In this article, I will show you how to write an investment policy statement (IPS), specifically for the average do-it-yourself (DIY) retail investor. An IPS is a formal document that outlines one's objectives and investment strategy. Most investors should have an IPS because it helps them consolidate their investment strategies into a coherent plan, protecting against the risks of emotional investing and self-sabotaging behaviors that many investors are prone to.

This article will explain the IPS in greater detail, highlighting its key benefits and main components, and will also provide a free example/template.

Investment Policy Statement (IPS) Explained

An investment policy statement (IPS) is a formal document outlining the guidelines and objectives for an individual or institutional investment portfolio. Created through discussions between the investor (or client) and the portfolio manager (which may just be yourself), the IPS contains important details such as the client's risk tolerance, investment time horizon, preferences, restrictions, and specific financial goals. This document provides the foundation for how the portfolio will be managed, detailing allowable investment strategies to meet the outlined objectives.

Its purpose is to ensure a consistent approach to managing investments, serving as a decision-making framework and a tool for ongoing portfolio evaluation. The IPS is tailored to each investor's unique situation, reflecting that no two investors have identical financial goals or needs. It also outlines the conditions under which the IPS itself can be updated, such as significant changes in the client's financial situation, while discouraging modifications based on short-term market fluctuations.

By setting clear guidelines for both the portfolio manager and the client, the IPS acts as a safeguard against emotional investing, reminding all parties of the long-term strategies and goals of the investment portfolio.

Importance of an IPS

An investment policy statement (IPS) plays an important role in investment management, whether it's being used by money managers or individual investors.

For portfolio managers and financial advisors, the IPS outlines the investment parameters within which they must operate, detailing specifically what assets are permissible. This sets clear boundaries for investment actions, providing both clarity for the client and a measure of protection against potential mismanagement.

For the average retail investor, although drafting an IPS is not common, doing so can offer significant advantages. The process of creating an IPS can help organize a diverse range of investment thoughts into a cohesive and actionable plan. This is particularly beneficial for beginners who might feel overwhelmed by the breadth of investment information available.

Moreover, an IPS acts as a defense against common behavioral biases that often undermine investment strategies. These biases lead to decisions based on emotion rather than rational analysis and can significantly impact investment outcomes. Key biases include:

- Performance Chasing: Buying assets after they have performed well, hoping the trend continues.

- Reactivity: Making hasty decisions based on temporary market fluctuations.

- Overconfidence: Believing one's ability to make investment decisions is better than it actually is.

- Loss-Aversion: Unwillingness to sell underperforming assets to avoid realizing a loss.

By requiring decisions to align with the IPS, investors are less likely to act impulsively, ensuring that any actions taken are in service of long-term goals and within established parameters.

Investors lacking an IPS may also be more susceptible to making decisions driven by emotional reactions or popular trends. This includes:

- Herding: Following the crowd into an investment because it has recently performed well.

- Market Timing: Attempting to predict market drops and rises, which often results in buying high and selling low.

- Recency Bias: Giving too much weight to recent events while ignoring long-term historical trends.

- Authority Bias: Making investment decisions based on the recommendations of famous investors or "financial gurus."

An IPS proves its worth especially during tumultuous market periods, offering a steadfast guide that reminds investors of their long-term objectives and tolerance for risk. It helps maintain focus on the overarching investment strategy, despite the inevitable ups and downs of the market, and promotes disciplined adherence to a well-considered plan, minimizing the impact of detrimental biases and behaviors.

Components of an Investment Policy Statement (IPS)

While professional investment policy statements (IPS) from money managers for their clients typically adhere to CFA Institutes' guidelines and are polished, somewhat complex, and lengthy, the average DIY retail investor likely doesn't need anything fancy. A simple, yet customized IPS suffices. You don't need the perfect IPS immediately; start with the basics and revise as needed to ensure it remains relevant and helpful.

Although the IPS is a customizable document, there are essential components that should be included in the final version. Without these components, the benefits of an IPS may be minimal. These items are described in detail in the sections below.

IPS Example

Here's an example IPS document you can make a copy of and edit to fit your own personal investment goals and financial situation. This example is relatively simple but encompasses much of what is discussed below. It's also an example, so don't copy the allocation percentages or fund selections without doing your own diligence.

Account Information

Including detailed account information in an IPS is useful for aligning investment strategies with an investor's financial situation and goals. It ensures a clear overview of assets, facilitating informed decision-making.

Key financial account information includes:

- Account Overview: Lists all financial accounts, including savings, checking, retirement (e.g., 401(k), IRAs), education savings, and investment accounts. This section highlights both tax-advantaged and taxable accounts.

