In this article, I will show you how to identify an economic moat, a distinct/durable/sustainable competitive advantage a company has over others in the same industry or sector. Identifying an economic moat is an essential part of the analysis process for value investors looking to make a long-term investment. Without a strong economic moat, companies are at risk of losing significant market share to competitors, which has become increasingly true in today's fast-changing tech environment.

Therefore, in this article, I will provide numerous examples of companies with economic moats, discuss different types of economic moats companies have, and will uncover the steps you can take to identify an economic moat for any company in the stock market. After all, although one can look at a company and think it has an economic moat, it's more important to objectively know that it does before making an investment decision.

Importance of an Economic Moat

The term "economic moat" was coined by Warren Buffett. It refers to a castle and how it's surrounded by a deep trench, a moat, filled with water. This acts to protect the castle from attackers, and the bigger the moat, the less of a chance attackers have of getting across the moat!

"A company must have a durable competitive advantage that protects it from attack, like a moat protects a castle."

— Warren Buffett

Therefore, much like you'd always pick a castle with a big moat over one with a smaller moat, stick with investing in companies with a strong economic moat, particularly if you're a long-term value investor.

Companies that have strong economic moats are much more likely to thrive in the stock market and produce significant growing cash flows over the long-term. Often times, these companies are those that have products/services that most customers immediately select because it's the obvious and best choice for them.

It has also become increasingly important to invest in companies that have a strong economic moat, as we live in a world where technology, change, innovation, and globalization are advancing at an unprecedented rate.

One example of this is the digital transition change in the 1980's, which caused Eastman Kodak Co. (KODK), one of the market leaders in the analog and photographic film industry, to ultimately fail. A similar thing is being felt across the U.S. for various retail stores due to the rise of e-commerce.

In short, it's important that investors really understand how strong their company's economic moat is, and prioritize investing in companies that are most likely still going to be around and growing after 10+ years.

You also want to avoid investing in companies that sell goods/services for fixed prices, as they will be eaten by inflation, and are doomed to fail. Instead, purchase market leaders that can increase their prices when it seems fit. Even if the products/services cost a little more than a few years prior, customers will pay the price if the company has a strong economic moat.

At the end of the day, the last thing you'd want is to invest in a company that begins to have slowing revenues or margins due to competitors.

7 Major Economic Moats With Company Examples

Below is an expansive (but not comprehensive) list of the seven major economic moats companies have, and examples of companies and/or industries that have them.

Typically, the best companies have more than one economic moat. However, it's not required that companies have multiple, as a company only needs one strong economic moat to maintain a distinct competitive advantage over its competitors.

Therefore, your objective here is to use the list below to guide your research on whether the company you're analyzing has some distinct advantage that competitors do not offer... An advantage that could sustain and grow its market share over a long period of time, at minimum 10 years.

Network Effect Moats

The network effect is when a company's products/services become more valuable as more people use the product/service.

Naturally, as more people use the product/service and it gains transaction, it becomes more valuable, in turn leading more people to be interested in using the product/service the company is offering.

This is basically like a positive feedback loop, similar to the "flywheel effect," where companies gradually build up momentum for their product/service, until the momentum just doesn't seem to stop.

Social Network Platforms

One thing that may come to your mind here are social network platforms, such as Facebook, YouTube, Snapchat, Twitter, TikTok, Yelp, and others. If no one used these platforms, they'd hold little value whatsoever. However, because many people actively use these platforms, it has created a very strong economic moat for these companies that competitors may never be able to replicate.

Take Google's (GOOG) YouTube, for example. It began with only a few videos, but as more users began posting videos and more users began searching for videos, YouTube grew exponentially and has really only seen its user base grow. Currently, there's no real competition in sight for YouTube, largely because of the massive amount of capital and resources it would require for other companies to gain significant market share in the online video-sharing space.

Marketplaces

One marketplace example is Amazon (AMZN), which has managed to create a massive network effect due to the supply and demand created by suppliers and customers on the platform. This network effect ultimately enabled Amazon to leverage its positive feedback loop from users on the website to become a massive e-commerce marketplace.

Another marketplace example is Uber (UBER), and how the service attracted drivers by offering a source of income, and attracted customers by offering a source of reliable transportation. Together, this created massive growth for the company, and although it's very similar to the many drive-sharing competitors like Lyft (LYFT), the company still has an economic moat due to the network of Uber drivers and riders in thousands of cities globally, which takes a lot of time and capital to achieve.

Intangible Asset Moats

Intangible assets are non-physical assets or attributes a company has that is giving them an advantage.

