken down into multiple categories and a description. For this particular example, you can focus your attention on the outlined area:

For Jack In the Box, you could therefore assume that the following items are growth CapEx numbers, as money is being spent to grow the business:

- New restaurants

- Purchases of assets intended for sale or sale and leaseback

- Other, including facility improvements

- Information Technology (for both restaurants and corporate services)

On the other hand, you can likely infer that only "restaurant facility expenditures" is maintenance Capex, as it relates to the operational expenses required to sustain the business. Although this estimation may not be the most accurate, I used the description below the total CapEx number and my knowledge on growth and maintenance CapEx to make the best judgement I could.

Clearly, this differentiation is not always super clear or explicit, and those who are more knowledgeable about a particular business and the industry it's in can likely provide a more accurate estimate on this maintenance CapEx number.

Maintenance CapEx is Not Provided

Often times, management will not say anything about maintenance CapEx in their 10-K annual reports. Instead, they would only list their total CapEx number and would provide generic information on what they spent their money on.

This is when we are forced to make more vague maintenance CapEx estimations, or take the longer approach and attempt to calculate it as discussed in next section.

There are two general things you can do when maintenance CapEx is not given or implied:

- Estimate a percentage: You would estimate the percentage of maintenance and growth CapEx based on the business and industry knowledge you have. If you read through the most recent 10-K annual report, management will likely make a few comments on CapEx spending, which can help you make a more accurate estimation.

- Assume all of CapEx is maintenance: You can be extremely conservative and approach the problem in this manner, and calculate free cash flow (FCF) as mentioned before. However, if you were to do this, you would assume nothing is being spent on growth, even though this does not necessarily hold true. Regardless, this is what I would recommend doing if you are in doubt and cannot make an accurate percentage estimate.

If you want to avoid vague maintenance CapEx estimates, or if you want to double-check any assumptions you may have made, then it's never a bad idea to read the next section where a more involved process will be used to calculate maintenance CapEx. However, if you feel confident in the maintenance CapEx you have estimated, there is nothing wrong with computing owners earnings from here on.

How to Calculate Maintenance Capital Expenditure

The simplest way to calculate maintenance CapEx is to just use a figure called "depreciation and amortization," found on the financial statements, as this accounts for the diminishing value of an asset over time:

Maintenance CapEx = Depreciation and amortization

Although you can use this as a solution, there is one major flaw (if not more).

The problem, is that depreciation can be misleading at times, which can lead to an unrealistically high number for maintenance CapEx calculations. Accounting-related depreciation is misleading, as it can be higher due to price reductions from technological advancements. Depreciation can also be lower in an inflationary environment, where reproduction costs are higher.

Therefore, although it's a more involved process, using Bruce Greenwald's method of calculating CapEx is the next step you should take, as it works towards finding true depreciation.

Bruce Greenwald's Maintenance CapEx Calculation

Bruce Greenwald is widely recognized for his authority on value investing, and his method for calculating maintenance CapEx is ideal when it's not provided in the 10-K annual reports, or if you cannot make an accurate estimation.

In Bruce Greenwald's book: Value Investing: From Graham to Buffett and Beyond, he describes how you can go about calculating maintenance CapEx. This is summarized in the bullet points below: (Source)

- Calculate the average gross property, plant and equipment (PP&E)/Sales ratio over 7 years.

- Calculate current year's increase in sales.

- Multiply the PP&E/Sales ratio by the increase in sales to get growth CapEx

- Subtract the computed growth CapEx from the CapEx figure (in the cash flow statement) to get maintenance CapEx, which is the true depreciation for the company.

Now, I will use Microsoft's actual Sales and PP&E (total CapEx) numbers from their past seven financial statements, so that I can calculate their maintenance CapEx (which is not given on their annual reports).

The two table shown below show how you can go about setting up Greenwald's method for calculating maintenance CapEx, in this case for Microsoft. I've broken this down into steps and two different methods as well. Whichever method you use doesn't matter, although method #2 is a lot more simpler.

Method #1

See the table and steps 1-5 below:

Values are in millions of U.S. $

- Step 1: The first step is to find revenue (sales) and the plant, property and equipment (PP&E), which we also know as total CapEx, for the last seven years. This information can be found on the income statement and cash flow statement.

- Step 2: The next step is to take PP&E (CapEx) and divide over sales. This will provide you with the PP&E/Sales ratio, which shows how much the company needs to invest in PP&E to generate $1 of sales. For example, in 2020 Microsoft needed about $0.108 in PP&E to generate $1 in sales ($15,441 / $143,015).

- Step 3: Average the PP&E/Sales ratio from 2014 to 2020, to normalize company movement and distortions caused by business cycles. For Microsoft, this comes to 8.95%, which we will then use to compute growth CapEx.

- Step 4: Compute growth CapEx using the 8.95% figure. You can do this for every year. For example, in 2020, this would be $1,537 in growth CapEx ($17,172 x 0.0895). Note that although we have 7 years worth of sales and PP&E (total CapEx), 2014 data is only used to calculate the average PP&E/Sales ratio and the annual changes for Sales and PP&E.

- Step 5: Finally, solve for maintenance CapEx by taking the PP&E (CapEx) figure and subtracting the computed growth CapEx figure for the year. For example, in 2020, this would be $13,904 ($15,441 - $1,537). The latest CapEx figure is also the most relevant for computing owners earnings.

Method #2

Alternatively, you can follow step 1 and step 2 above (skip steps 3-5), and then just apply the formula shown below to estimate maintenance CapEx:

Maintenance CapEx = CapEx - (PP&E % of sales * Sales growth (decrease))

In this case, you do not have to average out PP&E/Sales Ratio and apply it to growth CapEx. Instead, you're directly solving for maintenance CapEx. This is shown below:

Values are in millions of U.S. $

As you can see, the end result does not differ too much between the two methods (Method #1: $13,907 vs. Method #2: $13,587). This is because you're essentially applying the same concept, just in a different manner.

Conclusion

This method works best for companies that are relatively consistent, but not for companies who experience a sales growth number greater than the PP&E (total CapEx) figure. It also doesn't work well for commodity-based businesses.

This method is not a perfect solution to finding the maintenance CapEx number. Regardless, it's the best calculation-based method out there, and can be utilized when all else fails. However, if you're not confident in the solution you arrive at using Greenwald's method, then just stick with using the total CapEx figure and calculate free cash flow (FCF) instead.

The Bottom Line

In summary, owners earnings, popularized by Warren Buffett, is one of the best figures you can use to estimate how much cash is left over after the normal operations of the business for its shareholders.

Owners earnings can be calculated by subtracting maintenance capital expenditures (CapEx) from the operating cash flows of a business. This is a rather simple calculation, but maintenance CapEx is a number that is not always explicitly provided, and often times needs to be estimated through various means in order to solve for owners earnings.

However, once accomplished, this owners earnings number can be applied to your intrinsic company valuations (in replace of free cash flow (FCF)), to more accurately determine whether a stock is overvalued or undervalued at its current stock price. Therefore, it's in your best interest to become comfortable with finding the components of owners earnings, so that you can make more informed and accurate investment decisions in the future.