- Account Details: Provides information on the institutions where each account is held, partial account numbers for reference, and, optionally, current balances to accurately reflect the investor's financial state.

- Beneficiaries and Access: Notes designated beneficiaries for relevant accounts, aiding in estate planning, and outlines access methods to account management tools and financial institution contacts, without including sensitive login details.

By incorporating detailed financial account information into the IPS, investors gain a holistic view of their assets, enabling more informed and strategic investment decision-making. It also serves as a reference for adjusting the investment approach in response to significant changes in financial status, as detailed later.

Investment Objectives

The investment objectives section of an IPS document covers the investor's return requirements and risk tolerances. This is tied to the account information section, given that understanding the current financial assets and their classifications informs the realistic setting of these objectives and tolerances.

Starting with your short-term and long-term financial goals is recommended, as it sets a clear framework for your investment strategy:

- Short-Term Goals: These might include immediate liquidity needs, such as saving for emergencies or significant purchases (e.g., down payment for a house).

- Long-Term Goals: Focus on retirement planning, detailing the desired retirement age, funding requirements based on withdrawal rates, and considerations for potential lifestyle changes. The necessary portfolio value at retirement can be estimated using a safe withdrawal rate (SWR).

For both short-term and long-term goals, it's advisable to specify your timeframe for achieving these goals. This involves outlining your approach, which usually requires a detailed understanding of your asset allocation (discussed later) and their expected returns. It also includes determining how long you need to maintain and potentially continue investing in these assets.

Regarding the required level of return for your short-term and long-term goals, this can be expressed both quantitatively and/or qualitatively:

- Quantitative: Clearly specify the desired rate of return in numerical terms, taking factors like inflation into account. Differentiate between real returns, which adjust for inflation to reflect growth in purchasing power, and nominal returns, which indicate total growth before inflation adjustments, including after-tax results. For example, an 8% growth in a year (nominal return) with 3% inflation would adjust to a 5% real return. These specifications aim to fulfill specific financial objectives, such as generating sufficient retirement income to cover living expenses or tracking/outperforming a benchmark index (e.g., the S&P 500) by a certain percentage.

- Qualitative: Focus on non-numeric goals, such as the need for current income, capital preservation, capital appreciation, and the pursuit of an overall total return. Capital preservation aims to maintain the real value of the portfolio over time, ensuring stable future purchasing power. Capital appreciation seeks to grow the portfolio's value over time. Total return aims for a comprehensive strategy to enhance the portfolio's worth by combining income generation with capital growth.

After detailing return expectations both quantitatively and/or qualitatively, it's crucial to assess and describe your risk tolerance. This step is necessary because it recognizes the inherent risks in investing. If your risk tolerance doesn't align realistically with your short-term or long-term goals, adjustments to your goals or risk approach may be required.

For example, planning to retire at 65 while being 50 and having an aggressively growth-oriented portfolio (e.g., 75%+ in equities) may not be prudent due to the volatility and shorter recovery period for any market downturns.

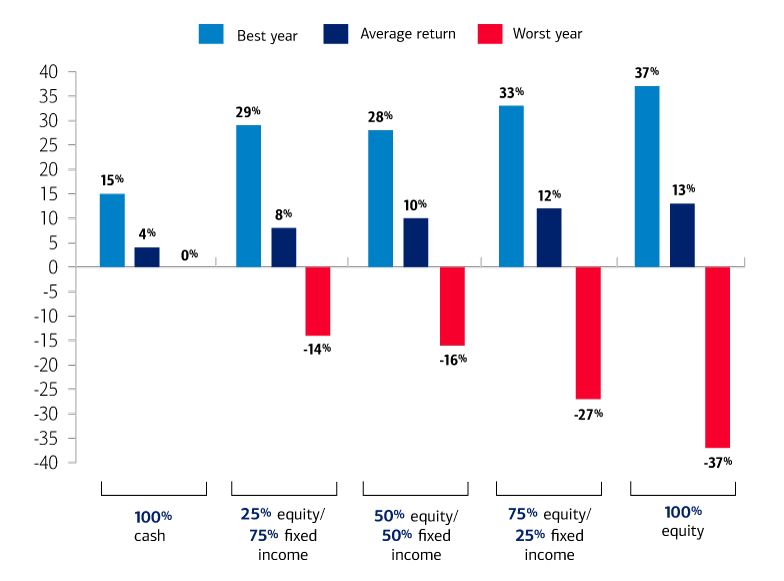

An illustration based on actual investment returns from 1977 to 2022 demonstrates the volatility and expected returns associated with different stock/bond portfolio allocations:

Now, when describing risk tolerance, which some might classify as "constraints" in an IPS, investors should consider the following factors:

- Time Horizon: The time until the funds are needed greatly influences risk tolerance. Longer horizons typically allow for higher risk exposure, given the potential for recovery from market volatility.