Strong Brand Name

One of the most effective intangible assets are strong brand names, especially when they are used in everyday language.

For example, when people say "just Google it" for searching something on the internet, or "give me a Kleenex" for tissues, or "Photoshop it," for any sort of image editing. This is the kind of moat that is really only possible because these companies have dominated the space for so long, that customers begin using the company's product/service brand name instead. Obviously, this provides a huge distinct competitive advantage that other competitors may never be able to cross.

Strong brand name recognition is also not limited to everyday language. For example, the Coca-Cola Company (KO) has created a massive brand name over time, proven by the number of sales it receives on its signature Coca-Cola drink every year. Even its closest competitor, Pepsi-Co (PEP), and its signature Pepsi drink, have never come close to beating Coca-Cola's signature Coke drink in sales or market share.

Although brand moats are valuable, the downside is that they are subject to change over time. For example, less people are drinking Coca-Cola because of the negative health implications of sugary sodas. Therefore, even strong brand moats can slowly fade over time due to things like changes in consumer buying behaviors.

Secret Moats

Secret moats include things like patents, trade secrets, and intellectual property that can make direct competition illegal, or at the very least, almost impossible to figure out.

Patents in the U.S. are generally granted for 20 years from the date the patent application is filed, so patent moats are not always the strongest. Examples of these are pharmaceutical companies who get their moats from patents on drugs, or technology companies like Intel (INTC), that get their moats from computer chips.

Trade secrets, on the other hand, can be protected indefinitely, as long as the owner(s) manage to keep it secret from the public. For instance, The Coca-Cola Company has managed to keep its signature Coca-Cola drink secret formula from the public since the soft drink product was conceived in 1886, providing a distinct trade secret moat that other companies simply cannot replicate.

Intellectual property extends to copyright laws and licenses, protected by law, that no other business can use. The popular example here is The Walt Disney Company (DIS), and the valuable fictional characters Disney owns (e.g., Mickey Mouse). Without intellectual property rights on these characters, Disney may not have been one of the most dominant entertainment companies in the U.S.

Switching Cost Moats

This is when a company's products/services lock a customer in and make it so that switching to a competing product/service is expensive and/or not worth the time.

Put simply, it's very difficult to come in and compete with companies that have already established an industry standard product. Therefore, it's wise to invest in companies over the long-term that are more or less guaranteed to sell significantly more products, as they're able to consistently outperform other companies with similar products in the same space, while also being able to invest in further growth opportunities when they arise.

There are several examples of companies that excel with having a switching cost moat, such as Adobe and its Creative Suite, Microsoft and its Office Suite, or Apple/Microsoft and the operating systems they offer.

Adobe's Creative Cloud

Adobe's (ADBE) Creative Cloud is a collection of numerous photo and video editing software products under the same company. These products are used across the globe by many individuals and businesses, and with its subscription model has only become more expensive for customers.

Although there are many alternative products that customers could purchase to do the same exact job, perhaps even for less, most do not switch because of the high switching costs. In other words, businesses would have to re-train their staff, account for uncertainties in the new program(s), and accept the potential loss in efficiency (and revenue) that would arise from learning new software, all of which may not make the switch worthwhile. Therefore, this is a strong competitive advantage Adobe has, as many customers are locked-in to using its products/services.

Windows and Macintosh Operating Systems

Most people that use a computer either have Windows or Macintosh (Mac) operating systems installed. There is a high switching cost here for many consumers, especially with the software installed (e.g., Microsoft Office and its many industry-standard products/services), which creates an economic moat for both Apple (AAPL) and Microsoft (MSFT) that other competitors have failed at beating.

Apple as a whole makes a very specific ecosystem, where other Apple products can be easily connected to others just by turning them on. Nobody else really has this (to an extent), which is one reason why they are able to charge a premium on many of their products/services.

IBM and Fear

In short, when a company has products/services that locks-in their customers, as bad as it sounds, it is often beneficial to you as an investor. Often times, going to a competitor is not worth the time and/or price. So, even if a competitor comes in with a better product for a lower price, it may still take a long time for businesses and individuals to switch.

International Business Machines (IBM) is a great example of this, as their entire business was really only kept alive due to the switching cost moat they had built up. In other words, IBM kept their business customers on a legacy computer system, on the basis of fear that if they were to switch to an IBM competitor, it would cause their company to shut down.