- Investment Capital: The amount available for investment affects risk tolerance, with larger portfolios potentially able to withstand more downside risk.

- Discretionary Income: Income remaining after essential expenses can affect an investor's ability to absorb losses, thus influencing risk tolerance.

- Financial Goals: The necessity for growth versus preservation of capital is determined by both short-term and long-term objectives, as detailed earlier.

- Market Experience: An investor's previous experience with the market can affect their comfort level with market fluctuations and risk.

- Life Circumstances: Changes in job stability, health, and family responsibilities can alter risk tolerance over time.

- Liquidity Needs: The need for ready access to funds can reduce risk tolerance, as certain investments might not be easily liquidated without significant loss.

- Economic Factors: Global or local economic conditions can influence risk tolerance, with more stable conditions potentially allowing for higher risk-taking.

- Tax Considerations: Assess tax implications, including tax efficiency, the investor's tax brackets, allocation between account types, capital gains implications, tax loss harvesting, and estate planning. These considerations impact risk tolerance by affecting the net returns investors receive and their capacity to endure market volatility and achieve financial objectives.

Collectively, these factors shape an investor's risk tolerance, guiding the development of a portfolio that aligns with their financial situation, goals, and comfort with risk.

Investable Assets

An IPS should also include a section on investable assets, specifying the types and categories of assets that an investor is open to including in their portfolio. This aids in diversifying investments and aligning them with the investor's risk tolerance and financial goals.

Investable assets can encompass:

- U.S. Stocks: Diverse sectors and market caps (large, mid, small).

- International Stocks: Both in developed markets and emerging economies.

- Bonds: Government, corporate, municipal, and international bonds.

- Real Estate: Real estate investment trusts (REITs) and direct property investments.

- Commodities: Gold, oil, and agricultural products.

- Alternative Investments: Hedge funds, private equity, venture capital, and collectibles.

- Cash and Equivalents: Money market funds and certificates of deposits (CDs).

- Derivatives: Options and futures for advanced strategies.

- Cryptocurrencies: Digital assets such as Bitcoin, Ethereum, and other altcoins.

Delineating these assets in an IPS helps in creating a balanced and tailored investment approach. Deciding on which assets you will invest in vs. those you will not consider investing in is useful to increase the diversification of your portfolio, while also preventing yourself from investing in "hot" assets that may not be suitable for your long-term investment goals.

Given that many investors don't invest heavily in individual securities, it may be beneficial to specify which types of funds you'll consider investing in as well. Funds can be categorized into various types, each with its unique investment approach:

- Passive Index Funds: Track specific benchmarks with minimal management.

- Actively Managed Funds: Managers make decisions in an attempt to outperform the market.

- Options-Based Funds: Employ options strategies for income, protection, or speculation.

- Sector and Thematic Funds: Target specific industry sectors or themes.

- Fixed Income Funds: Focus on bonds and other debt instruments for income generation.

For instance, many investors stick with passive index funds and fixed income funds, while those more comfortable with risk and willing to accept generally higher expense ratios may opt for actively managed funds.

Asset Allocation

Building upon the investment objectives and risk tolerance outlined in an IPS, the target asset allocation section provides a roadmap for constructing a portfolio that aligns with the investor's goals and constraints. Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, cash, and alternative investments, based on the investor's risk tolerance, time horizon, and financial objectives.

The target asset allocation should be expressed in percentage terms for each asset class and can be further broken down into sub-categories, such as market capitalization (large-cap, mid-cap, small-cap) for stocks or credit quality (investment-grade, high-yield) for bonds. This level of detail helps ensure that the portfolio remains well-diversified and aligned with the investor's risk profile.

When determining the target asset allocation, consider the following factors:

- Risk and Return Expectations: Each asset class has its own risk and return characteristics. Stocks generally offer higher potential returns but come with increased volatility, while bonds tend to provide lower returns but with greater stability. The target allocation should balance the investor's desire for growth with their tolerance for risk.

- Correlation: Asset classes with low or negative correlations can help diversify the portfolio and reduce overall risk. For example, bonds often have a low correlation with stocks, meaning they may perform well when stocks are struggling, and vice versa.

- Active Management: Different asset allocation strategies may require varying levels of active management. For instance, factor investing, which considers factors like size, value, and profitability, may require more active management to consistently tilt the portfolio towards these factors. This approach aims to outperform the market by exploiting specific market inefficiencies. On the other hand, a more passive approach, like the Bogleheads' philosophy, which emphasizes low-cost, broad-market index funds, requires less active management and seeks to match market returns rather than outperform them.

- Minimum Investment: The IPS should specify the smallest percentage of the portfolio that can be allocated to any one asset or investment, suggesting a minimum threshold, such as 5% or more. This ensures that if an investment generates substantial returns, it will have a meaningful impact on the overall portfolio performance, making the allocation worthwhile. Setting a minimum investment percentage also helps to avoid over-diversification and maintains a focused, manageable portfolio.

It's important to note that the target asset allocation may change over time as the investor's financial situation, risk tolerance, and investment objectives evolve. Consequently, the target asset allocation within their investment policy statement (IPS) should adapt to reflect these changes. The pie charts below demonstrate how a typical investor's asset allocation might shift as they progress from a young investor to one approaching retirement:

As you can see, as the investor progresses through these life stages, the target asset allocation gradually shifts from a more aggressive, stock-heavy portfolio to a more conservative, bond-focused one.

Lastly, the IPS should also note the acceptable range for each asset class. For instance, the allocation to stocks might be allowed to fluctuate between 55% and 65% before triggering a rebalancing event, as discussed further in the section below.

Portfolio Rebalancing Guidelines

Over time, the actual allocation of the portfolio may drift away from the target due to market movements. Rebalancing is the process of bringing the portfolio back in line with the target asset allocation. If you don't rebalance your portfolio, you'll let the market dictate its risk profile, which negates the entire purpose of a proper asset allocation strategy. The IPS should, therefore, specify the portfolio rebalancing strategy and how to actually go about performing the rebalance.

When it comes to the frequency of rebalancing your portfolio, investors typically opt for calendar-based and/or threshold-based options, as described below:

- Calendar-Based Rebalancing: The IPS can include how often the portfolio will be reviewed for rebalancing, such as semi-annually or annually. Most investors choose to do this during tax season (April) or at the end of the year (December), for financial planning purposes. More frequent rebalancing may be necessary for portfolios with a higher risk profile or during periods of market volatility.

- Threshold-Based Rebalancing: The IPS, either exclusively or in combination with calendar-based rebalancing, should also define the acceptable deviation from the target allocation that will trigger a rebalancing event. For example, if the target allocation for stocks is 60%, the IPS might state that rebalancing will occur if the actual allocation drifts above 65% or below 55% (5% fixed threshold).

Some investors may also choose to make tactical adjustments to their asset allocation based on short-term market conditions or economic factors. For instance, if interest rates are rising, the IPS may state to allocate more capital to fixed income instruments and stock sectors that benefit from rising rates, such as REITs and financial services.

If tactical adjustments are permitted, the IPS should outline the circumstances under which they are allowed and the extent to which the allocation can deviate from the long-term target. However, it's important to note that tactical shifts should be made sparingly and with a clear rationale, as frequent changes can undermine the long-term strategy and potentially lead to suboptimal returns.

The IPS should also specify the preferred method(s) for rebalancing, which may include:

- Sell and Redirect: Selling overweight assets and buying underweight assets. This may include using tax-loss harvesting to offset realized capital gains and rebalance the portfolio.

- Cash Flow Rebalancing: Directing new contributions and dividends towards underweighted asset classes.

- Withdraw First: Withdrawing from overweight assets until the desired balance is achieved. This is particularly relevant for retirees.

The chosen rebalancing methodology should consider factors such as transaction costs, tax implications, and the investor's cash flow needs. The approach may also differ across various investment accounts. For instance, in a non-taxable retirement account (e.g., 401(k), IRAs), selling and buying assets will not trigger a taxable event. In contrast, in a taxable account, contributing more to underweight assets via cash distributions or reinvested dividends is considered a better option, given that selling overweight assets will likely lead to capital gains taxes (either short- or long-term, depending on the holding period).

Portfolio Monitoring and Control Protocol

To ensure alignment with the investor's goals and to effectively manage expectations, the IPS can include the following performance evaluation criteria:

- Benchmark Index: The IPS should specify a benchmark index (or, more realistically, multiple indices), such as the S&P 500 Index, against which the portfolio's performance will be measured. This benchmark serves as a reference point to evaluate whether the investment strategy is meeting the investor's objectives.