Economies of Scale Moats

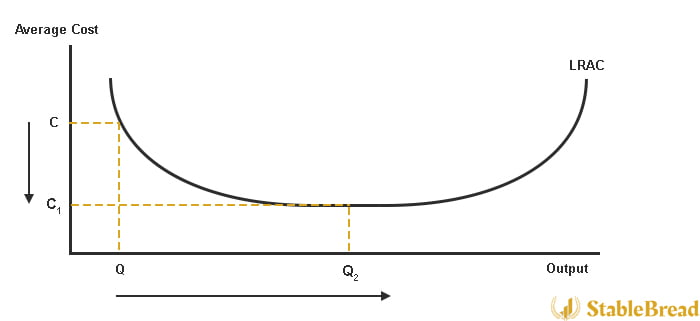

Economies of scale is when a business, usually due to it's size, has a cost advantage when supplying materials or adapting to changes in demand.

This is illustrated in the image above, where quantity of production increasing is represented from Q to Q2, and the average cost of each unit decreasing is represented from C to C1. "LRAC" is the long-run average cost.

Production and Demand

For a more literal definition of economies of scale, we can look at a company like Boeing (BA), one of the biggest aircraft manufacturers. Boeing has the ability to buy in bulk, and as a result, can get cheaper prices when ordering materials. They're also able to adapt to demand by opening/closing manufacturing centers or hiring/laying-off employees to meet this demand.

On the other hand, smaller aircraft competitors may have to take on large amounts of debt, and are not able to quickly capitalize on demand or efficiently produce goods for their customers to the extent that Boeing can, simply because of the cash flow and economies of scale they have built up over time.

Location

For location, this could refer to a company that builds something like a hydraulic dam, railroad track, power line, road, or some type of similar infrastructure. It's not feasible, logical, or profitable for competitors to build another hydraulic dam next to yours, or nobody would make money. Companies that are first to build these services are often those with large economies of scale moats.

A separate example are large fast food, restaurants, or retail stores, like McDonald's, Starbucks, or Walmart, that are notorious for building next door and causing local businesses to lose income. As unfortunate as this may be, investors can invest in these businesses confidently as they have large economies of scale moats which give them the ability to expand rapidly.

Low Cost Provider Moats

The low cost provider moat is when a company can consistently be the cheapest one in its industry or sector to offer a satisfying product/service to customers, so that there is no need for customers to switch to something else.

This is the most difficult moat to keep and get, as every company can technically price its products low. However, this does not happen because it's not profitable for these companies. Only companies that have rock-bottom operating costs are able to price their products/services for so little. This also ties into economies of scale, as companies with more cash flow are able to purchase more goods for less.

Applications

There are many free software applications, that if they were to begin charging for their service, would likely cause a majority of their users to immediately seek out the next-best alternative.

Take Facebook's (FB) WhatsApp for example, it's a free messaging app with two billion users. If WhatsApp began charging people to use the application, it would likely cause the company's value to rapidly deteriorate. Most likely, people would immediately switch to one of the many other messaging providers, so Facebook should be careful when monetizing this app. The exact same could be said for Snapchat, under Snap Inc. (SNAP), a free camera-oriented messaging application.

Retail Stores

Many massive retail stores like Walmart, Costco, and Target sell items for low prices, which other smaller businesses cannot compete with. If someone wanted to buy something, then most people would go to one of these stores or Amazon, instead of a small family business or other retailer due to the economies of scale and cheap prices the stores offer.

Toll Moats

A toll moat is when a business is the sole supplier of something the customer needs, somewhat like a monopoly.

Streaming Services

An example of a toll moat is Netflix (NFLX) or Disney+ (DIS), and the original content they provide on their subscription-based streaming services. Although there is content on Netflix and Disney+ that is available elsewhere, Netflix/Disney+ originals that are exclusive to Netflix/Disney requires a subscription in order to have access to the show or movie.

If many customers find this exclusive content to be valuable, then this is an economic moat that is challenging to beat. However, streaming service moats like the ones that Netflix and Disney+ offer do not last forever, and consumer media consumption preferences can always change.

Government Protection

Companies that are protected or supported by the government have an extremely strong economic moat. These are more often found in emerging markets, because at least in the U.S., they do not like companies getting "too big." However, oil, agriculture, transportation, energy, and utility companies, at times, can be heavily supported by the government. Without these essential industry companies, it would cause many people to panic.

Cultural Moats

While less common, cultural moats based on a company's value proposition, brand, culture, and/or tradition can provide distinct economic moats for companies that regularly utilize them well.

Environmental and Sustainable Causes

Beyond Meat (BYND) is a company that offers revolutionary plant-based meats. Its brand commitment is also to "Eat What You Love," representing the company's strong belief in addressing concerns on climate change, resource conservation, animal welfare, and human health (among other things).