- Acceptable Deviation Range: The IPS should define an acceptable range of deviation from the benchmark's returns, both in terms of magnitude and duration. For example, the IPS might state that the portfolio should not underperform the benchmark by more than 2% over a rolling three-year period. Similarly, if the portfolio significantly outperforms the benchmark, exceeding the acceptable deviation range, it may indicate that the portfolio has taken on more risk than intended, which could also warrant a review of the investment strategy.

Comparing the portfolio's performance to the benchmark is important when updating the IPS, as it helps determine whether adjustments to the portfolio are necessary. If the portfolio consistently falls short of the benchmark by more than the acceptable deviation, it may indicate that the current asset allocation or investment selections are not effective in achieving the investor's goals.

In such cases, the IPS should be revised to address these issues, which may involve modifying the asset allocation, replacing underperforming investments, or reassessing the investor's risk tolerance and objectives.

Thus, within the IPS document, it's important to specify the conditions under which updates are required. While some opt for annual updates as a matter of routine, this approach can be somewhat arbitrary and not always needed. A more effective strategy involves revising the IPS in response to significant life changes that impact the investor's financial landscape. Such "qualifying events" may include:

- Significant deviation from the portfolio's expected returns (as discussed above).

- Changes in marital status (e.g., getting married, divorce, death).

- Addition of dependents (e.g., having children).

- Significant job changes (if they substantially affect income).

- Major purchases (e.g., buying a house).

- Relocating to a significantly different cost of living area (e.g., moving to another country).

- Significant changes in health (for yourself or a dependent).

- Reaching retirement age milestones, including:

- Penalty-free withdrawals at age 59 1/2 from tax-advantaged accounts (e.g., 401(k), 403(b), IRAs).

- Eligibility for Social Security benefits at age 62.

- Pension eligibility (typically ranges from ~55 to 65 (or older)).

If none of these qualifying events have occurred, updating your IPS is likely unnecessary.

In fact, its advisable for the IPS to explicitly outline scenarios that do not necessitate an update, such as short-term market fluctuations, minor financial changes, or the introduction of new investment vehicles (e.g., spot ETFs). Implementing a waiting period, say six months, before making significant portfolio adjustments or decisions can also promote careful, strategic investment choices aligned with the IPS's long-term goals and guidelines.

Other Considerations

When crafting an IPS, there are several other considerations to take into account beyond the core components discussed above. These additional factors help to further personalize the IPS and ensure that it comprehensively reflects the investor's unique circumstances, values, and preferences. Some of these considerations include:

- Ethical and Social Investing: The IPS should address preferences for specific types of investments that align with the investor's values, such as ESG (environmental, social, governance) companies, socially responsible investments (SRI), or avoiding "sin" stocks (e.g., tobacco, alcohol, gambling). This section details the investor's ethical, social, or community-oriented investment criteria, guiding the inclusion or exclusion of certain securities based on personal beliefs.

- Stock Selection Guidelines: For investors who include individual stocks in their portfolios, the IPS should outline criteria for choosing these securities. This may include factors such as the company's financial health, industry position, growth prospects, and valuation metrics. The guidelines may also specify diversification requirements across sectors, minimum market capitalization thresholds, and other qualitative and quantitative measures to assess potential investments.

- Legacy and Estate Planning: For investors concerned about leaving a financial legacy or transferring wealth to future generations, the IPS should include guidelines for estate planning. This may involve specifying beneficiaries, outlining strategies for minimizing estate taxes, and establishing charitable giving goals.

By addressing these other considerations in the IPS, investors can create a more comprehensive and personalized document that guides their investment decisions and ensures that their portfolio remains aligned with their unique goals, values, and circumstances over time.

The Bottom Line

An investment policy statement (IPS) is a valuable tool for both professional money managers and individual investors. It serves as a comprehensive guideline for managing an investment portfolio, outlining the investor's objectives, risk tolerance, asset allocation, and rebalancing strategies. By creating an IPS, investors can ensure a consistent and disciplined approach to their investments, reducing the likelihood of emotional decision-making.

The process of drafting an IPS helps investors clarify their financial goals, assess their risk tolerance, and develop a suitable asset allocation strategy. It also provides a framework for monitoring and evaluating the portfolio's performance against predetermined benchmarks. While professional IPS documents can be complex and lengthy, individual investors can benefit from a simpler, more concise version that still captures the essential components.

If nothing else, the IPS acts as a reminder to stay on track, avoid hasty decisions, and focus on the long-term investment journey.