This provides the company with a cultural moat which many investors and customers love, and that other non-plant-based meat companies do not have. However, I would not consider this to be a strong moat by itself, as there will likely be even more plant-based meat competitors in the near future.

Cultural Expression/Change

Starbucks Corporation (SBUX), is a perfect example of a company that created cultural change and got cultural expression right by offering quality and exotic-sounding coffee, all in a sophisticated manner. After all, not many coffee shops offered the experience of roasting and brewing in front of customers. Thus, Starbucks has a strong cultural moat in this regard, which is very difficult to beat, especially given its large economies of scale.

Two Steps to Identify an Economic Moat

Now that you have an understanding of the various types of economic moats, and perhaps those that are more effective than others, the next step is to follow the logical two-step process outlined below to determine whether or not your company actually has an economic moat. This includes determining how durable the economic moat is as well, because companies with a small moat are useless to value investors.

Step #1: Understand the Business Model and Identify the Economic Moat(s)

The first step is to understand the business you may be looking to invest in, primarily in a qualitative manner, and to come up with a hypothesis on its economic moats, if any. Looking through a company's website or 10-K annual report should provide you with this information.

Qualitative questions you should find answers to include:

- How does the company make money?

- What products/services are the cash cows for the company?

- What industries does the company operate in?

- Who are the biggest players in the industry?

- What is the company doing now to improve the value of its products/services?

If you cannot answer these questions confidently, then move on to the next company. If you can, then come up with a hypothesis for the advantages you think the company has over its competitors. For this, you may want to focus on the products/services the company generates the most income from, and use the previous section to help you identify any economic moats.

Often times, you can find out rather quickly whether or not your company has an economic moat. Again, this just an opinion or hypothesis that you will confirm in the next step, so it does not need to be right whatsoever.

Step #2: Look at 4 Key Performance Indicators (KPI's)

The next (and final) step is to determine whether our opinion or hypothesis is correct. This is done by looking at various key performance indicators (KPI's), because at the end of the day, if a company has a strong economic moat, it should be drawing in customers from competitors, which should show through financial performance.

The four main KPI's you want to focus on are:

- Revenue

- Stockholders' Equity

- Free Cash Flow (or Owners Earnings)

- Earnings per Share (EPS) or Net Income

Focus on these four KPI's when looking at the core growth of a business to determine whether the company actually has an economic moat, and to better understand how big the company's economic moat is.

In specific, you should look to see whether the company has had really strong results in these five KPI's over the last 10 years. In other words, these KPI's must be growing each year, ideally at a consistent and higher rate every year. The bigger the growth over this 10-year period, the bigger the economic moat(s), as competitors have not yet been able to replicate or take enough market share for the company to begin showing reduced margins.

Margins (gross, operating, and net profit margins) are also something you should look at to determine whether or not your company is maintaining a strong economic moat. Ideally, you'd want stable or growing margins over the last 10 years.

However, if there is a clear trend of their margins shrinking over the 10-year period, this can be a sign that competition is beginning to get an edge over one or more of their economic moats. You can verify this by researching the market share performance for companies in the industry and by looking into how much the company is now spending on new research and development, among other things.

Below is a chart showing The Coca-Cola Company's (KO) revenue, net income, stockholders' equity, and FCF from 2010-2019:

As you can see, Coca-Cola may have lost some of its economic moat strength since 2013 or 2014, leading to declining/stagnant KPI numbers. Although this does not clearly discredit Coca-Cola as a bad long-term investment, investors should look closer into the company and its 10-K annual reports to see how the management team is reinvesting its cash for future growth.

The Bottom Line

An economic moat is a company's ability to maintain a distinct/durable/sustainable competitive advantage over competitors in its industry or sector. It's the ability to consistently outperform other businesses over the long-term, even if they are selling similar products/services.

Economic moats are growing and shrinking at a much quicker pace in the modern world, so you should keep an eye on what's going on with your company's economic moat. If you deem its economic moat to be shrinking without any possibility of recovery, it may be best to sell your shares immediately. Recessions sometimes help investors uncover this as well.

In closing, to identify an economic moat, understand the 7 most common economic moats: network effects, intangible assets, switching costs, economies of scale, low cost provider, toll moats, and cultural moats. Then, use the two-step process to (1) understand the company's business model and potential economic moats and (2) analyze 4 key KPI's (revenue, stockholders' equity, free cash flow, and earnings per share) over the 10-year period to better gauge the strength of the company's economic moat. Afterwards, you can use this information to help you make a decision on whether to purchase the stock or not.